On today’s show, we are joined by Brian Belski, Chief Investment Strategist at BMO Capital Markets to discuss sector rotation, earnings, Iger returning to Disney, and much more!

On today’s show, we are joined by Brian Belski, Chief Investment Strategist at BMO Capital Markets to discuss sector rotation, earnings, Iger returning to Disney, and much more!

On today’s show, we discuss the psychology behind big gains and losses, why retail traders are buying again, entertainment vs. advice with Jim Cramer, new bull market vs. bear market rally, value vs. growth. vs. rates, the strongest labor market of our lifetimes, tales from Miami, and much more.

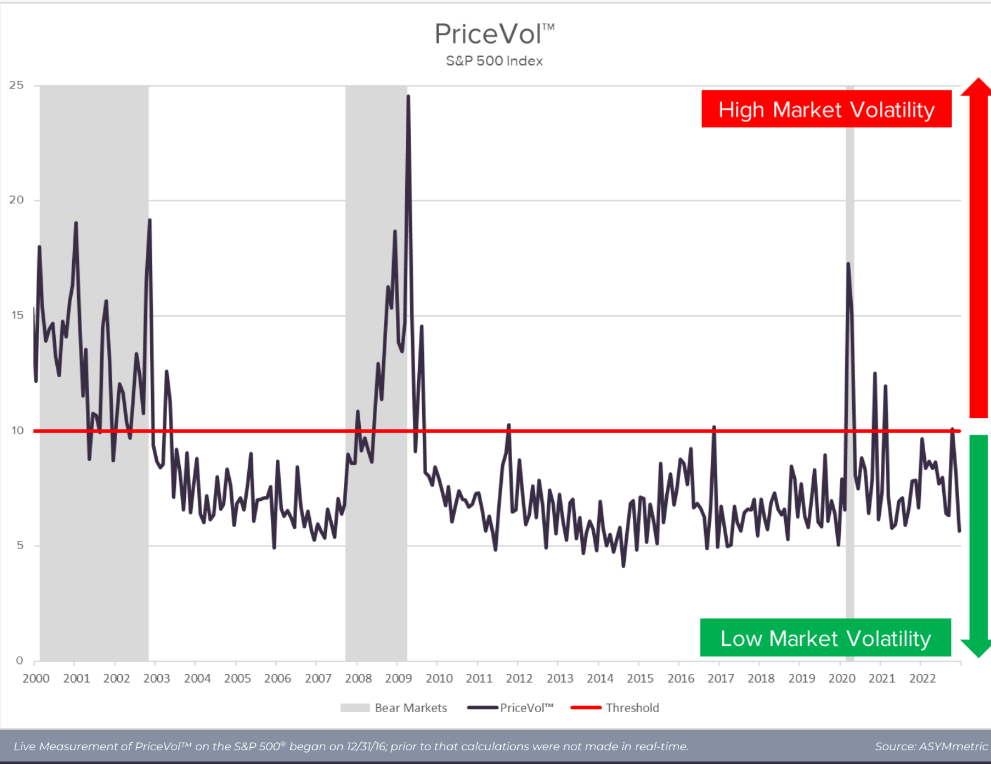

On today’s show, we had Darren Schuringa, CEO and Founder of ASYMmetric ETFs on to discuss market volatility, how leverage works within leveraged ETFs, how ASYMmetric utilizes leverage and trend following, and much more!

The broken Vix, soft versus hard data, a big regime change, and more things I chewed on last week

On today’s show, we are joined by Jason Hsu, Founder and CIO of Rayliant Global Advisors to discuss FOMC meeting fallout, big tech earnings reports, market sentiment, China reopening, and much more!

