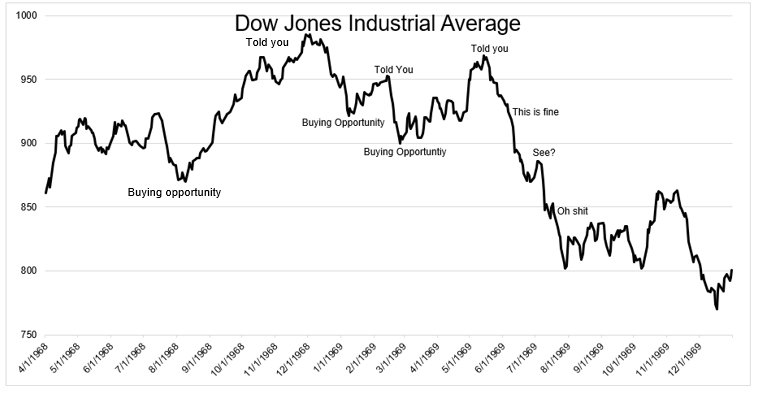

Conventional wisdom goes that tops are a process. This makes sense when you think about market psychology. In a rising market, every pullback is bought, which conditions us to expect future dips to behave like previous ones. But eventually, bounces are met with less enthusiasm and the rallying cry of buy the dip morphs into sell the rip. This typically plays out over weeks and months because in a bull market, investor psychology doesn’t stop on a dime, but rather it turns around like a cruise ship. The 1969 top provides a good visual of what this looks like.

Markets usually to start roll over before they fall through the elevator shaft.

By October 1929, the Dow was already 30% off its August highs and had spent more than a month below its 50-day moving average. On October 18, 1987, the Friday before the crash, the Dow was 18% lower than its August highs and again, had spent a few weeks below its 50-day moving average. I don’t believe the 50-day is some magic line that is any more important than the 20-day, I just use it here to make the point that at previous market tops, there was some deterioration before a vertical plunge lower.

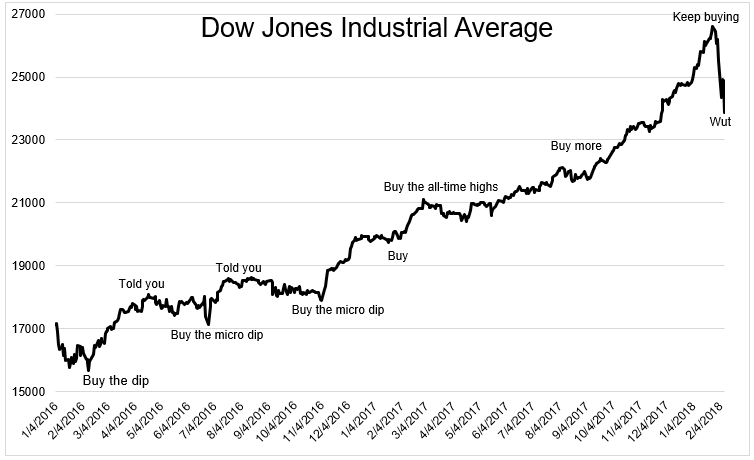

This time, there was very little warning. Now, what just happened is nothing compared to the crashes of 1929 and 1987, but the recent move is unprecedented in terms of how quickly stocks fell from an all-time high. CTAs- which are expected to provide protection in a down market- didn’t have time to react, due to the nature of the decline. The CTA index experienced its worst 5-day return since 2007.

On January 26th, 2018, the Dow Jones Industrial Average closed at an all-time high. On Thursday, nine days later, it closed more than 10% below those highs. This is the first time ever (going back to 1900) that the Dow closed at an all-time high and declined 10% over the next nine days (1928 saw an all-time high then declined 9% in nine days).

The V-top we just experienced is a great reminder that anything can happen, and just because something has never happened doesn’t mean it can’t. As Josh Brown said this morning, “If there were ironclad rules, we would all be following them.” I don’t know if this was the top, but it certainly was a top, even if it proves to be short lived.

