Our intern Tommy Tranfo wrote a great piece about his generation and investing that I thought was worth sharing.

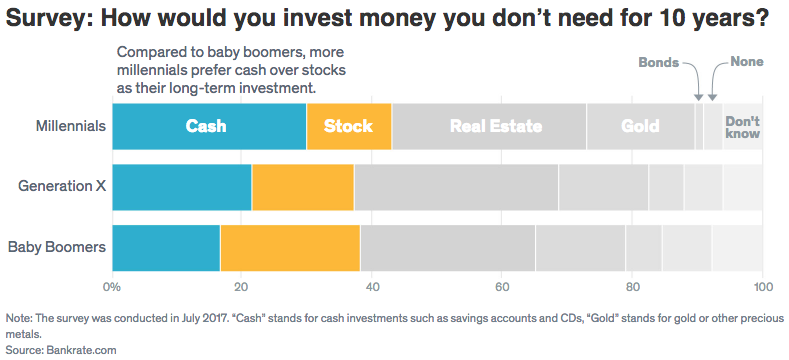

In a recent Barron’s Next article, Why Won’t Millennials Embrace the Stock Market, they write, “The S&P 500 has grown over 75% in the past five years, yet, according to a new survey only 13% of millennials said they’d invest in the stock market.”

If you asked most prominent investors today what their biggest regret was about their early to mid-twenties, I think it’s safe to say that most wish they started investing sooner. If there is one thing that I’ve learned while interning for Ritholtz Wealth Management, it’s that my particular edge in the stock market is my youth. But not every ‘millennial’, a word I will begrudgingly be using, has the opportunity to learn about their greatest advantage.

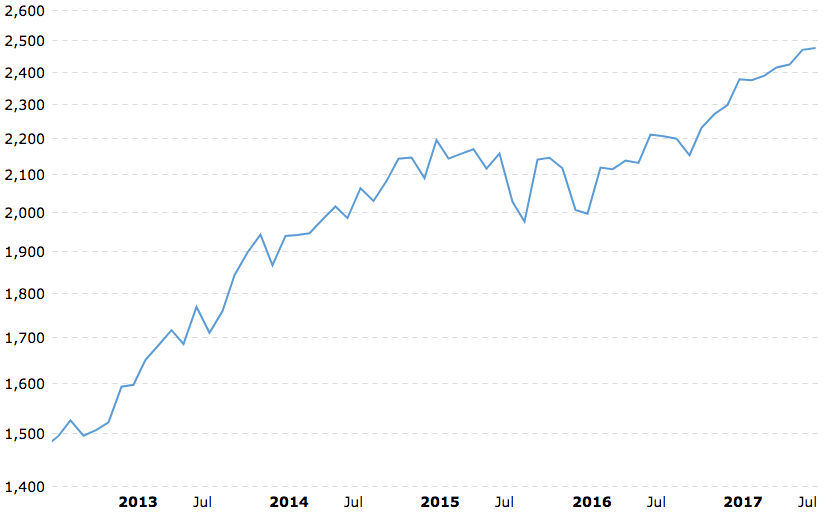

In the financial world, there seems to be a consensus that millennials are drastically different than every previous generation. Barron’s writes, “Folks in their 20s and 30s graduated high school with the tech-bubble bursting in 2000, around the 9/11 attack, or with the financial crisis and stock market crash in 2008.” Sure, these have been scary, uncertain times and we know that we have a loss aversion bias, but to play devil’s advocate, this is what the S&P has looked like the past five years.

I would like to flip the article’s title around and ask the question, why should millennials embrace the stock market. I don’t believe that we as a generation have a newfound incentive system where we are somehow no longer interested in money (which is what these articles seem to be suggesting). It is simply the case that people in their twenties either can’t afford to save money, or feel they have no reason to start investing for their future.

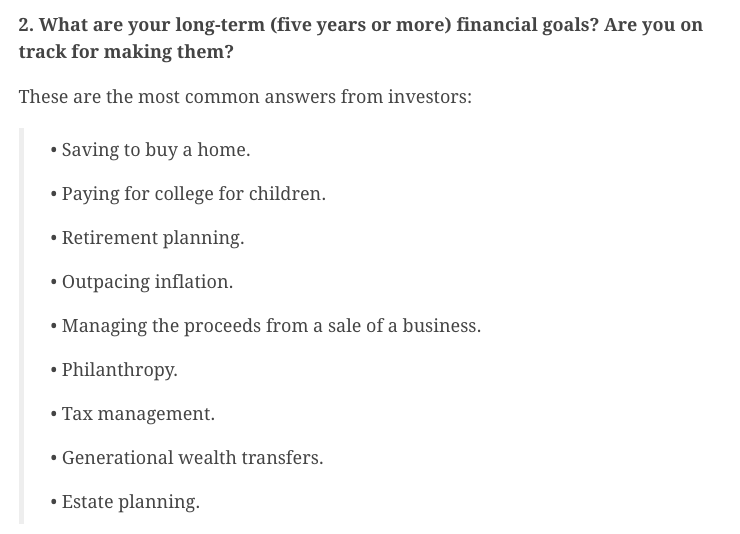

This list is from a Barry Ritholtz article Do You Need a Financial Advisor. He listed the items in order of relevance…

….How many twenty year olds do you know that have any of those concerns? My number is zero. So why then is there all this hubbub about millennials being so averse to the stock market?

This chart, from the Barron’s article, is frustrating for a couple reasons. Chief among them: how can you draw conclusions about one specific generation simply through comparative date? It is a given that the older generations are going to tilt more toward investing because they are the ones that have substantial reasons for doing so. What would be interesting instead is to compare millennial interest in stocks to Generation X’s interest in stocks when they themselves were in their twenties. The comparison as it sits now is not relevant.

Millennials will embrace the stock market more so than any previous generation combined. Robinhood is a stock-trading app that makes it incredibly easy to invest in the stock market. The app has over two million downloads and its target audience is the same audience that Barron’s suggests has no interest in the markets. Stocktwits is a financial communication platform dedicated to social media users, of which a majority are millennials, and is sitting around 1.1 million members. And finally, my home base of Reddit has a community 150,000 strong solely dedicated to millennials having fun with the stock market. All these entities have sprung up within the last five years and their communities have been growing rapidly ever since.

We are going to be the smartest generation because what schools fail miserably to teach us, we can learn through the ease of the internet. The burden is not on my generation but rather the ones who came before us to teach us the value in starting early because our incentives will lead us to act only when our edge is no longer sharp.

Source: