“Would you want to partner with us on this? We’re literally trying to build the exact same thing that you are.”

“Absolutely,” I said. “Let’s do it.”

This was the conversation I had a few months ago with Jeremy Schwartz, the Global Chief Investment Officer at WisdomTree. The project we were both working on, independent of one another, was building a diversified cryptocurrency strategy. As traditional finance people, we wanted to bring an old idea into the new world of digital assets.

What brought Jeremy and I together, aside from being friends for a long time, was our investments in Onramp Invest, a crypto technology platform built for financial advisors.

I’ll get into the index a little later on, but first a quick backstory.

In 2018, John Oliver described cryptocurrencies as “everything you don’t understand about money combined with everything you don’t understand about computers.” This about sums up my experience to that point. I read Satoshi’s whitepaper in 2013 but I didn’t get the problem they were trying to solve. My immediate reaction was, “What’s wrong with Venmo?”

A lot has happened between then and now.

As any Animal Spirits listener knows, I’ve grown more fascinated by the crypto space over the last two years. Like virtually everybody that enters the arena, my first investment was in Bitcoin, which, I wrote about back in the spring:

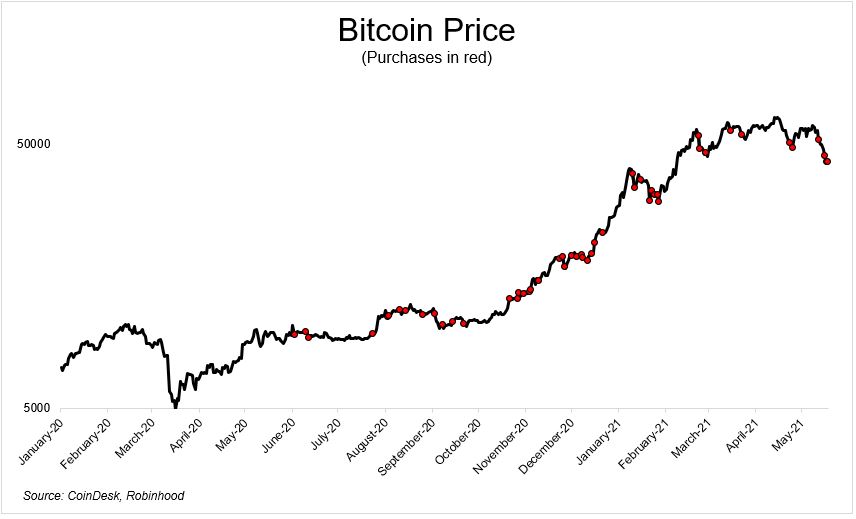

My first purchase was on June 2, 2020. I wanted to build up to 1 Bitcoin and figured I would have plenty of time to do that. Wrong. My first purchase was at $9,565. I bought $1,000 worth or 0.1045 coins. Over the next few weeks, I made three more purchases under $10,000, bringing my total to .4 coins by July. And then the price started to run away from me. I’ll spare you the details of every purchase I’ve made over the last year, but you can see that I bought on the way up, and I definitely bought on the way down.

I started with Bitcoin, and then, like most crypto investors, I bought Ether. The simplest way to explain the differences between the Kong and Godzilla of crypto is that Bitcoin is digital gold. No need to make it any more complicated than that. Ethereum is programmable money. From smart contracts to non-fungible tokens (NFTs) to decentralized applications (dApps), basically all the cool and exciting stuff that’s happening in the space is built on top of the Ethereum blockchain.

And then from Ether, I fell down a rabbit hole with the lights turned off.

The digital economy is evolving so quickly that it’s impossible to stay on top of all the latest developments. According to PitchBook, venture capitalists have invested more than $27 billion into crypto startups as of late November, more than the previous 10 years combined. If you think this is a fad or tulips or whatever, you’re not paying attention.

With all of the activity going on, it’s difficult to figure out who’s going to emerge from the crowd. Bitcoin was the first permissionless and decentralized way to send money peer to peer. Ethereum was the first programmable money to scale. But who’s to say that something better won’t come along?

