There are a lot of people who don’t believe in the merits of technical analysis. It doesn’t make sense to them that you can look at past price movements and determine future price movements. If stock prices are driven by earnings, how can a chart provide any insight? Well, yea, stocks are driven by earnings in the long-run, but in the short-run they’re driven by sentiment, which can be observed by measuring supply and demand.

Anecdotally, nonsensical forecasts seems to permeate from technical analysis way more than fundamental analysis, which is the main reason it often gets ridiculed (By the way, I’m not suggesting nonsensical forecasts aren’t ever driven by fundamental analysis, Dow 36,000 is a great example). These outrageous claims are provided by technicians that abuse the charts. They’ll draw a few dozen lines, waves and retracements, and use a handful of oscillators. In addition to some of the crazy artwork, the patterns they’ll cite have names that sound ridiculous to the laymen; a rising wedge, head and shoulders, three peaks and a domed house, etc.

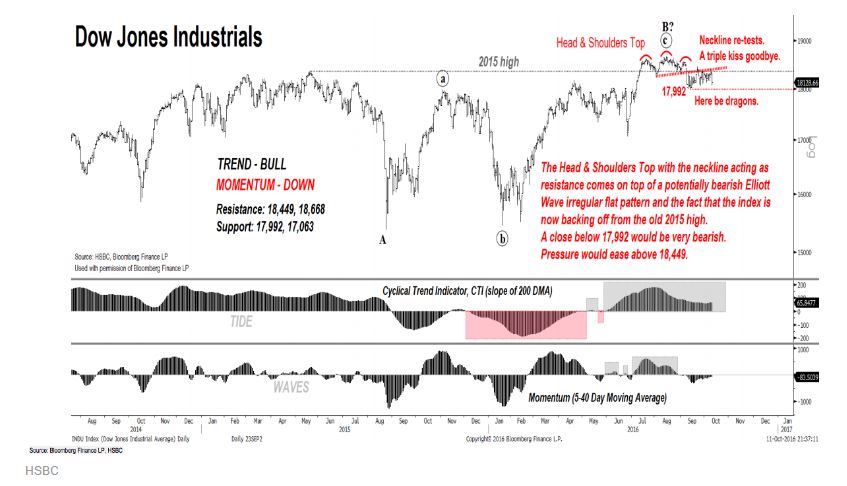

Here’s a recent “Red Alert” example from HSBC:

The Head & Shoulders Top with the neckline acting as resistance comes on top of a potentially bearish Elliot Wave irregular flat pattern and the fact that the index is now backing off from the old 2015 highs. A close below 17,992 would be very bearish. Pressure would ease above 18,449.

Lol, what?

Here is another example from an article yesterday in the Wall Street Journal with the headline “Technical Analysts are Getting Nervous About This Market.” It included the following statement:

Those who owned S&P 500 stocks only when both the index and its cumulative advance-decline line were below their 50-day moving averages, as is currently the case, would have lost about 50% since 2012, according to FBN Securities.

What does this actually mean!?!

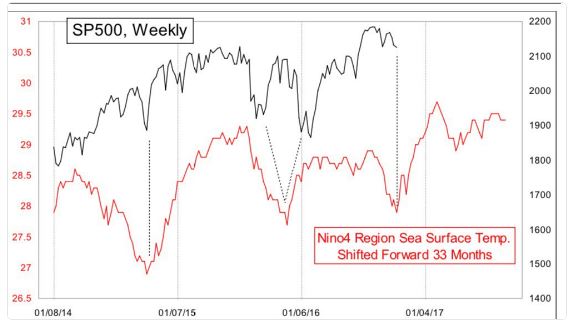

And finally, stuff like this exists, which shows stocks vs. regional surface temperature of the Pacific Ocean…

Requires no further commentary.

To me, technical analysis is not about predicting the future, but about managing risk. This distinction is really important and easily forgotten when we’re endlessly bombarded with the nonsense I’ve just shared.

Yes, the majority of technicians fail to beat the market, but one can just as easily look at the results from mutual fund managers and throw fundamental analysis into a waste basket. To be clear, I’m skeptical of somebody’s ability to look at a chart and turn that analysis into market beating results. But I’m no less skeptical of somebody reading financial statements and turning their analysis into market beating results. The point I’m trying to make is that technical analysts get painted with too broad a brush and the maniacal, rotten apples give the sane ones a bad name.

Source:

Technical Analysts Are Getting Nervous About This Market

HSBC: RED ALERT- Get Ready for a Sever Fall In the Stock Market