That depends on what you mean by “due.”

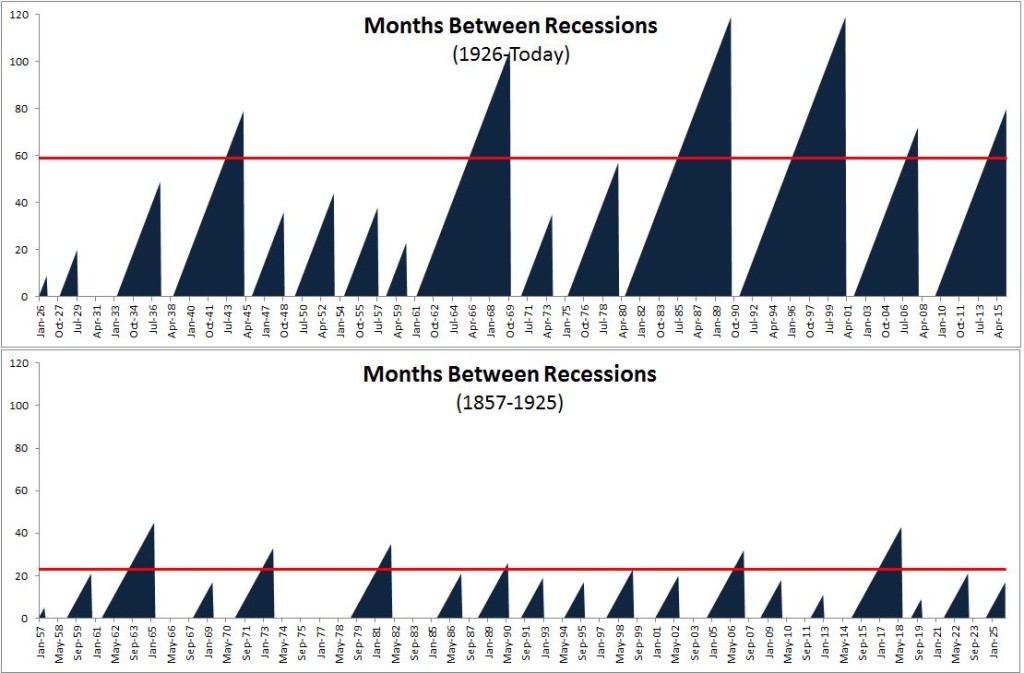

Are we due in the sense that it has been a while since the last recession? Sure. Since 1926, recessions have happened on average every 59 months. We’re currently 80 months removed from the last recession.

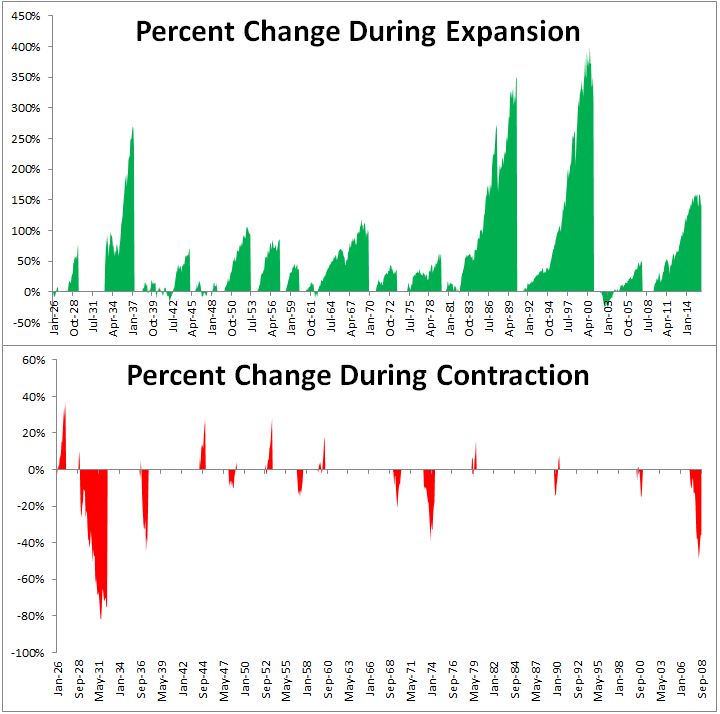

Are we due in the sense that stocks have gone too far? Sure. The S&P 500 has risen on average 111% in between recessions; currently stocks are up 142% since June 2009.

Are we due in the sense that the economy is overheating and we need a good flush of the excess? No. Quite to the contrary, people are worried that there is hardly any growth at all, and with this amount of debt in the system, perhaps it wouldn’t take much for it to all come crashing down. With the memories of 2008 fresh in our mind, it’s understandable that people might feel this way. But not every recession ends in massive unemployment and a collapse in the equity market. In fact, in recessions since 1926, stocks have risen as often as they have fallen.

Thinking that we’re due for a recession based on how long it has been since the last one, or because stocks are up so much are equally ridiculous lines of thought. Recessions don’t arrive on schedule and certainly don’t happen because they’re due. They generally coincide with an overheated economy, which I don’t think anybody would argue is the case right now. With that being said, the unfortunately reality with owning risky assets, and why we get paid to own them over time, is we can never be completely dismissive of any scenario.

The past can’t tell you anything about what will happen in the future, but that doesn’t mean there are no lessons to be learned from studying history. Let’s dive into some data to get a better understanding of past recessions.

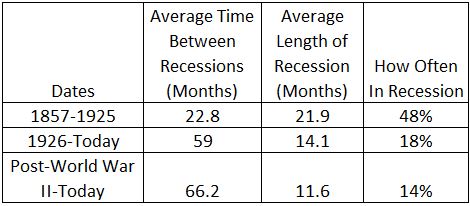

From 1926 through today, recessions have happened on average every 59 months, the economy has been in a recession 18% of the time, and the average recession has lasted just over a year. If you look at more recent times, in the post-WWII era, recessions have gotten shorter, the length of time between recessions has increased, and the amount of time the economy was in a recession has decreased. This shouldn’t be surprising as we’ve become a much more mature and stable economy.

If we look back earlier to when the United States was an emerging market, we notice some interesting numbers:

- The economy was in a recession 48% of the time,

- Recessions occurred on average every two years

- The average recession was twice as long as the average modern recession.

Let’s move onto how stocks have performed during expansions and contractions. While stocks have done well recently, it’s not as if their returns are at historic levels, they’re not even close (the S&P 500 hasn’t made any progress in twenty months). What’s really interesting about the charts below is how stocks have performed during the contractions. 50% of the time, stocks were actually positive during a recession! Which leads me to my next point…

Stocks are a leading indicator and tend to turn- on the upside and downside, well before the economy does. Take the tech bubble as an example; stocks lost 23% prior to the recession, and “only” 15% during the recession. The chart below from Ben Carlson’s blog shows how stocks anticipate a recession.

The problem with just using stocks as a read through to the economy is that as Paul Samuelson said, “The stock market has called nine of the last five recessions.” Meaning, often times stocks will fall not because fundamentals are deteriorating in the economy, but because of the simple fact that stocks occasionally decline. If an investor is uber bearish on the stock market because they think we are about to enter a recession, which we very well might, they must take that a step further and be convinced that we’re about to enter a crisis.

While recessions and stock market corrections are just part of the game, not every recession and bear market has to end in complete chaos. And by the time we finally realize we are in a recession, the worst will probably be behind us.

Source: