John Bogle, Cliff Asness, and Ray Dalio are just a few of the juggernauts that have recently been vocal about expecting lower returns. What is an advisor supposed to do when people like this are all on the same side of a very important issue?

Here are a few ideas:

- Lower your expectations, literally. In the financial plan, you can lower expected returns and or adjust inflation upward. Stress test the portfolio. Any plan that can’t succeed with lower temporary returns is destined to fail.

- When they’re warning of lower returns, they’re mainly talking about U.S. stocks and bonds. The easy answer to this potential problem is diversification. Emerging markets and developed markets Ex-U.S. have been dead money for over a decade.The chart below shows the ratio of the S&P 500 to MSCI EAFE; you’ll notice the relative outperformance of U.S. stocks is significant.

- Explain to clients that we just lived through a period of low returns! Over the last 15 years, the S&P 500 has compounded at just 2.5% a year. This is lower than 85% of all rolling fifteen-year returns. However, we’re simultaneously coming off a period of really strong returns, over the last six years anyway. Compounding at >12% a year makes the last six years better than 81% of all rolling six-year periods for the S&P 500.

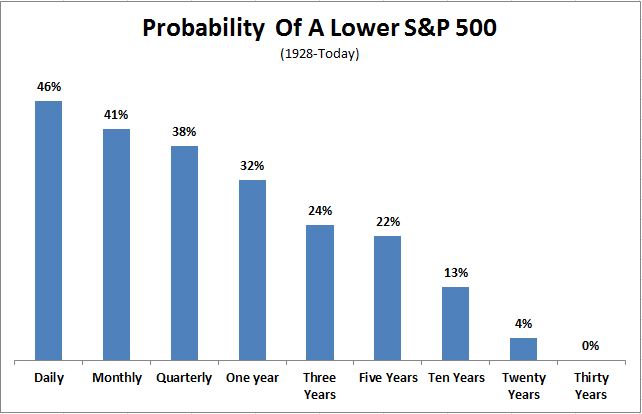

- What does “lower expected returns mean?” Bogle is not anticipating lower returns for the next thirty years, he’s looking out over the next decade. Fortunately, most investors have an investing horizon much greater than ten years. Pound this message home; we don’t know what returns will be going forward, but we do know that the odds of negative returns decreases with the passage of time.

Lower returns might very well be in the cards. The good news is that nobody actually knows, they’re guessing like you or I. The better news is that lower returns provide the foundation for higher future returns. Thinking and acting for the long-term while surviving the short-term is perhaps an advisor’s most important role.