On today’s show, we are joined by Bob Long, CEO of StepStone Private Wealth to discuss timing private markets, how valuations have held up in private markets, an update on venture capital, and much more!

On today’s show, we are joined by Bob Long, CEO of StepStone Private Wealth to discuss timing private markets, how valuations have held up in private markets, an update on venture capital, and much more!

The next Warren Buffett, Clapping for SBF, and what’s going on with GBTC

On today’s show, we are joined by Jeff deGraaf, Chairman and Head of Technical Research at Renaissance Macro Research to discuss the markets recent bounce, huge bond outflows, the difference between investing in oil and oil companies, and much more!

On today’s show we discuss the round trip in oil prices, why predicting the future is so difficult, how we define a bubble, why interest rates didn’t go higher, active outflows are speeding up, Black Friday deals we found, crypto prices got out of hand, the downside of technology and more.

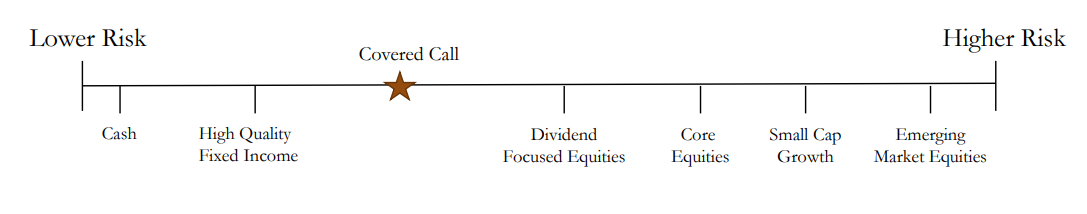

On today’s show, we are joined by Ray Di Bernardo, VP and Portfolio Manager of Madison Investments to discuss writing call options, buying growth at a reasonable price, earnings in 2023, and much more!

The tech industry’s midlife crisis, inflation versus employment, and life lessons.

On today’s show, we discuss the impact of interest rates on business formation, the opposite of stagflation, why there was no spillover from the crypto crash, why the S&P 500 is not the economy, why remote work might bring down rental inflation, and much more.

This week was all about SBF and FTX

On today’s show, we are joined by Gregor Macdonald, reporter and writer of The Gregor Letter, to discuss the FTX meltdown, yield curve inversions, and all things clean energy.

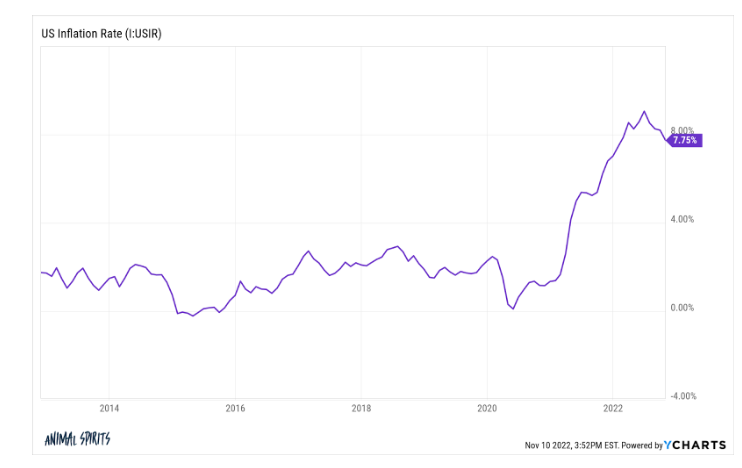

On today’s show we discuss inflation is finally falling, will the stock market wait for the Fed’s all-clear, the FTX saga, how SBF fooled everyone, what comes next for crypto, why streaming stocks are struggling, 5 years of Animal Spirits and much more.