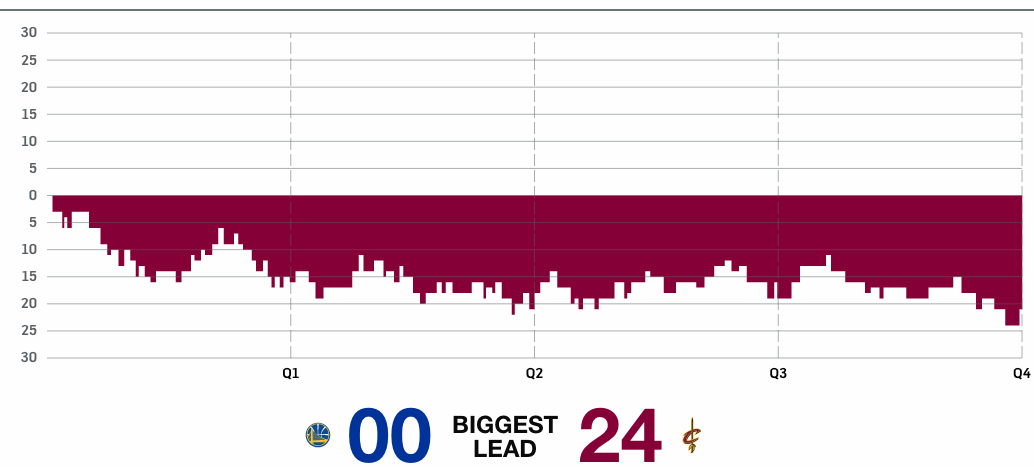

The Warriors set a record by winning fifteen straight playoff games. But that came to an end in game 4 when they got their asses handed to them. They lost by nineteen points and played from behind the entire game, there were zero lead changes.

After the loss, Steve Kerr said, “The biggest adjustment you make in the playoffs is always an emotional one.” The Warriors are not about to try different lineups, put a big on LeBron, or change much of anything in terms of x’s and o’s. What his players need to do is put game four behind them and prepare mentally and emotionally for game 5. Investors can learn a lot from Steve Kerr’s mindset.

The market also got its butt kicked on Friday. The S&P 500 fell just 0.08%, but the leading stocks experienced much steeper declines, with Facebook, Apple, Amazon, Netflix and Google each falling over 3%. The last and only time this happened was August 21, 2015 (earliest common date May, 2012). The obvious question on investor’s minds this weekend is, “is this the top?”

Nvidia, which is one of the hottest stocks right now, came into Friday up 50% for the year. It was trading 5% higher in the morning, but without any reason or advanced warning, it fell 15% and finished the day down 6.5%. This is certainly the type of candle you see at tops.

Now the question is, how should we react, if at all, to the mini-quake on Friday. While it’s certainly possible that Friday marked the top, unfortunately we just cannot know that answer today.

May 2015 didn’t feel like the top at the time, but it certainly did in hindsight. Over the next ten months, the median S&P 500 stock was down more than 20%, the Russell 2000 fell 26%, the transports were down 30%, oil was collapsing, the Shanghai and biotech stocks were both cut in half. All the pieces were in place for that to be the top. Except it wasn’t.

The S&P 500 has now gone 231 days without a 5% drawdown, which is the longest streak since 1996! This is why every time stocks fall a little, it feels like they’re going to fall a lot. The lack of volatility, paradoxically, is causing anxiety.

Stocks will experience a real bear market, whether or not that began on Friday, only time will tell. But rest assured, we will reach a point where buying the dip no longer works. Portfolios will be tested. The mocking and ridicule that’s been reserved for bears will be delivered ten fold upon passive investors.

Successfully adjusting your portfolio to the ups and downs of the market is extraordinarily difficult, which is why so many preach buy and hold. But if you’re truly committed to buying and holding, what will determine your ability to come out the other side are the emotional adjustments you make along the way.