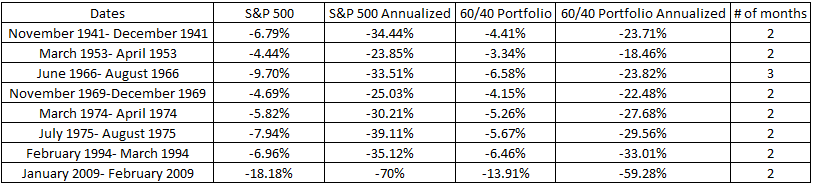

One of the appeals of having a portfolio of stocks and bonds is their tendency to move in opposite directions, especially when stocks fall. In fact, there have only been eight times that stocks and bonds both fell for consecutive months and only once did they both fall for three consecutive months.

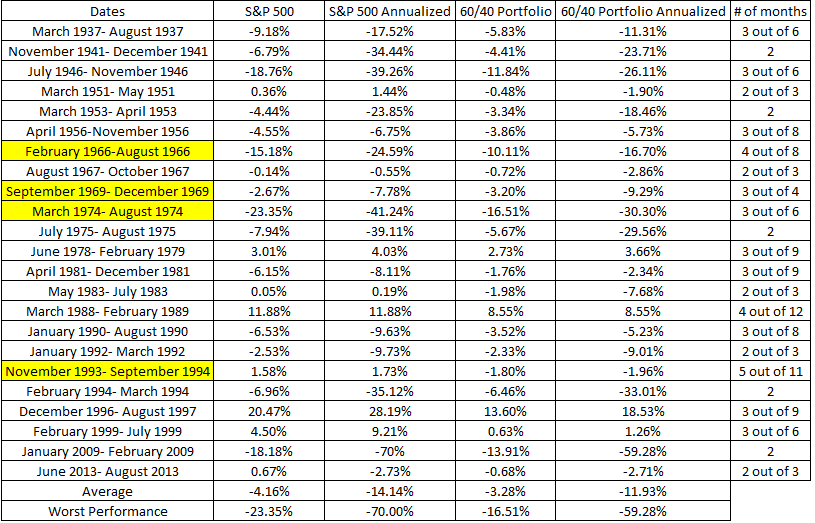

The data above is another example of telling the truth but distorting the facts. People don’t exist only in consecutive months, so if we expand our search we find that stocks and bonds absolutely have declined together. There were 23 times when stocks and bonds fell not necessarily in consecutive months, but in multiple months over a period of time, as seen in the table below (the yellow overlaps with consecutive periods above; For instance, stocks and bonds fell 3 consecutive months in 1966, but also fell in 4 out of 8 months).

So although bonds tend to steady the portfolio when stocks fall, investors should understand that this is far from a guarantee. And with interest rates at all-time lows and stocks at all-time highs, there are many who expect that not only will a 60/40 portfolio deliver below average returns, but that bonds might not provide the protection they once did. This has led to a boom in alternative solutions. According to Wilshire, there are now 545 funds managing $304 billion (there were less than 100 funds in June 2009).

If you’re seeking alternatives because you expect low returns from traditional asset classes, you have to understand that a lot of these funds are fishing in the same low-return pond. Sure there are funds that add in commodities, currencies and private equity, but the margin for error becomes that much smaller in a low return environment. And with the added layer of fees that these funds carry, they’re going to have to be exceptional to earn their keep.

People love to call themselves contrarians but the reality is that most aren’t suited to overcome the behavioral challenges of being different. Investors go into these funds because they don’t want to be correlated. However the reality is that people only want non-correlated returns when stocks are falling. And when they’re not, staying invested in something that’s underperforming the S&P 500 becomes mentally and emotionally exhausting.

It’s not fair to say liquid alts are bad because there are so many different strategies. However, because of the behavioral challenges of being different, investors need to be extra careful and ask themselves a few questions before investing in alternatives:

- Do I understand what the strategy is trying to accomplish?

- Do I understand the machinations of the strategy?

- How does it fit into my overall portfolio?

- Do I understand the strategies limitations?

- There’s a difference between a sound strategy underperforming and a strategy that simply no longer works. Will I be able to distinguish between the two?

- Are the costs involved excessive?

- Is this a core holding or a temporary solution?

- If it’s temporary, how and when will you know to exit?

If you can check all these boxes, I see no reason why alternatives can’t be a piece of your portfolio.