It seems like everybody wants to be a contrarian these days. Predictably, there were a lot of “Bill Ackman is out of Valeant, that’s your buy signal” comments this week. I want to talk about the three different types of contrarians: those who are early, those who are late, and those that are right.

On the early side, for example, are those who have argued that U.S. stocks are too expensive, or people saying this bull market is long in the tooth. With the length of this current run (however you measure it), and more importantly, with rich valuations, it’s hard to go a few hours without seeing a headline that a “rug pull” is imminent. So it’s really difficult to tell where the line is these days, it almost feels like it’s consensus to be a contrarian.

By definition, a contrarian is going to be early, but in order to be successful, they can’t be too early. It’s in this small window that greatness exists.

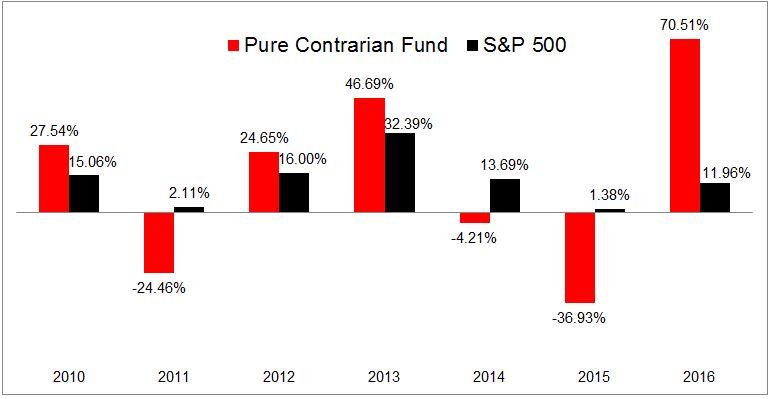

Professional investors tend to be early while non-professionals tend to be late. Remember all the black swan funds that were launched in 2009? Or what about this pure contrarian fund, which launched in September 2009, when stocks had already bounced 57% off their lows. This was a brilliant marketing play; stocks had recovered, but investor’s psyche was still mangled.

I will give this fund credit because their returns, at least so far, have been completely divorced from the market. They crushed the S&P 500 last year, but how many investors stuck around for these gains after getting crushed in the previous year?

People want to be different from the market when it’s too late. They run away from risk when they ought to be running towards it.

In the third bucket of contrarians are those rare individuals that are often right and have made a career out of it, like Howard Marks. In his interview with Barry Ritholtz, he said:

“Oaktree invested extremely aggressively between September 15th of 2008- which was the day Lehman went under, and the end of the year. We invested over half a billion dollars a week over that period.”

From the time Oaktree began investing aggressively until the market bottomed six months later, stocks fell an additional 47%, after already being down more than 20% from their peak (I know Marks is a bond guy, I’m just using stocks as a measuring stick- GET OFF MY BACK). The point is not that you should catch falling knives because it worked out this one time for Oaktree. The point is, well, in his words: (emphasis mine)

“Value investors score their biggest gains when they buy an under priced asset, average down unfailingly and have their analysis proved out. Thus there are two essential ingredients for profit in a declining market: you have to have a view on intrinsic value, and you have to hold that view strongly enough to be able to hang in and buy even as price declines suggest that you’re wrong. Oh yes, there’s a third; you have to be right.”

And that’s the hard part. It’s easy to be a contrarian, to think that you see something that the rest of the world is blind to. But it’s hard to be right

Alright, I know I said there were only three types, but there’s one more, which doesn’t even really deserve its own category, but whatever. They’re the knee-jerk contrarians, those that always take the other side. “Chris Sacca finally sold Twitter, I’m long!” Well, for the knee-jerk contrarians reading this, here’s one for you, the analyst initiations on SNAP are 0 Buys, 3 Holds, 1,734 Sells. Have at it 🙂

(h/t Joe Fahmy).