Howard Marks is a brilliant thinker and one of the most thought provoking investors out there. More importantly, he walks the walk and is the owner of a superb track record. Now that due praise is out of the way, I believe Marks is unfairly critical of technical analysis, specifically on momentum investing. From his book, The Most Important Thing:

“It seems clear that momentum investing isn’t a cerebral approach to investing.”

Perhaps this is true; momentum investing doesn’t require the analysis of macro-economic conditions or deep dives into a company’s balance sheet. However, one of the benefits to this strategy is that it eliminates many of the cognitive and behavioral biases that investors are subject to while doing cerebral analysis. Investing doesn’t have to be complicated. Like Einstein said, “everything should be made as simple as possible, but not simpler.”

Marks goes on:

“Another form of relying on past stock price movements to tell you something is so-called momentum investing. It, too, exists in contravention of the random walk hypothesis. I’m unlikely to do it justice. But as I see it, investors who practice this approach operate under the assumption that they can tell when something that has been rising will continue to rise.”

Pulling no punches:

“Moving away from momentum investors and their Ouija boards, along with all other forms of investing that eschew intelligent analysis, we are left with two approaches, both driven by fundamentals: value investing and growth investing.”

I’m not sure momentum investors actually operate under these assumptions Marks refers to. In fact, as someone who emphasizes risk management to such a high degree, I think Marks would be able to appreciate some trend following strategies, which rely not on intuition, but rather on rules to determine when the odds are no longer favorable.

To bring some data into the discussion, I looked at a simple momentum based strategy. I wanted to see what happens in the twelve months following a trending market. Now before going any further, it’s important to point out that Marks isn’t concerned about the next twelve months. He’s said “if you can’t hold a stock for five years, don’t even think about holding it for five minutes.

Back to business.

In order to measure a trending market, I looked at the ten-month moving average for the S&P 500, which is roughly equivalent to the 200-day. I defined a trending market as one in which the slope of the moving average is greater than one percent (arbitrary) in a market that is trending higher and less than negative one percent in a market that is trending lower.

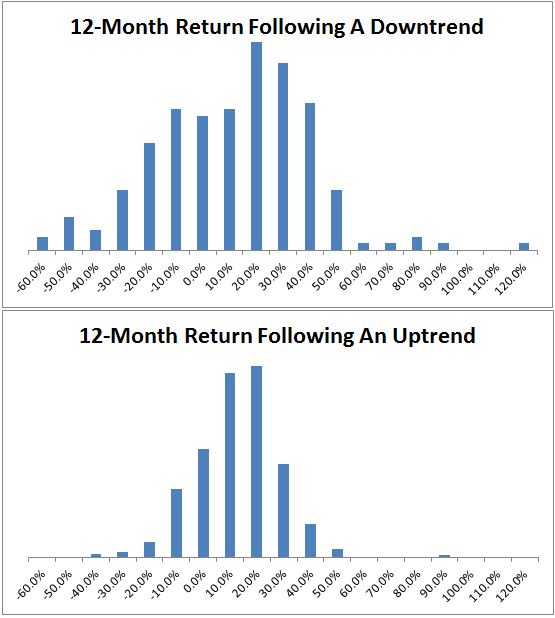

The average 12-month return following a down trending market is 6.7%. The average 12-month return in a market that is trending higher is 7.9%. This alone doesn’t tell the whole story and in order to make the point, it’s more helpful to look at the distribution of returns.

What you’ll immediately notice is that the distribution in downward trending markets is much wider than the distribution of returns in an upward trending market. Markets that are trending higher tend to have less tail risk. A twelve-month return of less than negative twenty percent occurred eighteen percent of the time following a downward trending market. This happened just three percent of the time following an upward trending market.

I’m not suggesting the above data will provide anyone with a way to derive superior returns. However, I am stating the obvious, which is that bad things tend to happen in bad markets. Perhaps this is too simplistic, but that’s the whole point. Momentum investing can be quite effective and does not rely on the “crystal ball” that Marks and many others often mistakenly assume. Bad markets can be quantified and to suggest otherwise is really doing momentum investors a great disservice.

[…] momentum misunderstood? (@michaelbatnick) […]

[…] Is momentum misunderstood? (theirrelevantinvestor.wordpress) […]

[…] (FT) • Three Edges to Beat Mr. Market (Seeking Wisdom) see also Is Momentum Misunderstood? (Irrelevant Investor) • Microsoft Exec’s Investing Answer: Charlie Munger. Tren Griffin says Munger’s approach is […]

[…] Especially for the proponents of momentum investing https://theirrelevantinvestor.wordpress.com/2015/08/10/is-momentum-misunderstood/ […]

[…] price momentum (or relative strength). Value investing works, but it has the tendency to be early. Momentum investing works, but it’s sometimes volatile. Both factors have outperformed the market over time, but […]

[…] Why momentum is so widely misunderstood (Irrelevant Investor) […]

[…] A defense of momentum investing (theirrelevantinvestor) […]

[…] Is Momentum Misunderstood? Does This Time Feel Different? […]