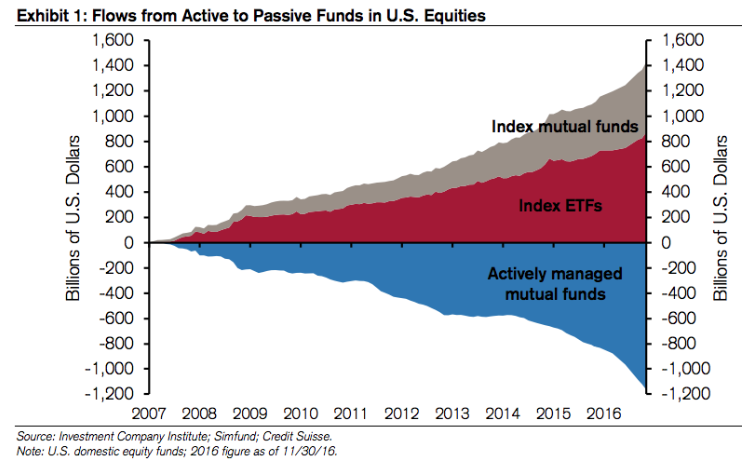

One of the concerns that people have expressed over the rise of index investing is that it will prevent true price discovery, if it isn’t doing so already. With fewer and fewer people doing fundamental research and more people only acting as price takers, at what point do prices truly separate from the economic realities of the business? This is the visual that really gets these fear juices flowing.

I believe this idea that prices will no longer accurate represent a company’s true worth are overblown.

In The Index Revolution, Charlie Ellis writes

“First, while index funds and exchange traded funds (ETFs) now approach 30 percent of stock market assets, their turnover is so small compared to that of active investors that they account for less than 5 percent of trading, and trading is what sets prices”

While active is losing market share to indexes, they’re still aggressively setting prices. In June, 205 million shares of Disney were traded. This represents 13.8% of the total shares outstanding. Bank of America traded 1.38 billion shares in June, also coincidentally representing 13.7% of total outstanding shares (these were the first two stocks I randomly picked).

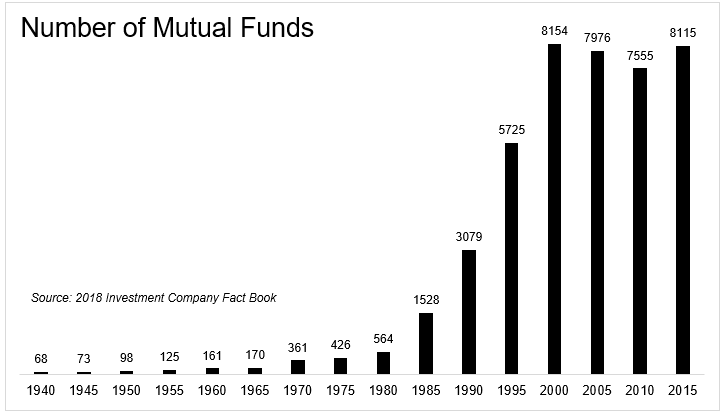

Charley Ellis told Ted Seides, “In the early 1960s I came into the investment management business, there were no courses at the Harvard business school on investment management.” Nobody wanted to go into finance in the 50s and early 60s (read The Go-Go Years if you’re interested in learning more). But finance became a very lucrative career, and by 1985 there were ten times as many mutual funds as there were in 1960. Today there are more than 8,000.

In a New York Times article from 1984, Mutual Funds Trail S.& P. 500, Michael Blumstein wrote:

“For the fifth consecutive quarter, the average gain for equity funds failed to match the Standard & Poor’s index of 500 stocks” This didn’t surprise me, after all we’re all aware of the fact that most funds don’t beat the index. I was surprised however, to read this:

“For the last 10 years…equity funds have increased 453.84 percent, compared with a rise of 326.46 percent for the S. & P. 500” (Over the same time, CRSP 6-10 returned 986%, which likely explains much of the outperformance).

The number of mutual funds tripled between 1975 and 1985, and as competition exploded there was less alpha (not really alpha but that’s for a different post) to go around.

