A new paper was recently published titled The Market for Financial Adviser Misconduct by Mark Egan, Gregor Matvos, and Amit Seru. It takes a deep dive into financial adviser shenanigans and quantifies everything from repeat offenders, to misconduct across firms, to the consequences of misconduct. This is a must read for anybody in the industry.

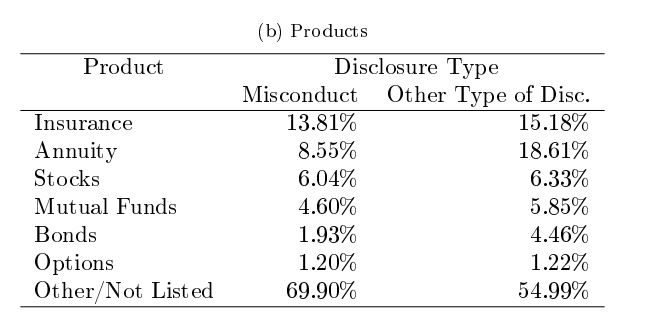

Below I’ve clipped some of the data I found to be most interesting.

- “In total, the data set contains 1.2 million financial advisers and includes roughly 8 million adviser year observations over the period….The data set contains a monthly panel of all registered advisers from 2005 to 2015. This panel includes 644,277 currently registered advisers and 638,528 previously registered advisers who have since left the industry.”

- “One in thirteen financial advisers have a misconduct-related disclosure on their record”

- “Approximately one-third of advisers with misconduct records are repeat offenders. Past offenders are five times more likely to engage in misconduct than the average adviser, even compared with other advisers in the same firm at the same point in time.”

- “We find that advisers working for firms whose executives and officer have records of misconduct are more than twice as likely to engage in misconduct.”

- “Almost half of financial advisers who engage in misconduct in a given year do not keep their job into the subsequent year.”

- “We find that 44% of advisers who lost their job after misconduct find employment in the industry within a year.”

- “Misconduct is more common in wealthy, elderly, and less educated counties.” Of the 5,278 advisers in Palm Beach, Florida, 18.11% have engaged in misconduct.

- “Almost 7.56% of currently registered advisers engaged in misconduct at least once during their career. Of those, 38% are repeat offenders, having two or more disclosures of misconduct.”

There is a ton of eye opening data in this paper, I highly recommend at the very least finding some time to skim through it.

Source:

The Market for Financial Adviser Misconduct