“Don’t put all of your eggs in one basket” is as old as time. With a nascent asset class like crypto, we think it’s the prudent way to invest.

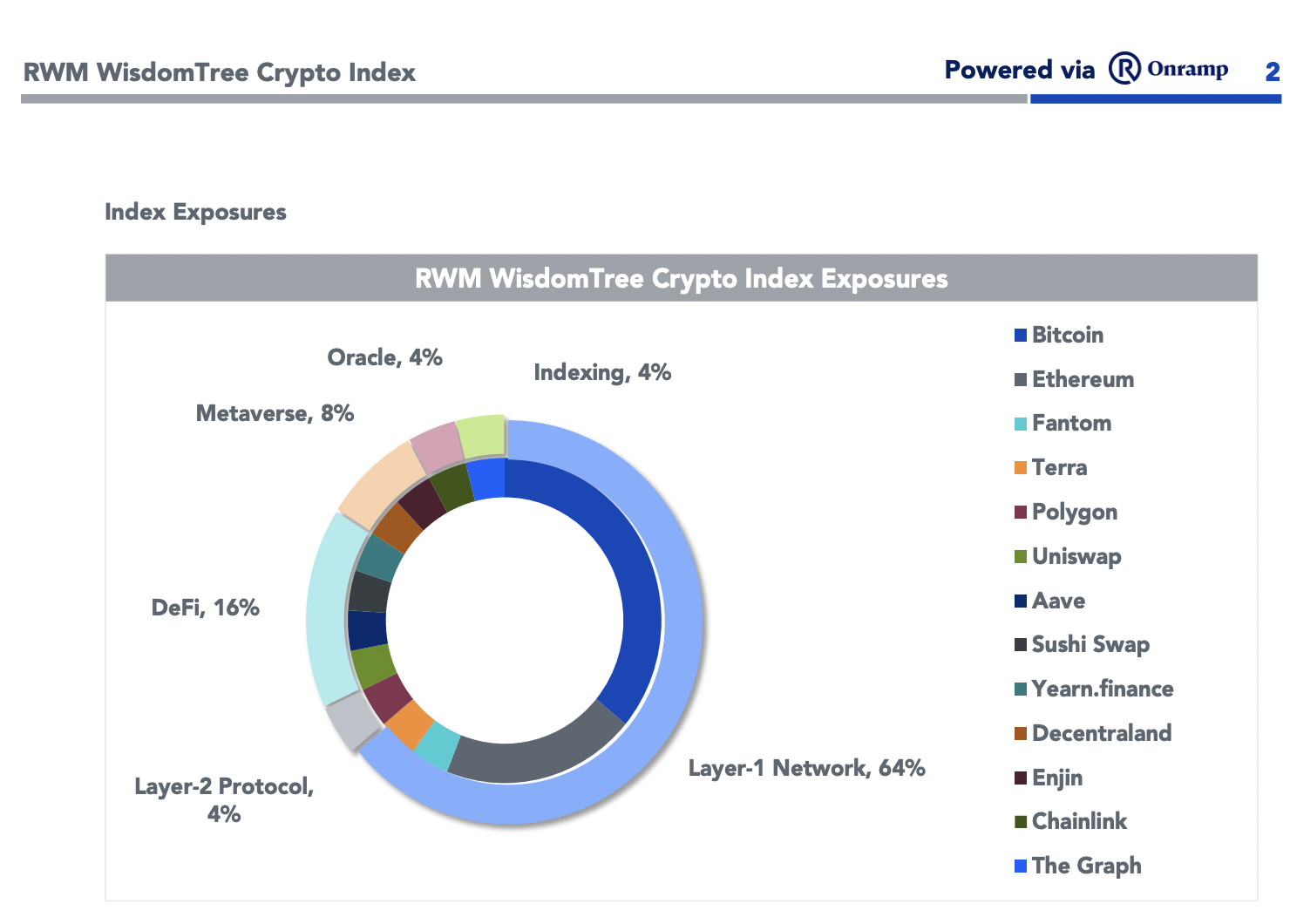

Working with the digital asset team at WisdomTree, we came up with a portfolio that we hope will provide beta-like exposure to the crypto economy. We will continue to monitor the landscape and add new coins as they meet the index’s inclusionary criteria.

