The typical long/short equity strategy- the one that Alfred Winslow Jones used in the 1950s to put hedge funds on the map- goes long cheap stocks and short expensive ones. It’s fair to say that Jones would be shocked at the current market environment.

Recently, Mondelez put in a bid to buy Hershey, which would bring together two of the biggest food/snack companies in the world. The proposed deal, at $107 a share, puts that right about 25x earnings. Not exactly a bargain for a company that has had single-digit earnings growth for each of the last three years.

This deal puts the cherry on top of a theme we’ve seen all year, low vol, expensive stocks. This chart from iShares pretty much says it all.

Investors in these areas of the market have been handsomely rewarded; both the iShares Low Volatility ETF and Real Estate Investment Trusts are up 13%. We’re just barely through half the year, and utilities are up 23%!!!

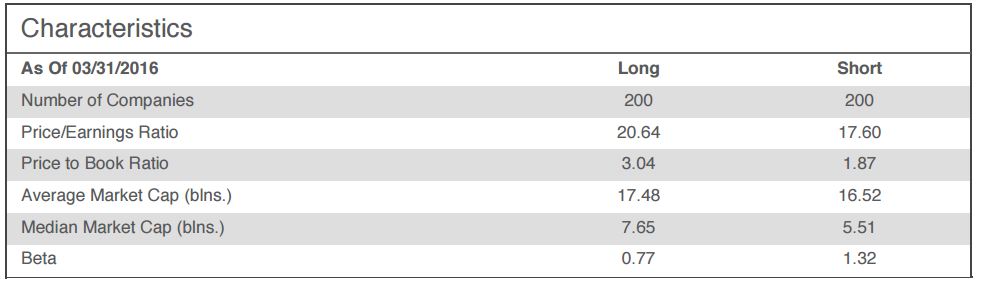

Let’s look at another ETF that doesn’t get as many eyeballs but is the perfect screenshot of today’s market, BTAL, the QuantShares market neutral fund. This fund does long/short a little differently than Jones did, they’re long low beta and short high beta.

Check out the characteristics of this portfolio. The low beta stocks are far more expensive than the high beta sleeve, the exact opposite of normal. These portfolio characteristics are a few months old, but it seems that since March this story has only accelerated.

This observation is not a knock on the fund, they’re just following the rules they set out. It is however so emblematic of what is going on in the market today. With interest rates at all-time lows, the chase for yield has pushed these “bond equivalents” to what some would call absurd valuations. In fact, utilities now has a higher price-to-earnings ratio than technology stocks.

This observation is not a knock on the fund, they’re just following the rules they set out. It is however so emblematic of what is going on in the market today. With interest rates at all-time lows, the chase for yield has pushed these “bond equivalents” to what some would call absurd valuations. In fact, utilities now has a higher price-to-earnings ratio than technology stocks.

One final point on this pricey group of stocks; Something can be expensive and not end with tears and destruction. Whenever valuations get elevated, we think of just a few periods in time; the tech bubble of the late 90s, the Japanese stocks in the late 80s or the Nifty-Fifty stocks from the late 60s. But crashes are the exception. More often than not these areas that people point out as “bubbles” just deflate rather than burst. And when they do, the bubble callers move on to the next area of the market where they’re not making any money and where the people who are will eventually “be so sorry.”