It’s generally accepted that the current bull market began in March of 2009, which means that stocks have been running for 2002 trading days. I’m not on board with this line of thinking. Forget the first point, that the bull started at the lows in 2009, as opposed to 2013 when the 2007 highs were taken out. Rather, I’m talking about the idea that this bull has been running for eight straight years. I think it’s been been reset not once, but twice.

From May to October, 2011, the S&P 500 fell 21.6%. On a closing basis, however, it only fell 19.39%, so an “official” bear market never registered. And while the S&P 500 fell just 15% from the middle of 2015 until early 2016, I believe it absolutely was a bear market. Below are some of the peak-to-trough numbers that support this idea.

- S&P 500 -15% (Median stock -25%, nearly 80% of S&P 500 stocks were below their 200-day moving average.)

- Russell 2000 -27%

- Japanese Stocks -29%

- Dow Jones Transportation Average -32%

- Emerging Market stocks -40%

- Chinese stocks -49%

- Small Cap Biotech -51%

- Oil -76%

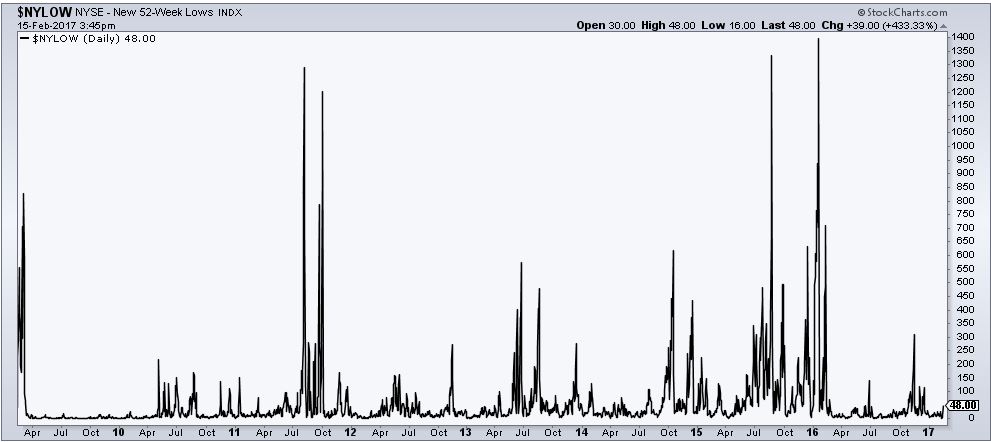

- NYSE new 52-week lows were at their highest point since November 2008, which is shown below.

Nobody saw this happening and thought new all-time highs were imminent, and that the complete collapse in oil and the blowout in high-yield credit spreads weren’t signaling something much bigger than a temporary hiccup. The stage was set for a deep correction, for the 15% decline in the S&P 500 to fall even further. And then, voila, without any reason and without any notice, stocks stopped going down.

If you’re like me, and like most other human beings, you’re almost always scared of a bear market. If you’re actually in one, you think it’s going to get worse, and if you’re not, you’re waiting for it to arrive. It’s just the way it works. And this constant fear leads to disastrous returns for many investors. Look at this chart from my friend @econompic.

Oooffff… pic.twitter.com/KRA16pqtzJ

— Jake (@EconomPic) February 15, 2017

I’m not exaggerating when I say that I feel like every 5% dip is the next bear market. I’m never like, “oh, this is healthy, stocks will be at new highs in no time.” So what do I do, given that I’m fearful every time stocks fall? I don’t sell everything, I don’t even sell anything. I have a portion of my money invested in a simple rules based strategy that will (hopefully) avoid at least part of a bear market. I’m not expecting it to nail the top, and I am expecting it to register some false positives. I know it won’t “beat” the market over the long-term and I don’t care. I view it as the cost of protecting myself from myself, and I’m happy to pay it. It’s there so that I never interfere with the rest of my invested assets, which I’m hoping will compound (at whatever rate the market will allow) for the rest of my life.

Stocks are going to crash. This is not a prediction or a forecast, this is a fact. Unfortunately, I don’t know when they will and neither does anybody else. But as we recently saw, not every 15% drawdown leads to a 50% meltdown. So you have to put yourself in a position where you can survive the short-term in order to be successful in the long-term.