I’m a fan of letting the crowd be the ultimate arbiter of value in public markets, but not in crypto. A market-cap-weighted approach a la the S&P 500 just doesn’t work for several reasons.

A top-10 coin has been charged by the SEC for violating securities laws. Two of the top 10 are stable coins. Another one started as a meme. And then there’s the problem of market dominance. Bitcoin and Ether currently represent 60% of the $2.5 trillion universe.

The S&P 500 index, while mostly passive, is run by an active committee. Just as there are decisions to be made on what goes in and comes out, we are operating in a similar fashion with the RWM WisdomTree Crypto Index. The index provides exposure not just to the layer-1 titans, but to DeFi, the metaverse, and other burgeoning areas in the cryptocurrency landscape.

Today, the RWM WisdomTree Crypto Index is only available for Ritholtz Wealth Management clients using separately managed accounts on Gemini. Onramp is working hard to bring this index to financial advisors across the country. They are also busting their hump to open this up to individual investors who don’t work directly with an advisor. We intend to have this available in the first quarter of next year. To receive real-time updates, please visit our website here.

We’re thrilled to be working with Onramp and WisdomTree to offer this product to our clients and soon the world. But I would be remiss if I didn’t mention the risks involved. I genuinely think the $2.5 trillion in crypto today can be multiple times larger in the years ahead. But I am more confident that there will be brutal wipeouts along the way. No pain, no gain. Casting a wide net across more than a dozen coins does not eliminate risk, it just spreads it out.

“Invest as if it is going to zero” is just silly. It’s not going to zero. But “invest as if it will get cut in half multiple times” is a good way for new investors to think about allocating money to this space.

We don’t know what’s going to happen in the coming days and months, but we want to have exposure to this space over the long term. The RWM WisdomTree Crypto Index is our vehicle of choice on the long highway ahead.

For more information on the index, please see the fact sheet here.

For disclaimers, please click this link.

Josh, Jeremy, and I discussed all of this and much more on the latest edition of The Compound and Friends, which you can listen to here

***

New technologies can be overwhelming. You need someone to translate complex topics into plain English. I want to highlight some people that have helped me on my journey.

Patrick O’Shaughnessy showed me that there are really smart people working on these incredibly complex projects. His Hash Power series came out back in 2017 when all I saw was hype and little substance. Patrick taught me that there was some serious mental horsepower here.

Packy McCormick has been my shepherd into this strange new world. His piece Own the Internet helped me understand the power of programmable money.

Mario Gabriele’s piece on Sushiswap taught me about automated market makers and liquidity pools. His piece on DAOs explained why they can become the LLC of the future.

Chris Dixon taught me about the inherent flaws in centralized platforms and the opportunity that Web 3 has to shift the balance of power.

Matt Hougan and the team at Bitwise helped me understand the power of the blockchain and why self-driving banks are the future.

Eric Peters helped me understand how institutional investors are thinking about allocating to cryptocurrencies. This podcast with the Bankless guys is great if you prefer to listen than to read.

Bill Miller helped crystallize the case for owning Bitcoin back in April of this year. Barron’s asked him:

You’ve made a killing on Bitcoin. What’s the rationale for owning it?

Here was his response (emphasis mine).

Bitcoin is a decentralized, permissionless, peer-to-peer network of computers that’s permanent and unhackable. When you buy a Bitcoin, you’re buying a slot on that database, and almost all of those slots have been allocated. There’s only going to be 21 million Bitcoins in the world, and 18.5 million have already been mined and circulated. So we’ve got 2.5 million to go. It’s Economics 101. The supply grew 2.5% last year; it’s growing 2% this year. Is demand growing faster or slower than 2%?