Amazon gained 56% in 2017. Google gained 33%. Apparently that wasn’t enough. Year-to-date they’ve tacked on another 12.5% and 10.6% respectively, adding a combined $147,782,647,497 in market capitalization.

Amazon’s market cap was $70 billion in 2011. It just added the equivalent amount in fourteen days. That’s bigger than Colgate-Palmolive and General Motors and Marriott and 83% of companies in the S&P 500. Things are starting to get silly, and it’s not just happening at the company level, it’s showing up in the indexes.

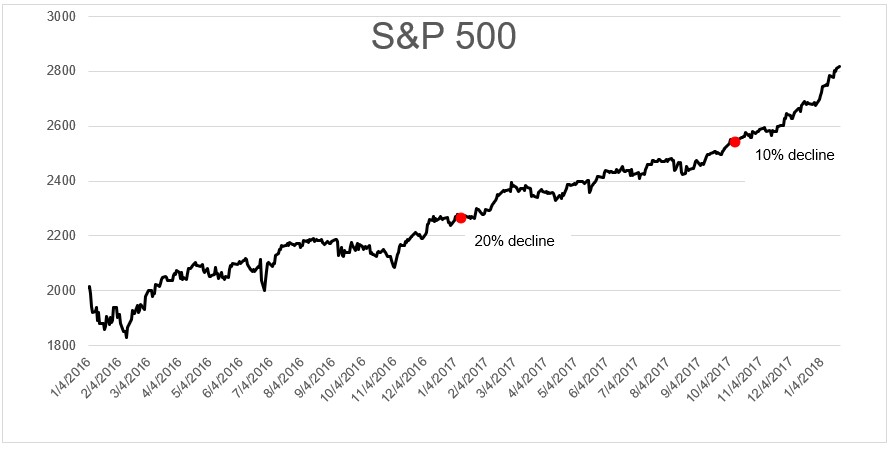

After posting a 22% gain in 2017, the S&P 500 is picking up right where it left off. It’s up 5.6% year-to-date. At this point, a 10% correction, which would not only be healthy, but doctor’s orders, would take the index back to where it was in October. A bear market would take the index back to where it was in January 2017, the point at which some people had bailed out of fears that the President would be catastrophic for the stock market.

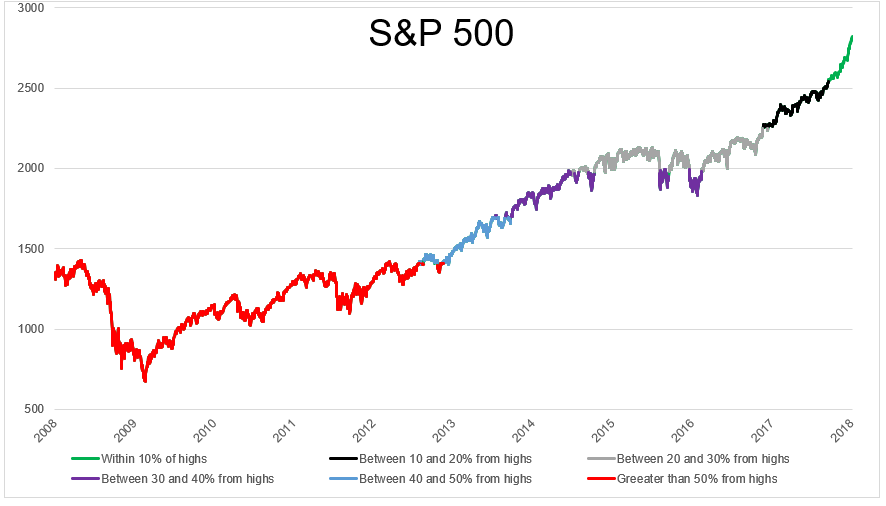

We’re just about two years removed from the bear market that wasn’t officially a bear market. Since the February 2016 lows, the S&P 500 is up an incredible 56%. A 36% decline from here would certainly scare the heck out of a lot of investors, but that would only take us back to where we were two years ago. A 50% crash would take the index back to the beginning of 2013- which is when a lot of the current bears started to growl.

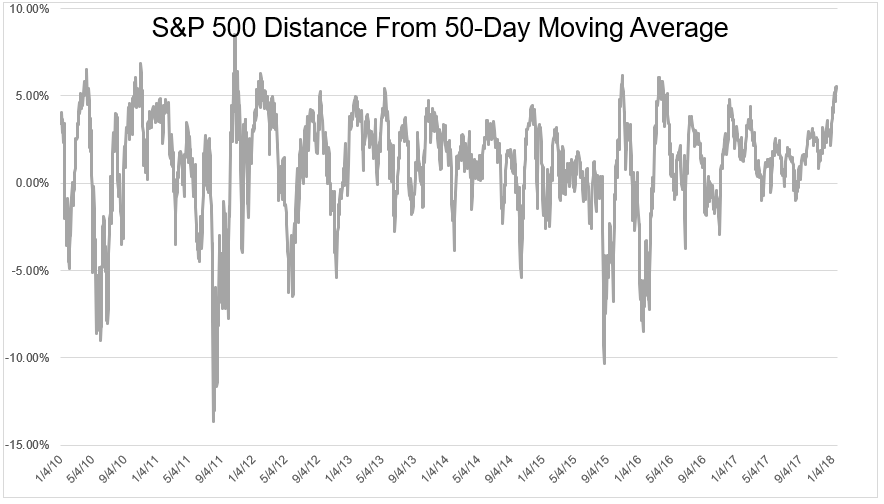

The S&P 500 is now 5.5% above its 50-day moving average. Since 1950, the S&P 500 has experienced this 6% of the time. Certainly not unheard of, but not a usual occurrence either. The S&P 500 was up 32% in 2013 and 38% in 1995, and neither of those years saw this type of relentless buying.

Reading this, you might get the feeling that I expect the market to do something or that I’m positioned a certain way. I am not. I’m neither bullish nor bearish, I learned to stop playing that game a while ago. The biggest takeaway for the average investor who is trying to figure out what is going and and what they should do with their money is this: nobody knows what’s going on. Nobody knows where the market is going and nobody will be able to explain why it did what it did even after the fact.

If you think things are getting silly now or have been that way for a while, there is no law to prevent them from getting a whole lot sillier.