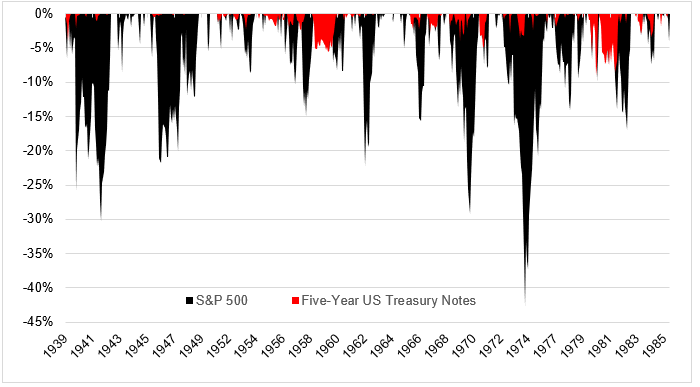

Does the chart below strike you as a risky investment?

What about this one?

Both of these charts cover the period from 1939 to 1985. The first one is five-year U.S. treasury notes after inflation. Five-year bonds are thought to be a rather risk-free investment. You lend money to the government, you receive interest payments, and then you get your principal back. But one dollar invested in bonds was still just one dollar 45 years later.

The second one shows the S&P 500 after inflation. The stock investor experienced large declines, as seen in the chart below, but they were more than compensated for that risk. $1 grew to $18 after inflation.

In a recent paper, Pulling the Goalie: Hockey and Investment Implications, the authors make the astute observation that investors “focus on the volatility of their portfolio rather than the probability of an unacceptable level of return over their risk horizon.”

People tend to feel safer investing in bonds versus stocks, but if the purpose of investing is to grow your purchasing power over time, then they ought to balance how they feel today versus what they’ll need tomorrow.

I’m not suggesting you shouldn’t own bonds because they can go decades without any real return. Stocks can do the same thing. What I am saying is that not everything that counts can be counted, and not everything that can be counted counts. If this was all there was to investing, nobody would know who Richard Thaler is.

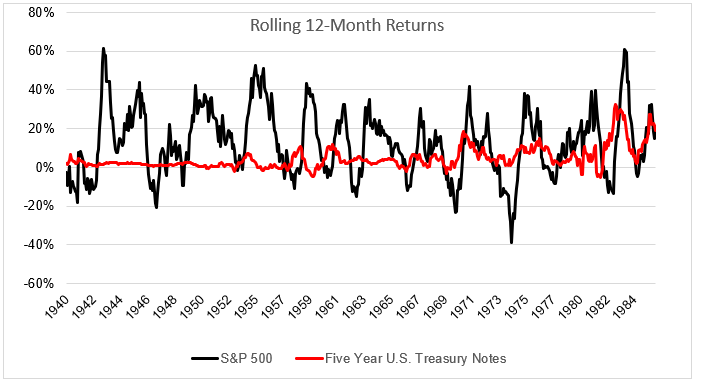

Over this time, the worst ten-year return for stocks and bonds was identical (-4.3% for stocks, -4.4% for bonds), while the best ten-year return for stocks was 19% annualized versus 3% annualized for bonds. But looking at ten year returns misses the point that investors live year-to-year and more likely, day-to-day.

The chart below shows that the worst nominal twelve-month period over this time for stocks was -39%.

Most people can’t experience a 39% decline in 100% of their portfolio, so combining stocks with bonds makes a lot of sense.

Investing isn’t just about maximizing returns. It’s about maximizing returns that you can reasonably expect to achieve. So despite the fact that bonds are very likely to have lower returns in the future than they did in the past, it doesn’t mean that investors shouldn’t include them in their portfolio. Striking the right balance between the black and red lines is the single most important decision that investors make.

Bonds aren’t risky in the sense that they don’t fluctuate as much as stocks. The worst calendar year return for bonds over this time was just -1.3%. But just because bonds don’t fluctuate as much as stocks, doesn’t make them any less risky. It’s about deciding when you’d rather take the risk. Now or later?

Source: