If you’re reading this, you probably already know that the S&P 500 made a new all-time high today.

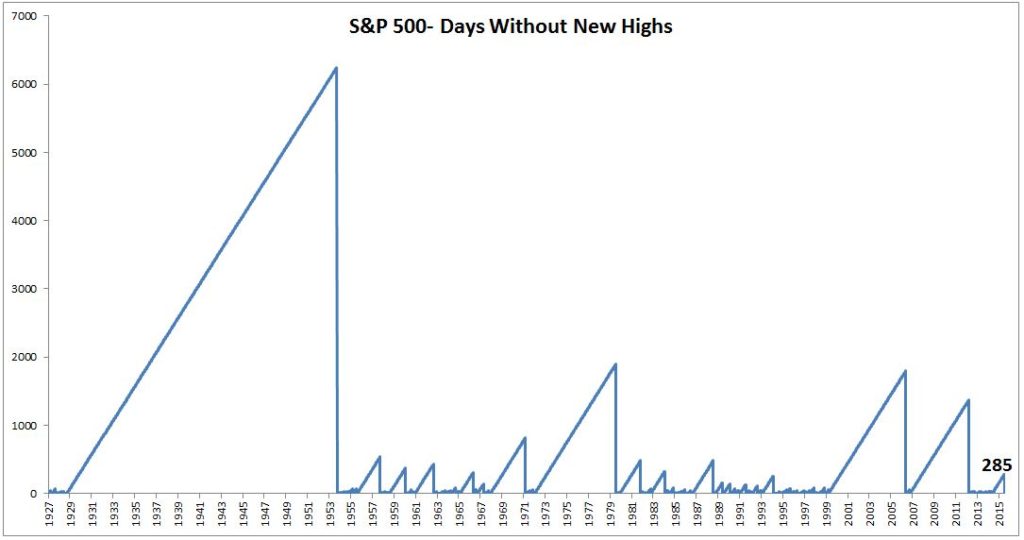

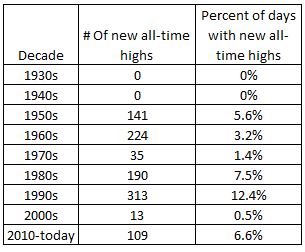

The streak ended at 285 days, the longest stretch without a new high since the 2007 peak was taken out. What’s particularly interesting when looking at all of the previous highs is that they tend to happen all at once, or vanish for several years. As Ben Carlson said yesterday, stock returns are lumpy and you can see this in the table below. Even still, it’s pretty incredible that stocks have experienced a new all-time high in each of the last seven decades, despite all the bumps and bruises along the way.

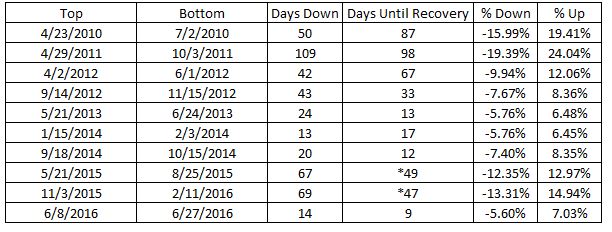

But the new highs have frustrated investors because they have come in an unusual way. It is often said that stocks take the stairs up and the elevator down. Now they take the elevator down and the elevator back up again. Below you’ll notice that each of the last seven dips have come back up faster than they went down. These are the V-bottoms that investors have gotten so accustomed to.

But it just doesn’t feel like things are better than ever before, which is why fresh all-time highs can be so confounding. Josh Brown does a great job telling the current story.

Small caps haven’t kept up. Growth stocks are trailing. The leadership – utilities, staples, low-vol, defensive – it’s all wrong. “Not what you want to see leading a rally.” International stocks are deteriorating. The banks don’t look healthy. The mutual fund flows are all negative, for months and months at a time. “The only buyers are corporations doing share buybacks.” Inflation expectations are crashing. Bond yields are “disagreeing, telling us something.” Commodity weakness too. There’s political uncertainty in Europe. In the US, two of the most unlikeable candidates in history fighting for an office they’re “not fit to hold.”

And given all of these headwinds Josh touched on, each of these V-bottoms has surprised me. Literally every single one. And sitting through these dips, shallow as they might be, is never easy. This is the single greatest challenge long-term investors face; finding new reasons not to sell, even when the dips turn into corrections and the corrections turn into bear markets. It isn’t simply doing nothing, it’s constantly making the decision to stick with the plan you put in place at higher prices.

Here is Charlie Munger on doing just this.

*These corrections came within 1% of new highs.