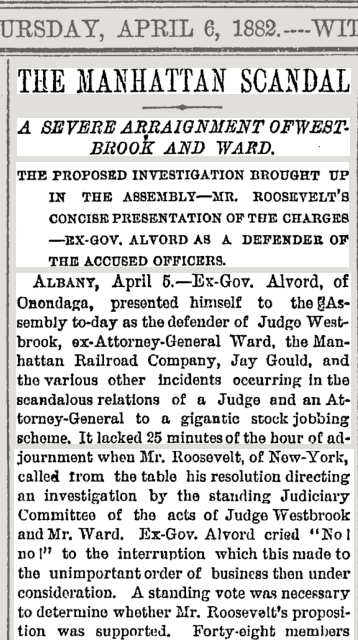

I want to share an amazing piece of history that I found in the New York Times archive from 1882. It pertains to Teddy Roosevelt, who in addition to being the youngest President of the United States, was also the youngest New York assemblyman. In one of Roosevelt’s first acts as an assemblyman, he would take on the corrupt Jay Gould, as well as a judge and Gould’s conspirator, Judge Westbrook. I came across this in The Bully Pulpit, by Doris Kearns Goodwin, which I highly recommend. Also, if this interests you, check out The Roosevelts, which is available on Netflix.

Below is the speech from 23-year old Teddy Roosevelt, emphasis mine.

“Mr. Speaker: I have introduced these resolutions fully aware that it was an exceedingly important and serious task I was undertaking, and fully aware it would need proofs to substantiate before I would have a right to ask the gentleman of this House to pass these resolutions. I do not make them on such general statements made in the newspapers. I make them on specific charges against the gentlemen named in the resolution. These suits were brought as you all know against a fraudulent company-the Manhattan Elevated Railroad. That was a company that had a nominal stock of $2,000,000, really of $100,000- that is, it possessed but 5 per cent of its nominal wealth. An agreement was concluded by that company with two other bona fide companies by which they purchased the right to run their own roads- I am quoting from the opinion of the present Attorney General, Russell- they purchased the franchise of running their own roads; that is, they purchased nothing.

This whole transaction was stigmatized by the Hon. Judge James Emott of New-York, in August of 1880, as fraud, pure and simple. The men who were mainly concerned in this fraud are known throughout New-York as men whose financial dishonesty is a matter of common notoriety. I make that statement deliberately; that the three or four wealthy stock gamblers who re interested in those roads were men who would barely be trusted in financial operations by any reputable business man.

Under such circumstances, an almost confessed fraud having been perpetrated on a number of the stockholders by these three or four Directors, it would have behooved the judiciary and the gentleman who held the highest office in the gift of the people of this State to have handled it with peculiar care. A suit was brought in May last, I think, by the Attorney-General against the Manhattan Corporation. Mr. Burton Harrison was employed to investigate the affair. His report was absolute and conclusive that it was a fraudulent corporation, that it had no legal existence. It could have none when only 5 per cent of its stock had been paid in, and for a corporation that had only 5 per cent of its stock paid in to assume an additional debt of $13,000,000 and to shift that on the community at large, was an absolute fraud.

Under such circumstances the Attorney-General acted properly in bringing a suit declaring the corporation to be illegal. Without any reason he suddenly discontinued this suit, and after two days brings another admitting the legality of the corporation to be illegal. Without any reason he suddenly discontinued this suit, and after two days brings another admitting the legality of the corporation and merely declaring that it was insolvent, an objection that he knew would be much easier overcoming that the one first raised.

The reason for discontinuing that suit has never been explained. It never ought to have been discontinued. It was a gigantic fraud and ought to have been stopped. It was an absolute wrong against the interest of the people for the Attorney-General to change his suit and at the same time to allow any set of wealthy swindlers to escape the consequences of their misdeeds. One of the men employed by the Attorney-General was also employed by the very man he was looking after, I believe by Jay Gould.

