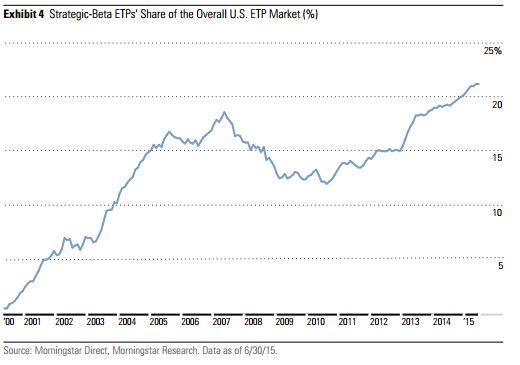

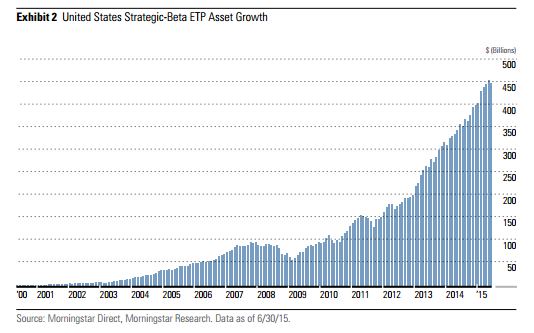

Investors have become enamored with alternative ways to slice and dice the indices. According to Morningstar, “Strategic Beta” now accounts for 21% of total industry (ETP) assets, up from under 5% in 2000. As assets have exploded, so too has the number of strategic-beta ETPs, which have grown from 673 to 844 in the past year, while assets grew 25% to $497 billion.

While much of the focus is on the nomenclature- “smart” vs. “factor” vs “strategic,” perhaps the most important aspect is being overlooked; like all things investing, the product won’t to be drive returns as much as your behavior will.

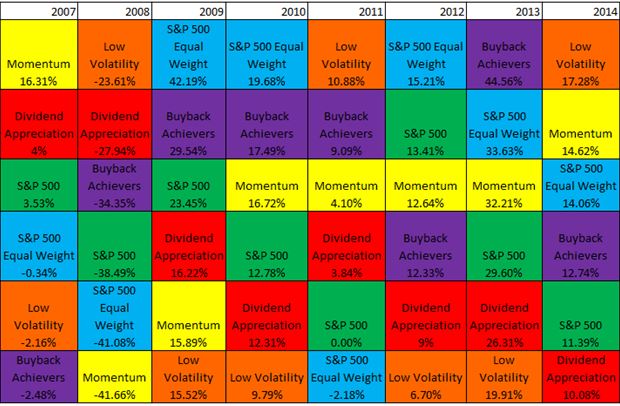

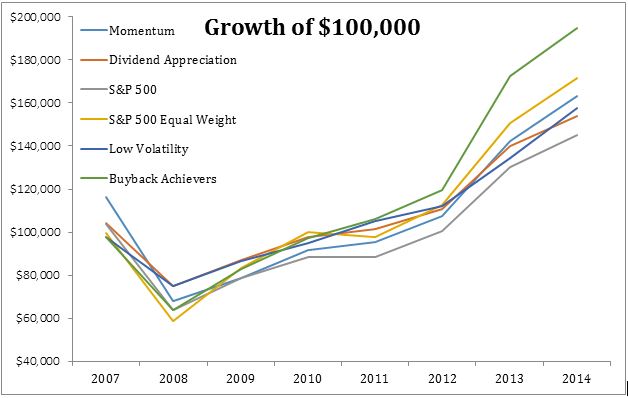

To demonstrate this point, I chose five popular strategies that differ from the traditional plain vanilla cap-weighted index: Nasdaq US Buyback Achievers Index, S&P 500 Equal Weight Index, Nasdaq US Buyback Achievers, MSCI USA Momentum Index and the S&P 500 Low Volatility index.*

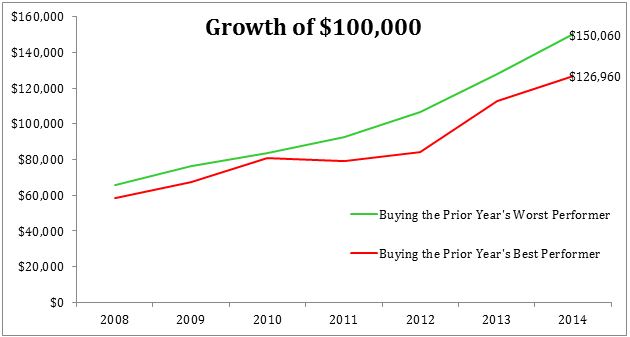

Every one of these Smart Beta strategies has outperformed the S&P 500 from 2007-today**. The problem investors run into, as you can see below, is that very often the best performing in each year lagged the S&P 500 in the prior year. Myopia is a huge impediment to successful investing as much of our “discipline” is driven by “what have you done for me lately?”

Each of these five strategies has outperformed the S&P 500 over the previous eight years.

Had you chased the prior year’s best strategy, you would have compounded your money at just 3.5%, less than the 6% you would have earned if you invested in the prior year’s worst strategy. This goes to show that mean reversion is a powerful force for a proven, repeatable process.

Anything other than a plain vanilla market-cap-weighted index has shown to outperform overtime. My friend Patrick O’Shaughnessy, in his great book Millennial Money, notes that “if you bought all large stocks in the United States that started with the letter C, you’d have outperformed the S&P 500 by 0.5 percent per year since 1962.”

One of the fundamental drivers of investors’ returns is having a disciplined process. The key is to find a strategy that you can live with; something that meshes with your investing DNA. Jumping from strategy to strategy is guaranteed to lead to poor returns.

*I used index returns for SPLV and MTUM; the ETFs are four and two years old, respectively.

**The earliest common date for these five products is 2007.