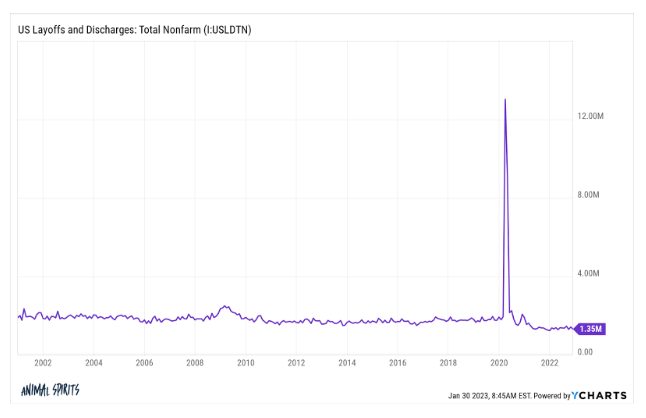

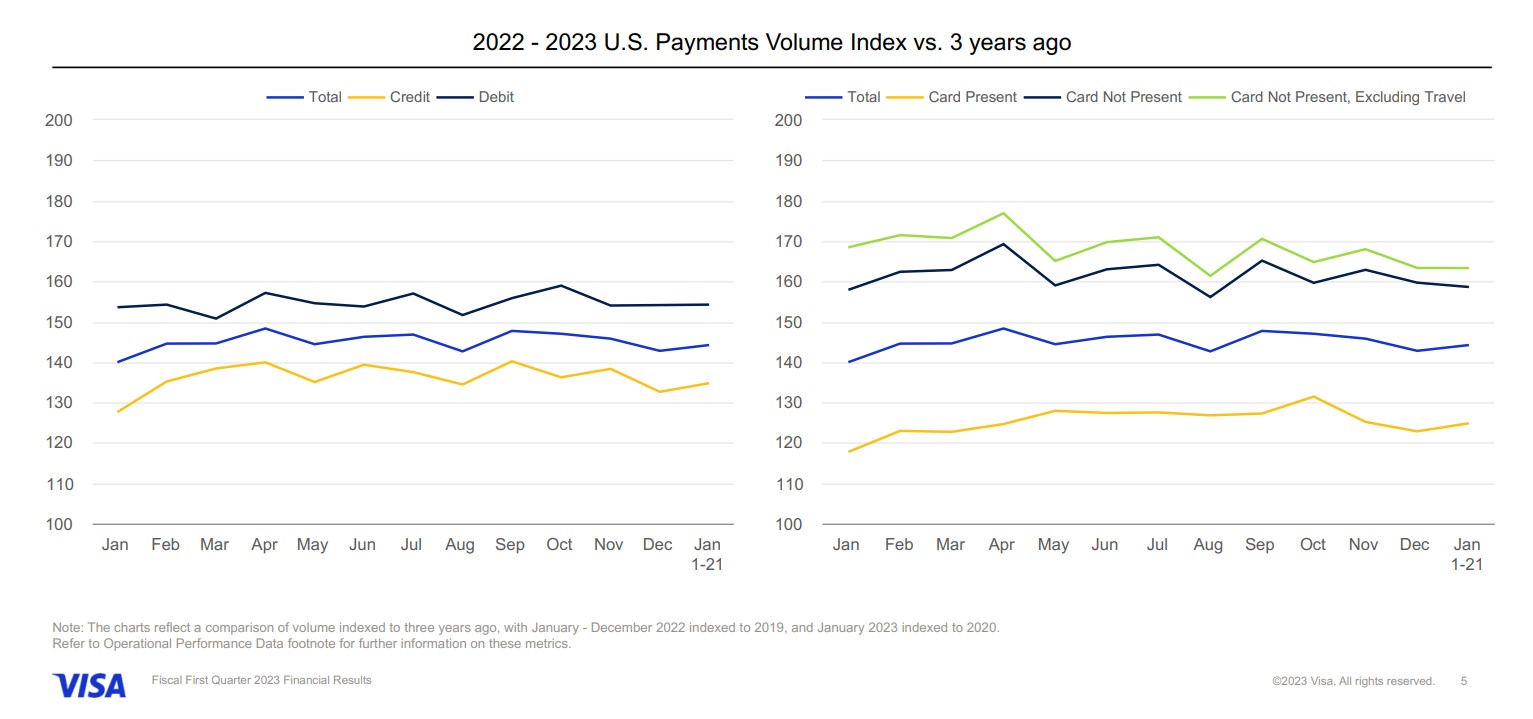

On today’s show, we discuss the stock and bond market rallies in 2023, why certain investors are so pessimistic all the time, housing market activity bottoming, the most hated economic expansion of all-time, context around tech layoffs, consumer spending is slowing, Michael’s first resume and much more.

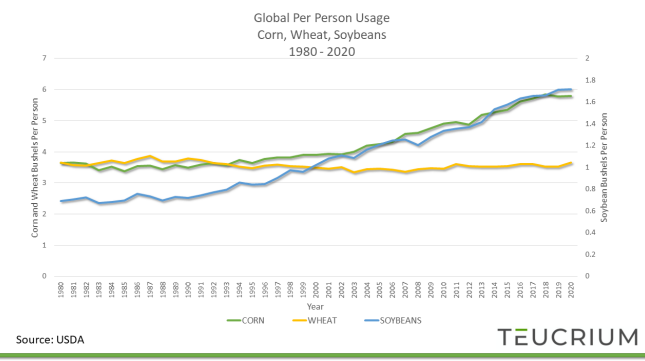

On today’s show, we are joined by Sal Gilbertie, CEO of Teucrium to give us an update on Oil & Gas, how supply chains are looking in 2023, Teucriums latest Long/Short fund, potential issues with China, and much more!