Judge Westbrook’s share in the transaction did not come in until about June 13, when the suit was brought before him. He then expressed in his opinion strongly and emphatically that it was a swindle from the beginning. These are all matters of record; they are no newspaper charges: you can see them from the recorded proceedings of the court. Then there was a petition to have Receivers appointed.

Four men were named by the President of the Manhattan Company, the very company whose issue was in existence, to be Receivers. After 24 hours’ delay- the Judge appointed as Receivers two men, one of whom was the Vice-President of the Wabash Railroad, of which Jay Gould was President, and who was reputed to be Mr. Gould’s clerk. The other was one of Gould’s lawyers; a man who had, early in the season, procured an injunction against the City to prohibit it from collecting taxes from these railroads. The fact that the taxes had not been collected was one of the grounds on which the suit for dissolving the corporation was brought. In other words, the judge appointed a Receiver to take care of the interests of the people who had been employed to prevent the people from getting their taxes from the company. Those two Receivers ought never to have been appointed by any Judge who cared for the purity of the office which he filled.

At the same time the Judge had appointed one of his relatives to take a certain position in the affairs of the company. It is not of record he ever performed any work. He received $1,000. This statement is made on the authority of a man who can be subpoenaed and brought before the committee to testify under oath to what he said. It is no loose statement whatever. At the same time the Receivers petitioned for leave to issue certificates of indebtedness. The Judge granted that petition in Gould’s office; while holding court in the office of one of the men whom common repute holds, and as I think holds correctly, was nothing but a wealthy shark, especially in the attitude he had take toward the people about these very suits. Those certificates were issued on such terms as to make it impossible they could be take up. The Manhattan stock at that time was only 86 per cent. The Judge allowed these certificated to the extent of $1,000,000 to be issued, but all should be taken at 6 per cent, or none be taken; all be taken at par or none be taken. It was an absolute impossibility they should be taken up. The issue of the order was simply ridiculous.

The affair went on, and on the 21st of October, the Judge declared, in a speech, that the corporation was a swindle- declared it emphatically, withnot any reserve. Four said after he does not write, but telegraphs, down an order allowing the road to go out of the hands of the Receivers back into the hands of Jay Gould, Cyrus W. Field, and Russell Sage. That was four days after he said it was a swindle. He puts the whole road in the hands of the swindlers. That is an absolute fact, and can be verified by matters of record. Finally a court is held, when the final decision is rendered- not in public, not where you would expect a case like this, affecting $14,000,000, and which the Attorney-General and the Judge knew well was a mere swindle upon a large number of innocent stockholders- the court was held, not in a public court-room, but other in Attorney-General Ward’s office, as he says, or, as other witnesses say, in Attorney-General private bedroom in the Delavan House. There were but three witnesses there. The one witness that was examined was President Gallaway, of the Manhattan Company. He twice held court in Gould’s office, and that is a matter you can see by referring to any of the papers of the following day. If you doubt the papers, then witnesses can be produced every time to testify it was held there- once up in a private bedroom. He appointed one of his own relatives to take charge of part of the case. They employed a man who, at the same time, was employed by the very men they were going against. In the appointment of Receivers he appointed men who were notoriously and openly in the interest of the company against which the people were proceeding. All his decisions were rendered in favor of a company which was not only insolvent, but was notoriously a fraud and had been pronounced so by proper judicial authority.

In addition to this, it must be remembered that the committee that is now investigating Receiverships have published some facts which reflect the reverse of credit upon Judge Westbrook. We have a right to demand that if we find men against whom there is not only suspicion, but almost a certainty that they have had collusion with men whose interest was in conflict with those of the public, they shall at least be required to bring positive facts with which to prove there has not been such collusion, and they ought themselves to have been the first to demand such an investigation. It was a matter of great astonishment to me that during three months that have elapsed such an investigation has not been asked. I was aware it ought to have been done by a man of more experience and possible an abler source than myself, and as nobody else chose to demand it I certainly would in the interest of the Commonwealth of New-York. I shall move to amend my resolution by allowing the committee to employ a stenographer and summon witnesses before them, at a sitting held in New-York. This is a most important investigation and it should be treated with due weight, and I hope my resolution will prevail.”