On today’s show, we discuss:

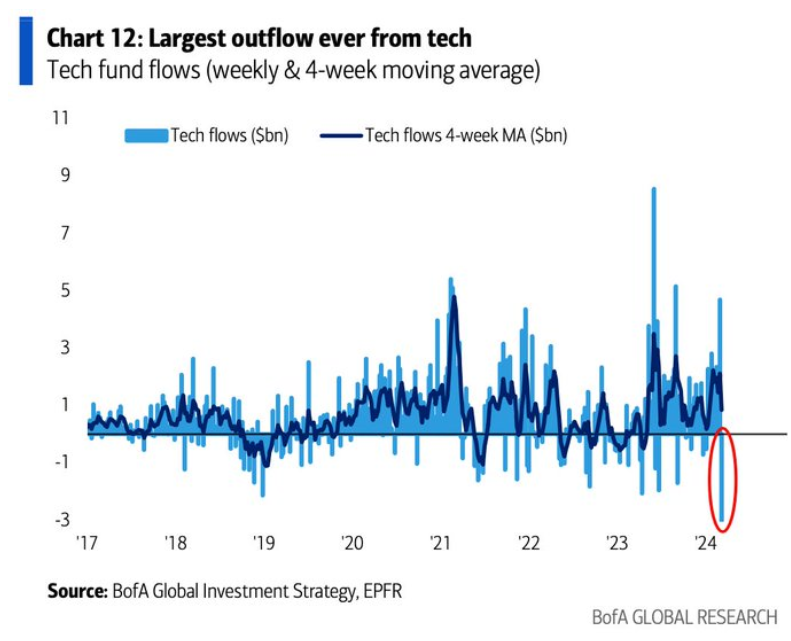

– One of the most resilient stock rallies ever

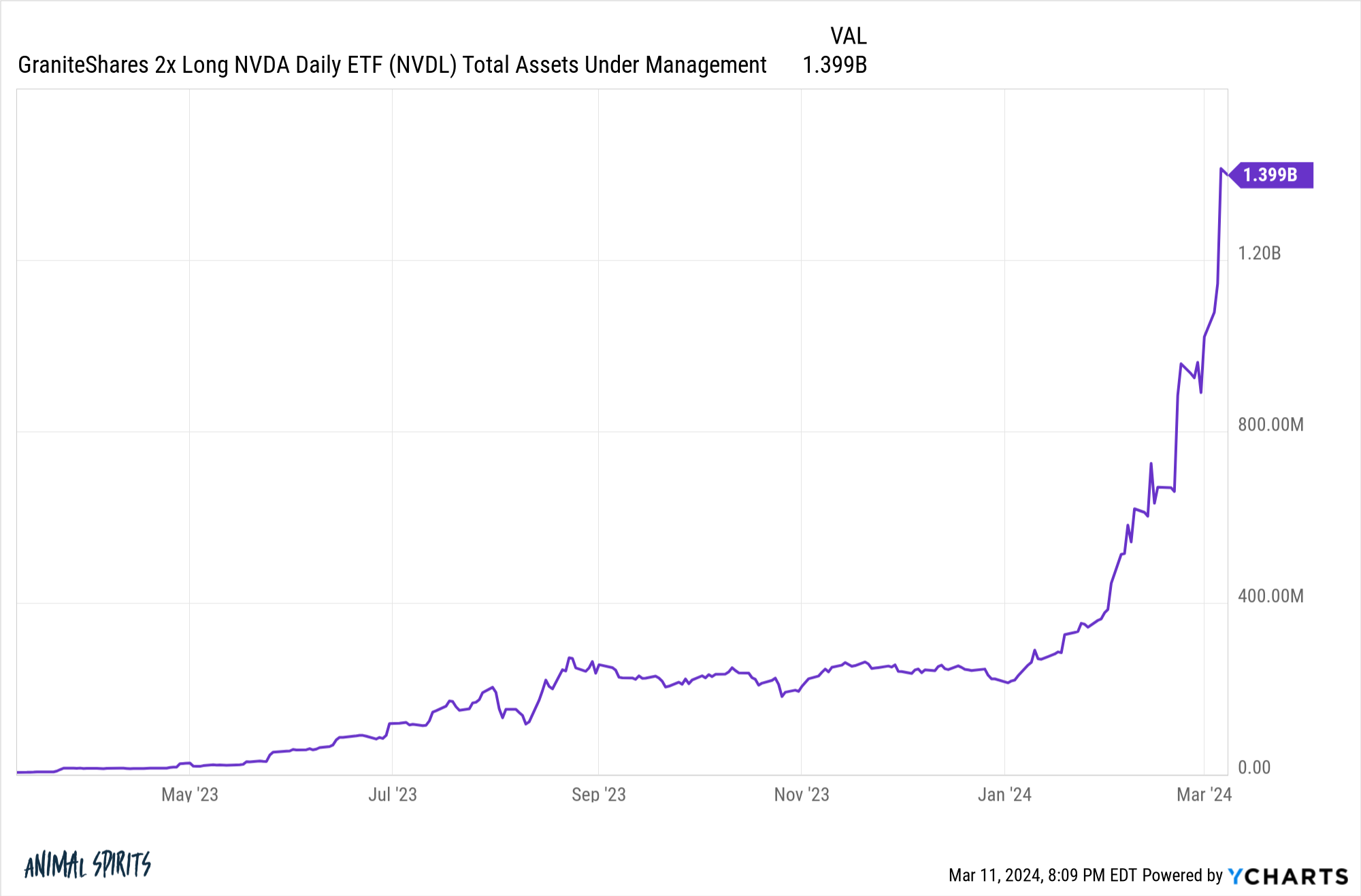

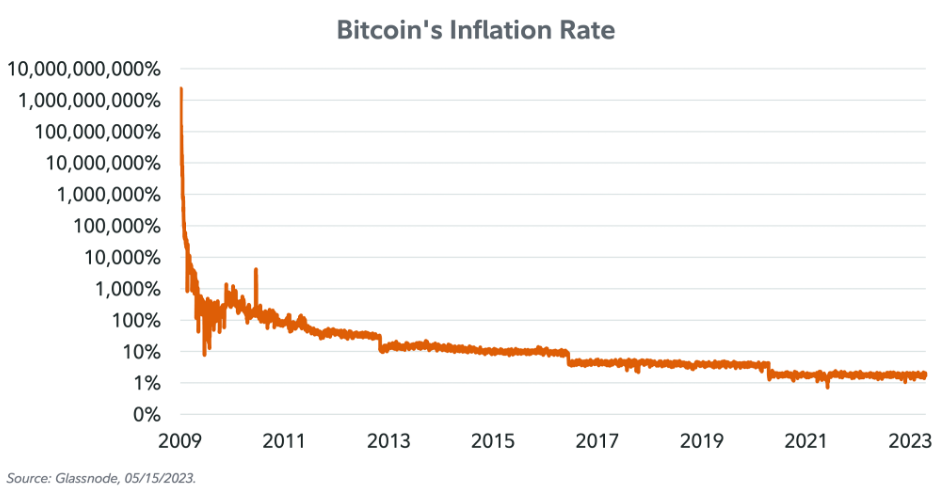

