Baby Boomers did not do a great job preparing for their future. The median retirement account balance for people ages 56-61 is just $25,000. This could have been accomplished by contributing just $6 a month into a 60/40 portfolio (since 1980).

Ask somebody whether they would prefer $100 today or $500 in twenty years, most people would choose the former. But if you would ask somebody how they would like to grow their money at 8.4% for twenty years, turning $1 into $5, they would likely say “where do I sign?” This is a framing issue, but it’s deeper than just the way the question is asked. It’s in our nature to seek instant gratification.

We have no relationship with our future self. We’re loyal to ourselves today.

In a 2011 study, increasing saving behavior through age-progressed renderings of the future self, participants were shown computer-generated representations of what they might look like in retirement and were then asked to make decisions whether to consume today or save for the future. Seeing these images had a big influence on behavior because “saving is like a choice between spending money today or giving it to a stranger years from now.”

In the first of four studies, participants who were exposed to their future selves allocated more than twice as much money toward the retirement account than did participants who were exposed to their current selves. The other three showed similar findings. Seeing what they’ll look like in the future established a relationship with themselves that made them more likely to save.

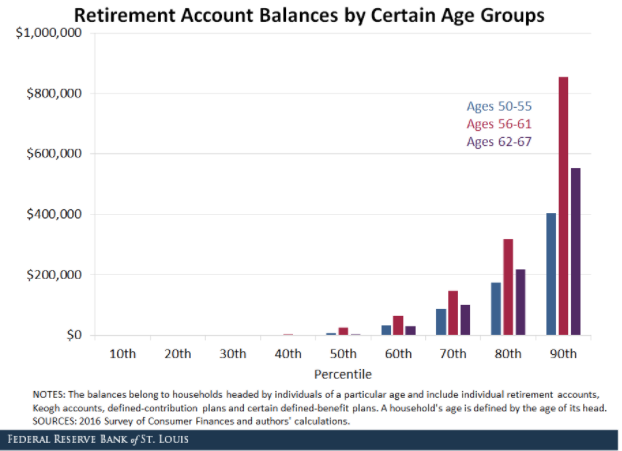

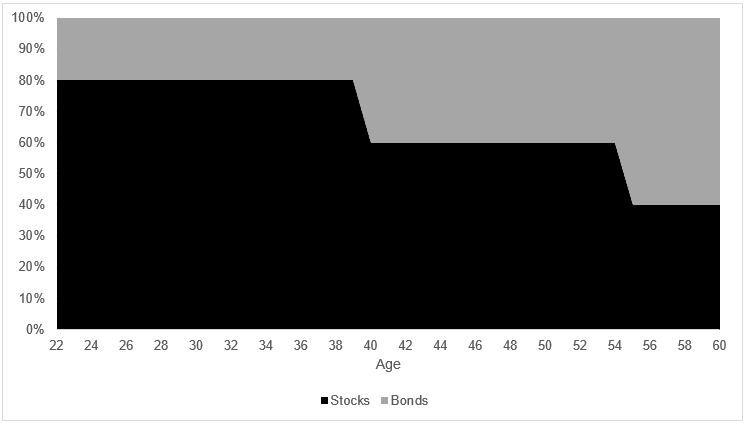

Getting back to where we are today, the 90th percentile of retirement accounts is $855,000. Let’s use this as a jumping off point to show the cost that delaying saving has on our future. In this exercise, I’m making the ridiculous assumption that a sixty-year old person came into the work force at 22 years old in 1980 followed this allocation: 80% stocks 20% bonds from 22 through 39, 60% stocks 40% bonds from 40 through 54, and 40% stocks 60% bonds from 55 through today, at age 60.

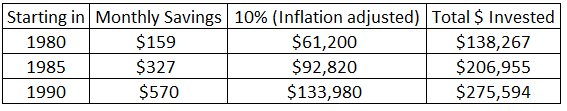

The table below shows the actual cost of waiting. In order to arrive at $855k today, the 90th percentile, you would have needed to save $159 a month, and increase that amount each month commensurate with inflation. Using a 10% pre-tax savings rate, you would have had to be making $61,200 in 1980, using today’s dollars.

If you waited just five years, using the same 10% rule, you would have needed to save $327 a month, again increasing it each month commensurate with inflation. The $206,955 invested is $68,688 more than had this person started five years earlier. Finally, had you waited ten years to get started, you would need to begin saving $570, which meant that your pre-tax income had to be $134k to stay with the 10% rule. Delaying retirement savings from age 22 to 32 means that you would have had to save $137,000 more to keep up with the person who started ten years earlier. Starting early is more important than earning higher returns. You’re better off earning 6% for thirty years than 9% for twenty years.

Too many people can’t afford to save money, but if you’re reading this post, you’re probably not one of them. Don’t delay. Think about your self today. That’s who you’ll be tomorrow.

Source:

Increasing Saving Behavior Through Age-Progressed Renderings of the Future Self