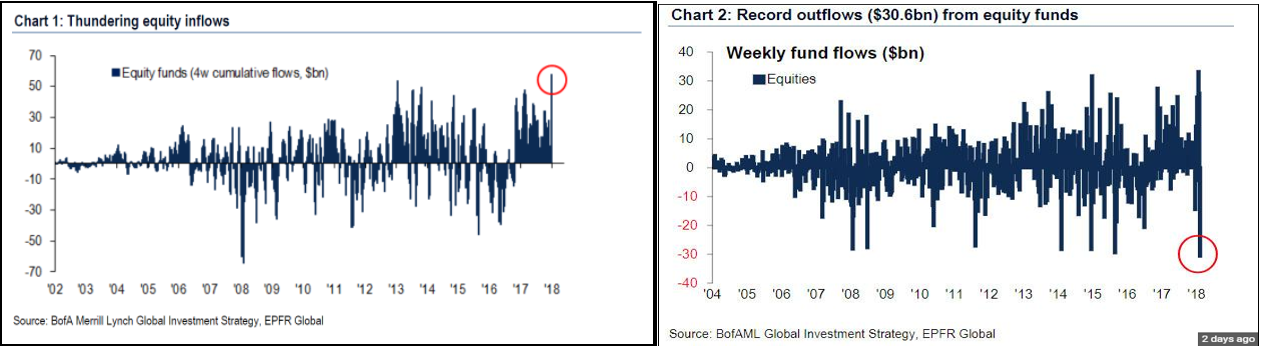

The Dow made 11 all-time closing highs during the first 18 days of the year, and investors responded by pouring a record $58 billion into stocks in the four weeks ending on January 17th. The V-top caught investors off guard and sent them diving for the exits, as a record $30.6 billion was ripped out of equity funds last week.

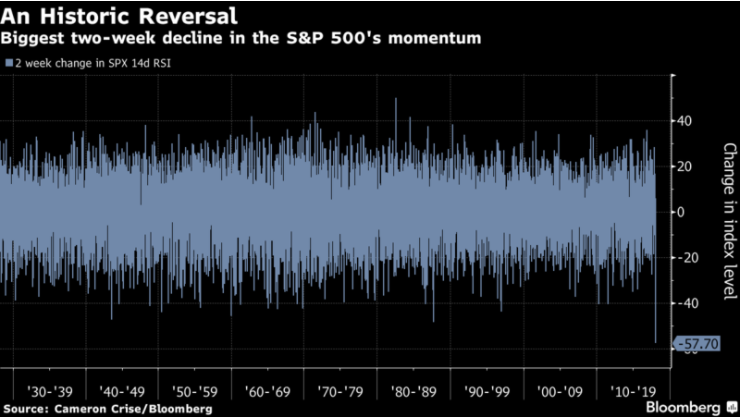

RSI, a momentum indicator, just experienced its largest two week decline of all time. There’s no doubt that what just occurred was a surprising turn of events. The fact that investors ran from risk, however, is no surprise at all. According to Sentimen Trader, SPY lost 9% of its assets, the most over any 5-day period since 2011.

Advancements in trading have made it easier for people to buy and sell. And because of the speed at which news spreads, maybe we shouldn’t be surprised to see investors react as quickly as they did. There was a knee-jerk reaction to blame the machines on the swift decline, and perhaps they exacerbated the selloff, but let’s not forget that human beings are perfectly capable of sending stocks lower. Following the 48% percent market decline in 1973-1974, investors made withdrawals from their holdings of equity mutual funds during 24 consecutive quarters, from the second quarter of 1975 through the first quarter in 1981 (From Jack Bogle’s Common Sense on Mutual Funds).

We finally have something to talk about. Stocks went two years without any volatility and a week with two-years worth of volatility. Nobody knows whether the worst is behind us or if it’s only beginning. Blame the machines if you’d like, but only you’re responsible for how you respond to this.