Which brings us to today. I think a reasonable case can be made that one of the primary reasons it has become so difficult to beat the market is because there is too much price discovery, leaving very little opportunities to exploit.

Here are a few data points on Facebook’s volume after it reported earnings on Thursday:

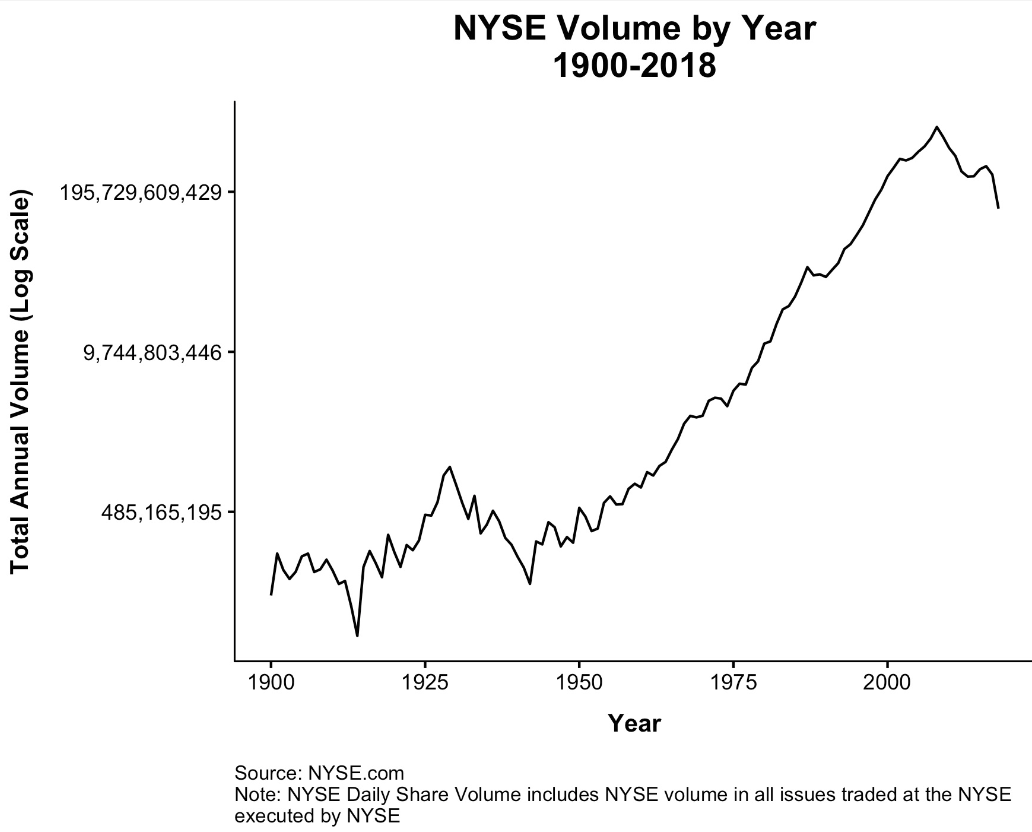

- 100 years ago, during all of 1918, 142 million shares were traded on the New York Stock Exchange. Last Thursday, after reporting earnings, 169 million shares of Facebook were traded.

- The average daily volume on the New York Stock Exchange in 1990 was 156 million shares. Again, Facebook traded 169 million shares on Thursday.

- The average daily volume on the New York Stock Exchange in 1980 was 44 million shares. Facebook traded more than 40 million shares in the first ten minutes on Thursday

Lest you think Thursday was an extreme outlier, it was the tenth highest volume day for Facebook, so not entirely off the charts.

How many actual buyers and sellers does it take to come to a reasonable approximation of underlying value? I’m not sure this can be quantified, but yesterday on the NYSE alone, 14,000 shares were traded every second.

The chart below shows how NYSE volume has grown over time (thank you Nick).

If you believe at all that markets function properly, whether it’s the housing market, a fish market, or the stock market, then you should believe that we have more than enough buyers and sellers to function properly. I’m not suggesting that prices are right 100% of the time or that there won’t be further dislocations like May 2010 and August 2015, but of all the things to worry about, price discovery is fairly low down the list.