On July 6, 1981, Du Pont, the nation’s largest chemical manufacturer, announced its intentions to pursue oil giant Conoco.

80% of Du Pont’s products were based on petrochemical feedstocks, and when the energy crisis hit in the early 70s, Du Pont was exposed to serious losses. Its profits fell from $586 million in 1973 to $273 million in 1975, a decline of 53%.

An analyst with Kidder, Peabody said “Du Pont’s merger with Conoco should also remove some of the volatility in the chemical company’s earnings, which have tended to rise and fall in line with the swings in prices of hydrocarbons and other raw materials.”

Looking back on the deal years later, Allan Sloan at The Washington Post wrote, “if you were around in 1981, as I was, you remember the fears that oil prices were going to the moon, that chemical companies like DuPont, which relied heavily on petroleum feedstocks, would lose control of their destinies, and that members of the Organization of Petroleum Exporting Countries would rule the earth. None of this happened, of course. But DuPont, egged on by fee-hungry Wall Street types, got the hots to buy an oil company.”

Upon completion in August 1981, it was the biggest deal of all-time.

Thomas Friedman at the New York Times wrote “The chemical company will pay $7.57 billion in stock and cash to acquire Conoco in a deal that will make Du Pont the seventh-largest industrial corporation in the United States, just behind the Ford Motor Company.”

Du Pont was not the only bidder for Conoco. They had to compete with Mobil and Seagram & Sons (yes, the Canadian liquor company).

“E.I. du Pont de Nemours & Company was able to claim victory in its multibillion-dollar bidding war with the Mobil Corporation and Joseph E. Seagram & Sons for control of Conoco after it began early yesterday to buy the 55 percent of Conoco stock attracted by its tender offer…The largest previous corporate takeover in history was the Shell Oil Company’s acquisition of the Belridge Oil Company in 1979 for $3.65 billion.”

In 1998, Du Pont would exit the energy business.

Allan Sloan at The Washington Post wrote, “DuPont’s experience with Conoco is a classic example of how smart companies advised by smart people can do what turn out to be incredibly dumb things. Such as buying Conoco in a seller’s market, when everyone wanted oil companies, and selling it in a market like this one, when oil stocks are about as popular as the plague.”

Sloan finished up the article with words that are as true today as they were in 1981:

“Ironies abound here. In 1981, Wall Street loved DuPont buying Conoco. In 1998, Wall Street loves DuPont selling Conoco. The bottom line: Wall Street has never seen a deal it doesn’t like.”

Source:

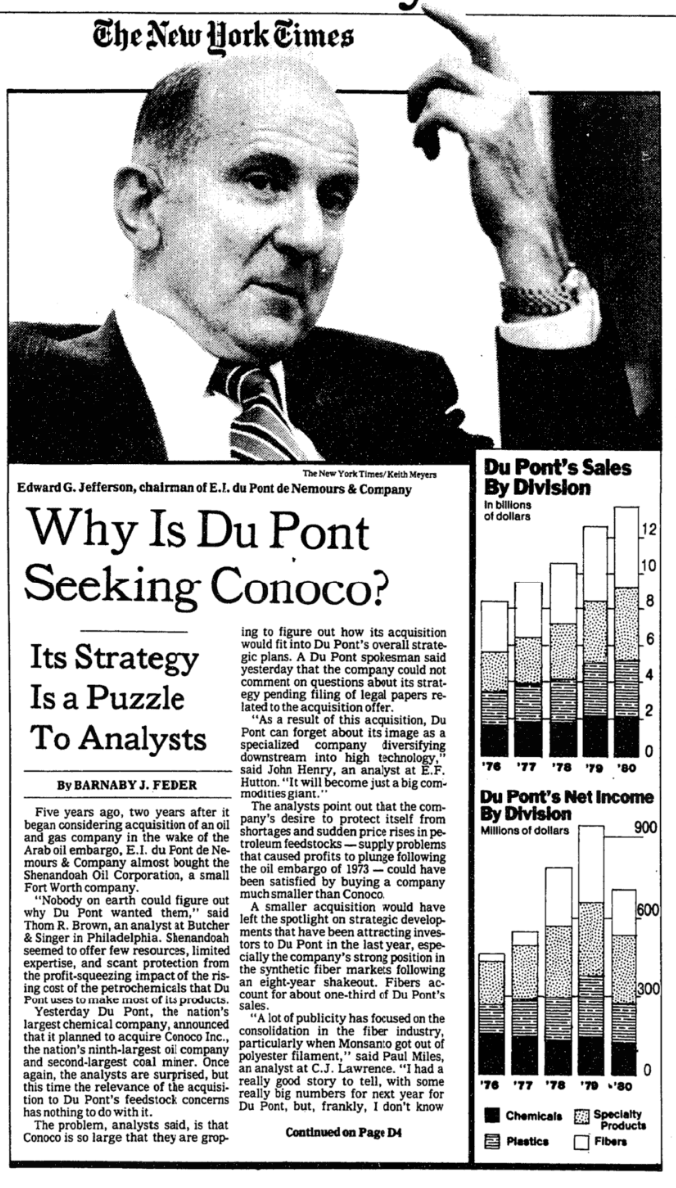

Why is Du Pont seeking Conoco?

Du Pont victor in costly battle to buy Conoco

DUPONT’S 17-YEAR OWNERSHIP OF CONOCO WAS A LOW-OCTANE INVESTMENT