Adam Smith once said “Show me a portfolio, I’ll tell you the generation.” It’s safe to say if he peeked inside a brokerage account today, he wouldn’t recognize which generation he was in.

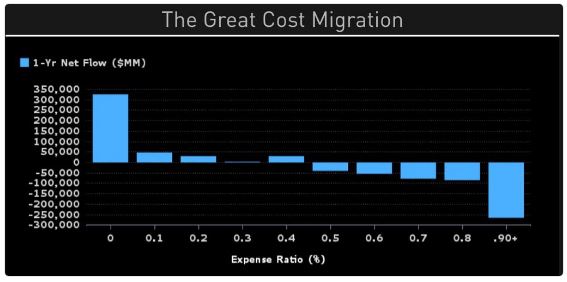

The story we keep hearing about is the shift from active to passive, and while it’s true that dollars are leaving stock pickers for indexes, it’s even more the case that they’re going from high cost to low cost. This chart from Eric Balchunas tells you what is most important to investors right now.

In Mark Schatzker’s The Dorito Effect, he discussed changing tastes and how arugula caught the salad industry off guard.

When talk of arugula first started back in the early ‘90s, the big players in the industry all had a good laugh. The people who grew and sold salad considered it nothing more than a vehicle for dressing. And nothing carried a dressing like crunchy, high-yielding iceberg lettuce, the vegetable that tastes like frozen water. Millions of pounds of lettuce came out of the Salinas Valley back then, and three-quarters of it was iceberg. None of it was arugula. When it came to flavor, the industry lived by the following maxim: “Bland is what people want.” Arugula was many things- dark green, peppery, bitter, loaded with plant compounds- but it sure wasn’t bland.”

Amid all this resistance, a few companies took the imprudent gamble of including leaves of arugula in their salad mixes. It wasn’t even the hard stuff- the “wild” arugula they eat over in France and Italy. This was a “cultivated” arugula that gas softer leaves and a milder flavor. Consumers loved it. The response was such that by the mid-2000s, arugula wasn’t only in mixes anymore. It got its own bag. Soon cultivated arugula was out, and Americans, acting like Utah goats, switched to wild arugula. They liked the bitter flavor. They loved the peppery intensity. Americans now eat twenty million of pounds of arugula a year. Bland, it seems, is not what people wanted.

In today’s world, ETFs are arugula, mutual funds are iceberg lettuce, and Fidelity is the salad company, scoffing when they should have been adapting. Fidelity Investments, once home to the gunslinger Gerry Tsai and stock picker Peter Lynch, is finally responding to the preference of today’s investor.

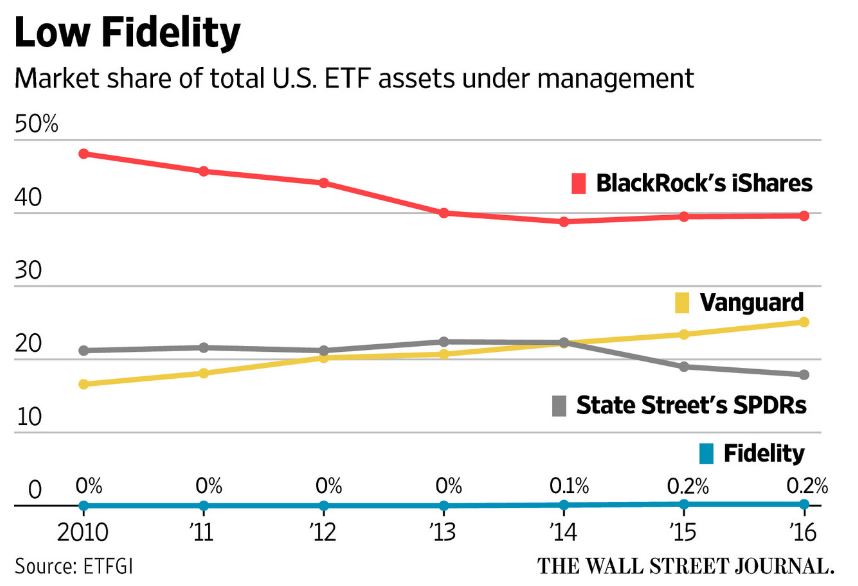

From 2003 to 2013 Fidelity had just one ETF. They’re making a bigger push now, but they’re so far behind the competition that they might as well not even bother. BlackRock, State Street, and Vanguard have $2 trillion combined in ETFs. Fidelity only just crossed the $5 billion mark.

Fidelity refused to face the reality of the world they were living in and are now forced to play catch up. These sort of sea changes don’t come around often, but when they do, markets don’t wait. Adapt or get left behind.

Source: