Schroders did a Global Investor Study (H/t Meb Faber)

They surveyed over 25,000 people from 32 countries and asked them various questions pertaining to investing. Some of the biggest findings are the usual suspects; people check their portfolio way too often (guilty), they don’t give their investments nearly enough time, and their return expectations are too high. Like, way too high.

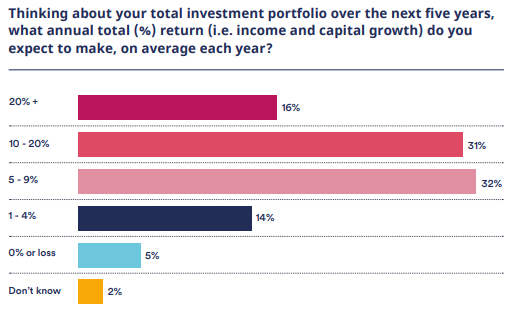

16% of people expect 20% annual returns over the next five years. 20% compounded over five years is 148%. Good luck with that. In not so crazy but also kind of crazy expectations are the 31% of respondents who think they’re getting 10-20% over the next five years. To be fair, this is global and global stocks haven’t done nearly as well as the S&P 500 so I suppose this is possible. Global stocks outside the United States (ACWX) have done just 3.9% a year for the last decade.

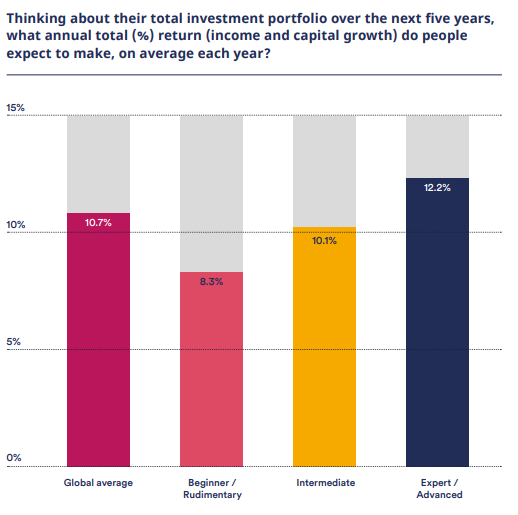

This next one shows expectations broken down by investor acumen.  Across the board, people are anticipating high returns going forward. We can’t control what the market gives us, but we can control how much we expect it to give us.

Across the board, people are anticipating high returns going forward. We can’t control what the market gives us, but we can control how much we expect it to give us.

The fastest way to fail as an investor to have reality fall short of your expectations. It’s better to plan for 5% and get 10% than to plan on 10% and only get 5%.