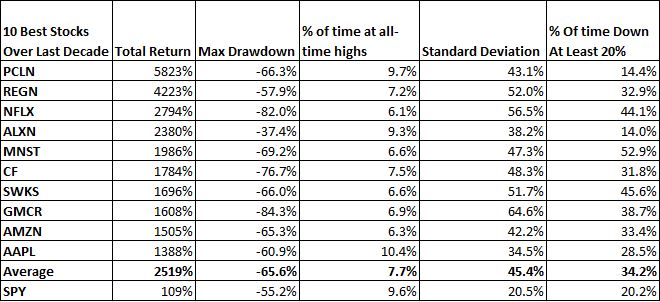

The other day I looked at a common theme among the decade’s biggest winners; they tended to be very expensive relative to their peers based on traditional valuation metrics. Today I want to look at another trait these winners share, volatility and big drawdowns.

A few things really stand out in this table.

- Nine of the ten biggest winners were all cut in half. Granted, the S&P 500 was as well, but the point is that even the best stocks gave investors plenty of sleepless nights.

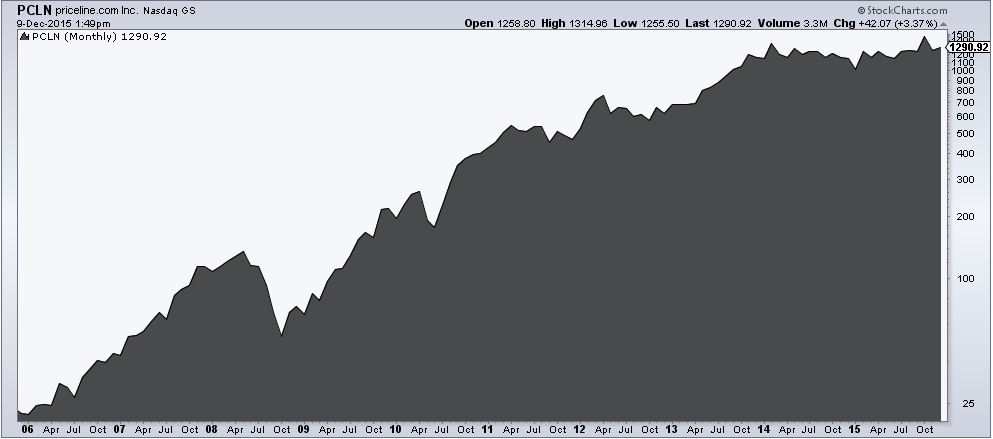

- Even though these winners returned 23x what the S&P 500 did, only Apple and Priceline hit all-time highs more often.

- The average standard deviation for these stocks was more than twice that of the S&P 500. No pain, no gain.

- These stocks spent on average 34% of the time in “bear market territory.” That’s pretty wild. One out of every three days these stocks were at least 20% off their all-time high.

The point of this data is not to suggest that all stock pickers suffer 50% drawdowns. The message is that if you’re looking at long-term charts and and playing the coulda, woulda, shoulda game, don’t kid yourself, it’s never as easy as it looks.