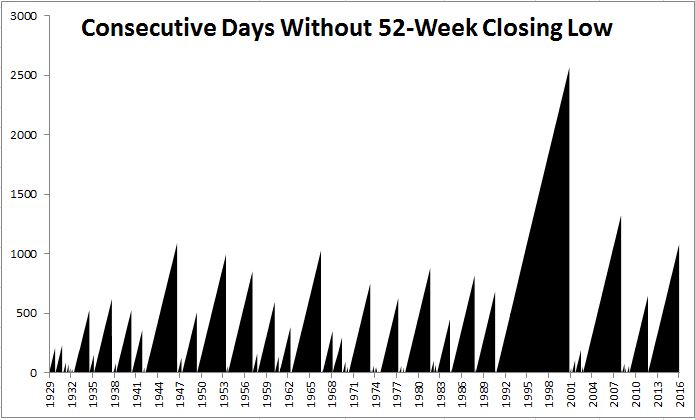

The S&P 500 just closed at a 52-week low (January 20) for the first time since October 2011. The 1079 days between 52-week closing lows is the fourth longest streak of all time.

I went back and looked at what happened in years that experienced a closing low versus those that didn’t and the results were pretty interesting.

A few observations:

- Of the 37 years that experienced a 52-week closing low, the average return was -10%. Of the 49 years that did not experience a 52-week closing low, the average return was 18%.

- 35% of all years have had negative returns. At 70%, years that saw a 52-week closing low were twice as likely to finish in the red.

- 2% of all days have closed at 52-week lows.

- 1974 had 38 different 52-week closing lows, the most of any year. 2008 had 27, for comparison.

- Just because we recently had a 52-week closing low, does not mean you should run and dump all your stocks. On five different occasions did a year see a 52-week closing low and still finish up double digits.

I’m sure I’ll get a lot of “no shit Sherlock” for this, but to keep it simple, the takeaway is that bad things tend to happen in bad markets.