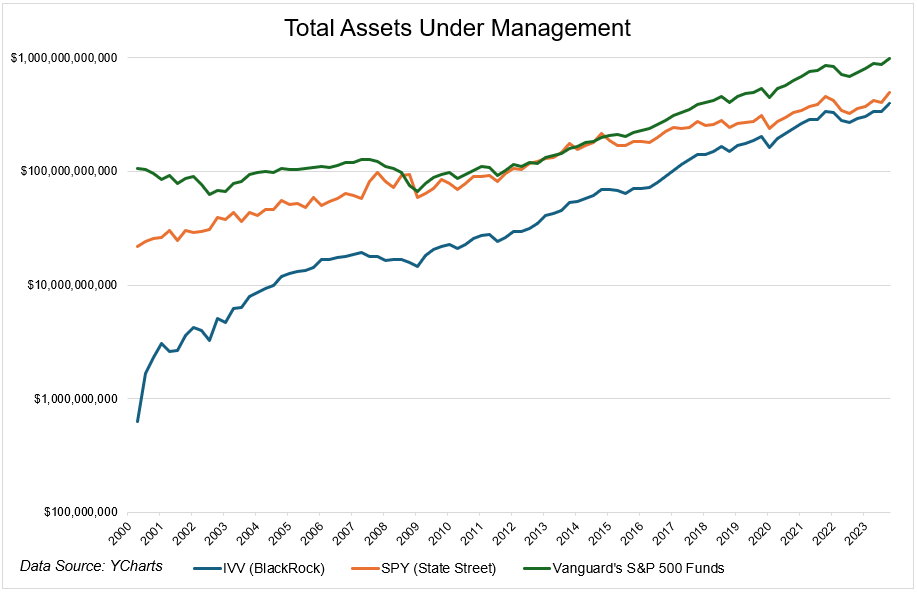

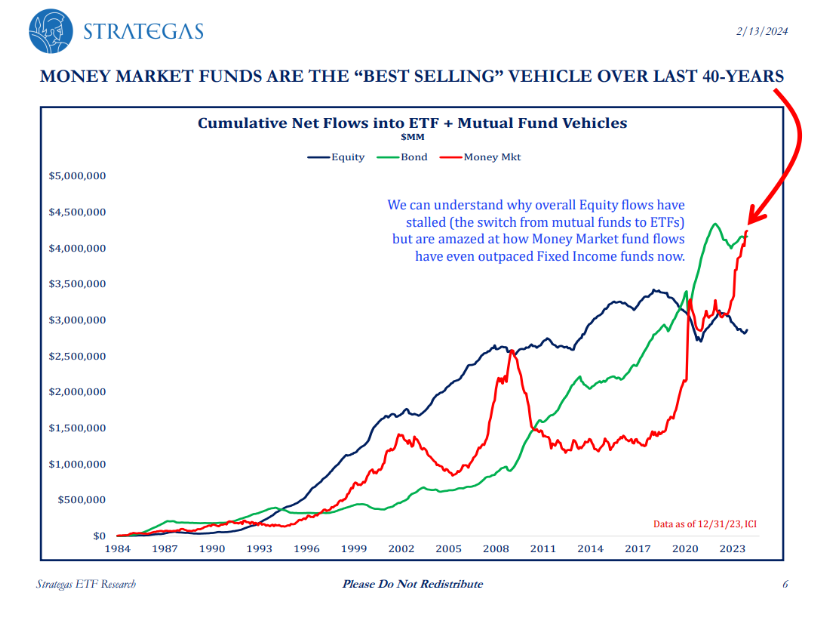

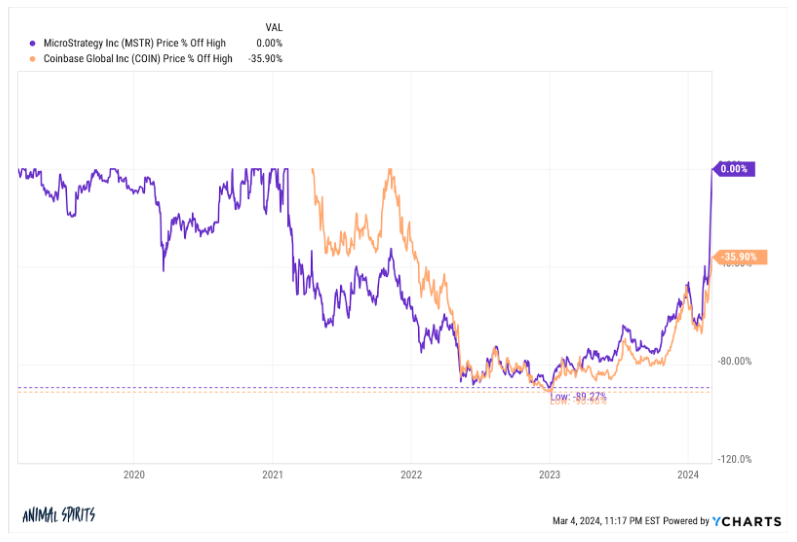

– Money market funds vs. crypto

– Americans are rich

– The stock market has always been concentrated

– Inflation at the grocery store

– The biggest reason the Fed needs to cut rates

– Some good news for first-time homebuyers, and much more.