On today’s show, we are joined by Guy Spier, Managing Partner of the Aquamarine Fund, and famous lunch partner of Warren Buffett to discuss:

– Guys lunch with Warren

– Value investing in 2023

– Investing in streaming stocks

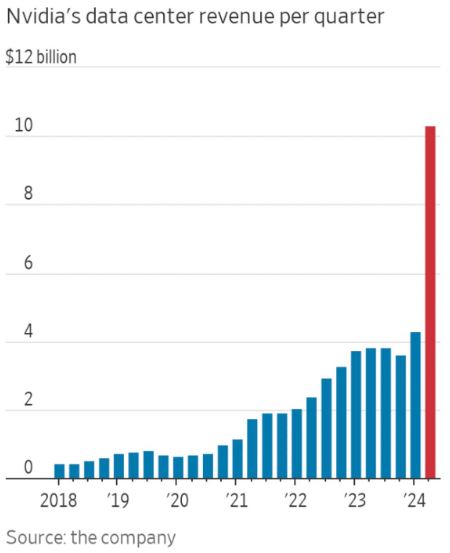

– Nvidia’s blowout quarter, and much more!