“There’s a quick and easy way to test whether an activity involves skill; ask whether you can lose on purpose. In games of skill, it’s clear that you can lose intentionally but when playing roulette or the lottery you can’t lose on purpose.”

– Michael Mauboussin

I don’t believe that stock picking is entirely a game of luck, but the fact that there is a large amount of luck involved is indisputable. Just ask yourself, can you identify ten stocks that will do worse than the market over any period of time? The answer is probably not. If you played this game at the end of 2015, some of the names you might have picked to underperform are in fact the best performers year to date.

The top three S&P 500 stocks so far are Newmont Mining, Michael Kors and Freeport-McMoRan. All three of these companies were down in 2015 and are a mile away from their all-time highs (60%, 42%, and 82% respectively). Broadening out this list a little bit, let’s take a look at some of the best performing stocks through 2016.

As of yesterday, 15 of the 16 strongest S&P 500 stocks YTD were down in 2015, on average 36.2%. These are the companies that many people would have chosen to continue their underperformance into 2016. Here are a few headlines in 2015 from this year’s best performing stocks.

Newmont Mining Profit Falls Sharply on Lower Metal Prices

Michael Kors Is A Hot Mess. Stock drops 20%

Why Freeport-McMoRan Is The Worst Stock In The World

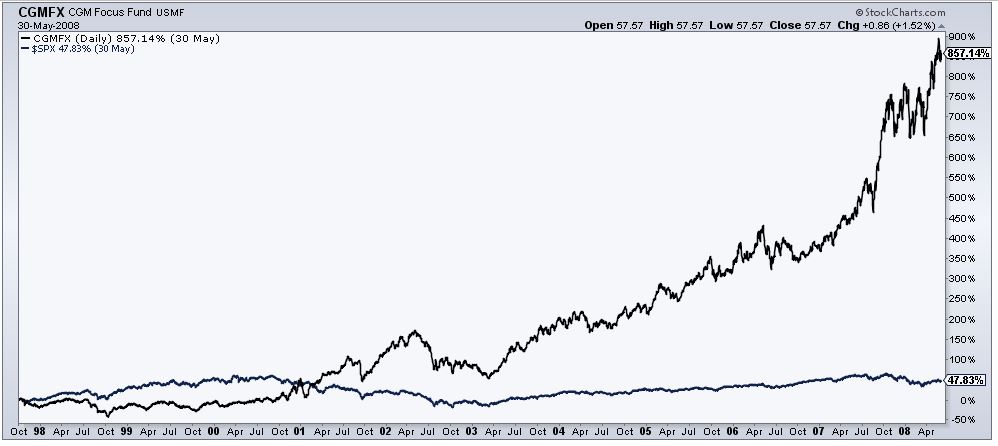

Let’s take a look at the role luck has played in a fallen star, Ken Heebner, who was once the best performing mutual fund manager of the decade (It’s too bad most of the investors weren’t around to see it). From the Wall Street Journal

“The gap between CGM Focus’s 10-year investor returns and total returns is among the worst of any fund tracked by Morningstar. The fund’s hot-and-cold performance likely widened that gap. The fund surged 80% in 2007. Investors poured $2.6 billion into CGM Focus the following year, only to see the fund sink 48%. Investors then yanked more than $750 million from the fund in the first eleven months of 2009, though it is up about 11% for the year through Tuesday”

Take a look at the massive outperformance from inception through the fund’s top in 2008.

The next seven and a half years was followed by massive underperformance.

In writing about Ken Heebner, the always brilliant Larry Swedroe writes:

“So, how should you interpret this outcome? Here are two possible explanations to consider:

- Heebner’s pre-2008 outperformance was a lucky outcome and his post-2007 performance was an unlucky one.

- Heebner was a genius who, on Jan. 1, 2008, took a “stupid pill.”

Which seems more likely to you?”

Being an index advocate doesn’t mean you’re admitting defeat, it means you want to participate in the future economic expansions while eliminating luck from the equation. As Warren Buffett says, “By periodically investing in an index fund, for example, the know-nothing investor can actually outperform most investment professionals. Paradoxically, when ‘dumb’ money acknowledges its limitations, it ceases to be dumb.”