Investors hire an advisor to help them achieve their financial goals. But what if the person they chose to work with is not properly measuring these goals? What if an objective third party would confirm that they aren’t? And what if an advisor isn’t even tracking their goals in the first place?

The State of Investor Trust and Transparency is a new research report produced by Phoenix Synergistics and Benjamin Gross of Visualize Wealth. They did a deep dive into the way financial advisors provide their clients with investment performance. More than 2,600 investors were surveyed across every state in the country, with the average age of 57 and average investable assets of $865k. The investors are broken down by advisor channel, with nearly 75% of respondents working with a full service broker or an independent advisor. The results are startling.

The survey reveals that a large number of investors are either unaware, or flat out aren’t provided with some of the most important information regarding their investment performance. And even worse, a significant percentage of investors don’t necessarily believe the information they are being provided is accurate.

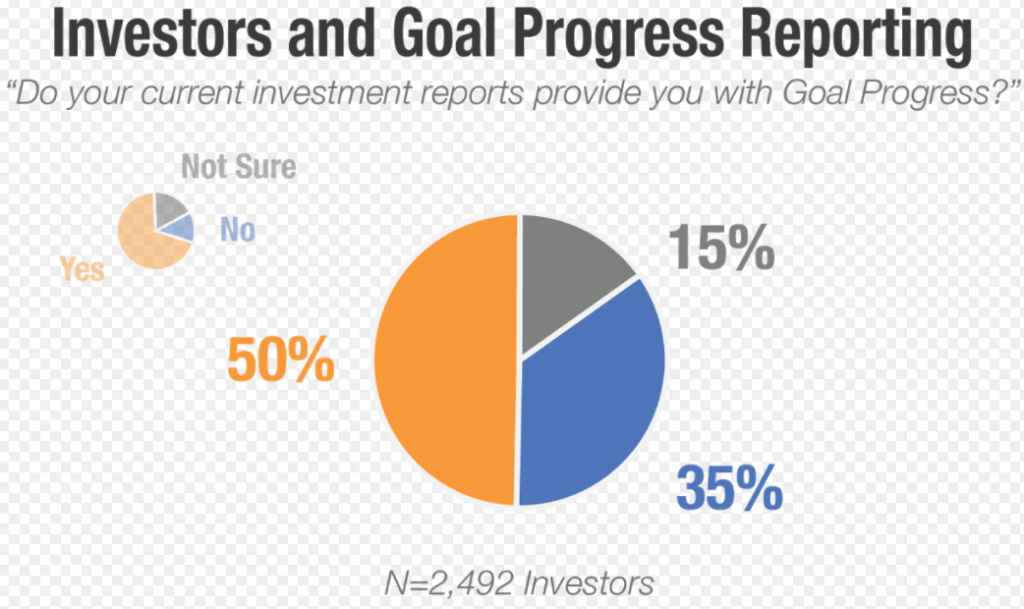

The report identifies the five most important areas of investment reporting as fees, return, risk, goal progress, and benchmarks. I’m going to highlight one area, goals and objectives, which was the highest or second highest priority metric by 40% of the investors who were surveyed.

15% said they weren’t sure whether or not their reports show their progress towards achieving their financial goals. 35% said they were not provided. So only one out of every 2 investors surveyed is being shown the only metric that actually matters; Are they going to be okay.

Investors were asked how confident they are that an unbiased 3rd party would get the same result as their advisor if they were to calculate their progress in achieving their financial goals. One out of three said they were not confident.

When asked how confident they are that information would be presented the same way if they were not on track to meet their goals, 31% said they were not highly confident that their advisor would tell them the hard truth. In other words, if they were falling short of where they needed to be, their advisor would alter the presentation.

When you go into a McDonald’s and look on the screen, you can be pretty confident that a Big Mac is 563 calories. It’s awful for your health, but at least you know exactly what you’re getting yourself into. According to this report, investors don’t have the same level of confidence as McDonald’s patrons. I’ve only scratched the surface, but the bottom line is that a large number of investors don’t trust the information advisors provide them.

We need to do a better job. Hard stop. If you’re not tracking an investor’s goals, I can’t imagine what value you’re providing, because, and forgive me for being cynical, I highly doubt you’re the Jim Simons of financial advisors. Clients pay us for reassurance, and if they don’t trust that you’re acting in their best interest, or that the information you’re providing to them is accurate, you deserve the client exodus that’s coming your way.

Source: