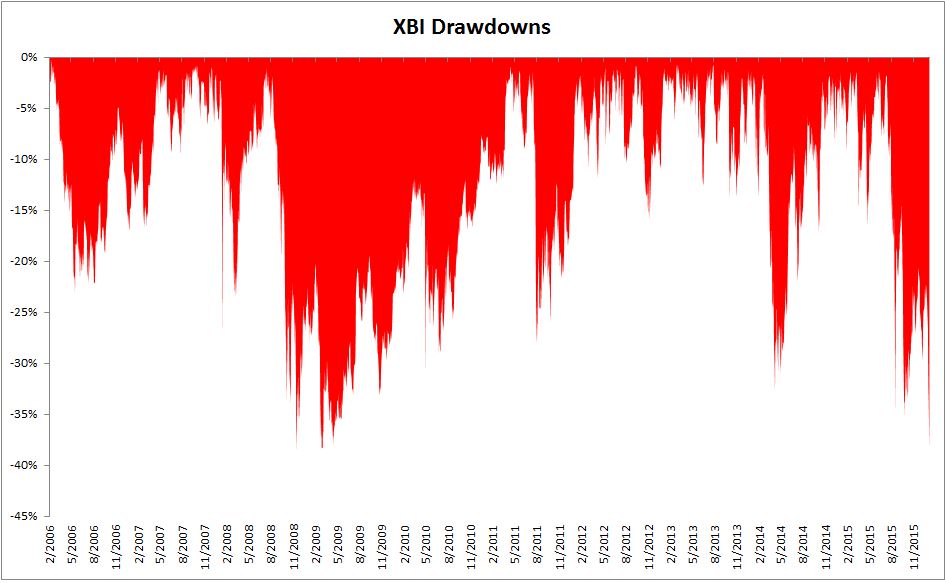

The S&P Biotechnology Select Industry Index (XBI) just experienced its worst drawdown ever. The 38.9% decline since July of 2015 (slightly worse than the fall in 2008) is unlike anything these investors have ever witnessed.

While the carnage going on in these stocks is ugly, these charts only show the losses over time, as if there is not a mirror image to these drawdowns. We’re assuming investors held on through the losses, we might as well assume they stuck around for the gains.

The chart below is a more accurate look at the experience a buyer would have had if he or she bought XBI on the first day it started trading.

The hypothetical biotech investor would have been in a 10% drawdown 51% of the time and in a 20% drawdown 25% of the time. For this pain they would have experienced a 257% return over the next decade, compounding their wealth at 13.7% a year. Granted, there might be one or two people alive that actually bought on day one and still own it today, but the point remains.

Biotech investors, and investors in general have been well compensated for the multiple large drawdowns they’ve experienced. No pain, no gain.