On this week’s Animal Spirits, we discuss:

Howard Marks on investing without people

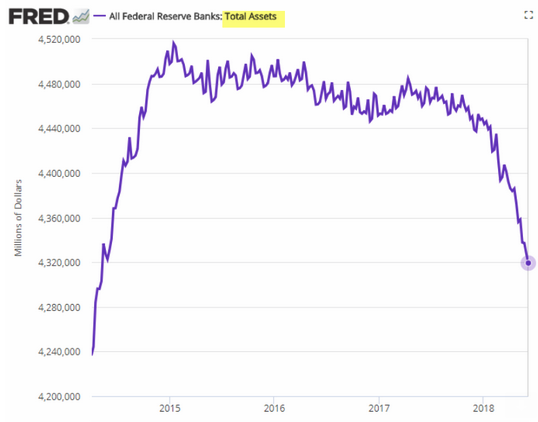

The mother of all credit bubbles

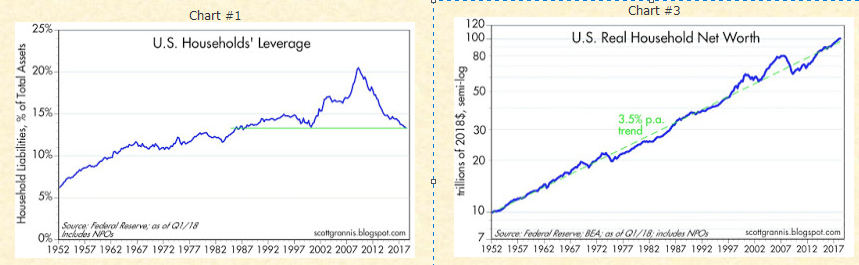

Time to not freak out about debt

Will Berkshire eventually get broken up by activists?

The two most indebted companies in the world

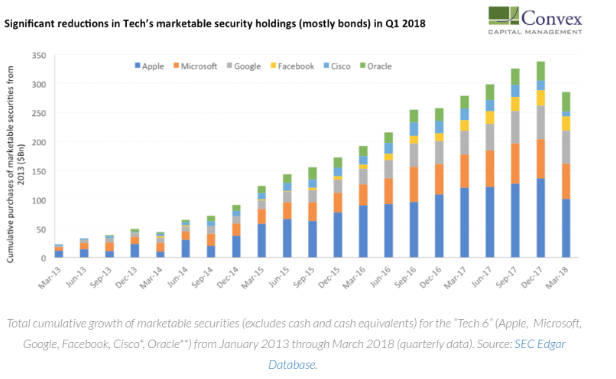

Tech loses its appetite for bonds

WeWork is worth quite a bit of money

Hindsight bias in dollar-weighted returns

Millennials and money (survey)

Predicting the World Cup Is Like Trying to Beat the Market

And an athlete getting smart with money

Bitcoin may have been manipulated

Listen here

Charts mentioned

“The shares are only slightly ahead of the index over the past 20 years. So maybe it’s time to start giving something back to shareholders.”

Tweets mentioned

.@elonmusk seriously bro. pic.twitter.com/n9JgLCPtDN

— The Klendathu Cap (@KlendathuCap) June 19, 2018

Due to SEC threats, I am no longer working with ICOs nor am I recommending them, and those doing ICOs can all look forward to arrest. It is unjust but it is reality. I am writing an article on an equivalent alternative to ICOs which the SEC cannot touch. Please have Patience.

— John McAfee (@officialmcafee) June 19, 2018

Recommendations

I, Tonya