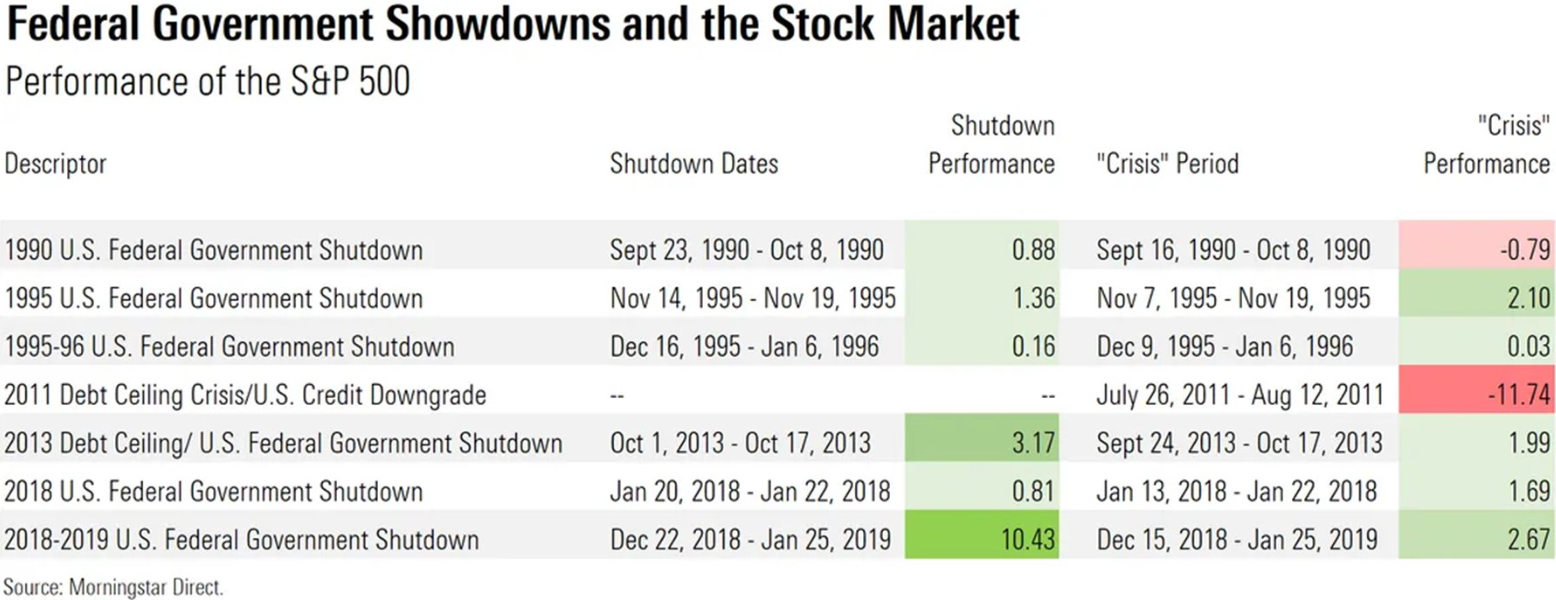

Risk happens when investors get blindsided by news they did not expect or news that is worse than expected.

A lack of meaningful consequences, the disappearance of egg futures, adventures in biotech, and more things I chewed on last week.

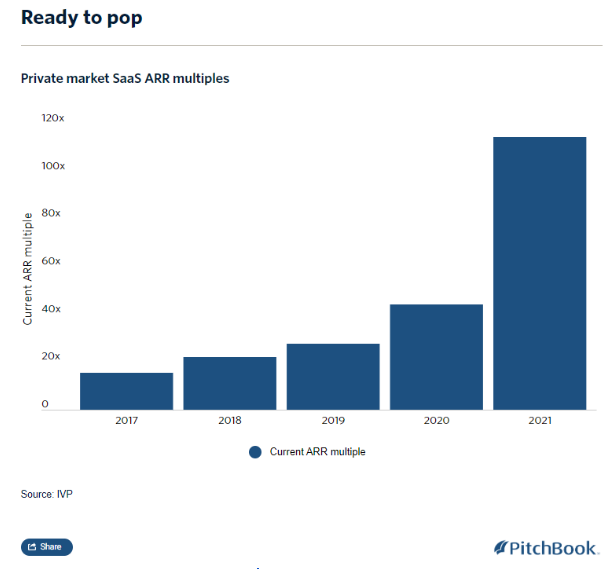

On today’s show, we are joined by Nathan Vardi, Managing Editor at MarketWatch and Author of For Blood and Money to discuss biotech investing, hedge funds, VC markdowns, and much more!