42 years ago today, Vanguard’s First Index Investment Trust was born. Bogle’s goal was to launch with $150 million, but there was little appetite for “average returns” and it gathered just $11.5 million, missing its target by more than 90%. Not only did they fall short in terms of money raised, but the product itself was not exactly a home run. From The Index Fund Revolution by Charley Ellis:

As a ‘load’ fund, with an 8.5 percent sales charge, aiming to achieve only average performance, it could not gain traction….To minimize costs, the portfolio did not own all the smaller-capitalization stocks in the S&P 500. Instead, it sampled the smaller stocks just as that group enjoyed an unusually strong run, so the fund failed to deliver on its ‘match the market’ promise.

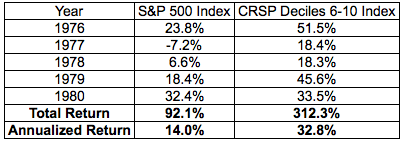

Small stocks absolutely crushed larger ones in the five years after the launch, and not owning all of them was a significant drag on returns.

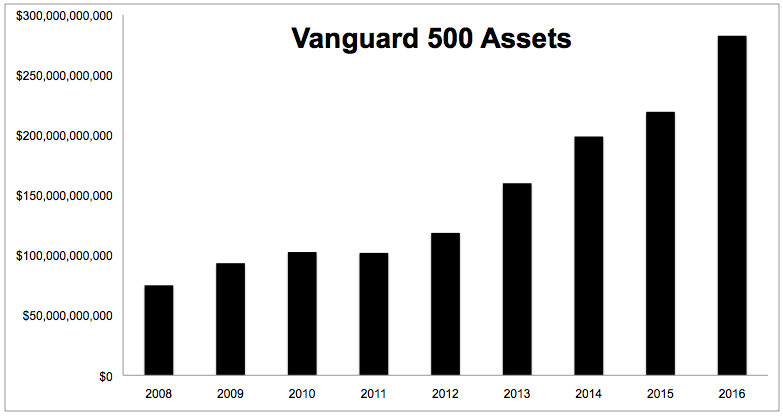

The index fund did not take to investors immediately. Vanguard didn’t have any competition until 1984, when Wells Fargo created the second index fund. The First Index Investment Trust, renamed the Vanguard 500, didn’t reach $1 billion in assets until 1990. Today, however, there are more index funds than species of insects, and $3 billion is going into exchange-traded funds and index funds every day! Vanguard has been the biggest beneficiary of the shift towards index-based investing.

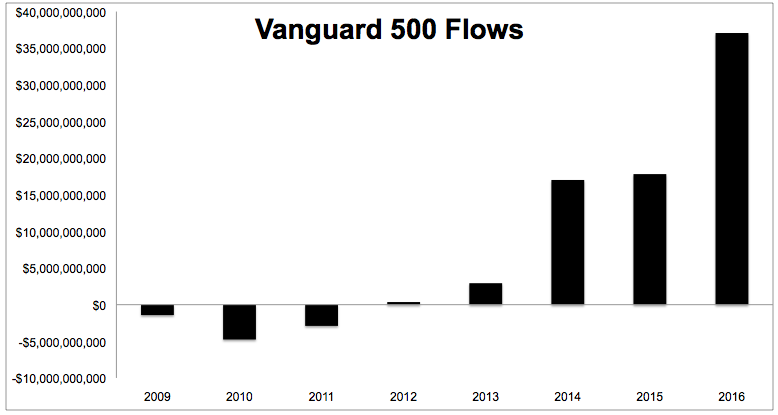

Charts like this tend to make some people nervous, but let me do a little bit of debunking. It’s not as if trillions of dollars are moving from money market funds into stocks. Assets are flowing out of high cost closet indexers to low cost index indexers. The chart above doesn’t show annual flows, it only shows the growth in assets, which have been pulled higher with the rising market. The chart below gives a better idea of how much money investors have pulled from and plowed back into the Vanguard 500 (investor, admiral and ETF).

A few things stand out:

- It’s pretty wild that flows didn’t turn positive until 2012. I guess a second 50% crash in a decade will leave some scars.

- The S&P 500 had a huge year in 2013, gaining 32%. But still healing from the recession, investors did not pile in, with fund assets rising just 35%.

- Flows didn’t go bonkers until last year. In 2016, flows just about matched the previous 4 years combined. The S&P 500 was up 12% in 2016- but Vanguard 500 assets rose by 30%!

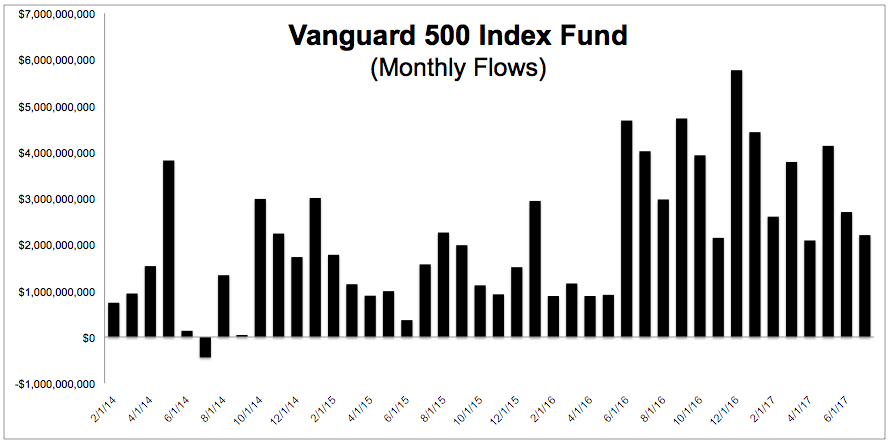

Money is flooding into indexes after an extended run, so the understandable fear is that when stocks stop going up, and particularly when they start going down, investors will rush for the exits and exacerbate the selloff. I think these fears are misguided.

The chart below breaks down the flows by month. From May 2015 to February 2016, the S&P 500 fell nearly 16%. There was not a single month of outflows. Granted, -16% is not -40%, but there are plenty of examples of investors panicking prior to index funds. The fact is, in a real bear market, it’s not as if people stay the course in active funds either…

…In Jack Bogle’s Common Sense On Mutual Funds, he wrote, “Following the -48 percent market decline in 1973-1974, investors made withdrawals from their holdings of equity mutual funds during 24 consecutive quarters, from the second quarter of 1975 through the first quarter in 1981.”

You have to keep in mind that a lot of the money going into index funds today is retirement money. In the previous example when investors were running for the exits, people relied on defined benefit plans for retirement, so a lot of the money withdrawn from active mutual funds was more of the speculative variety (I don’t have proof, but I suspect this is right). Perhaps today’s dollars will be a little more patient and a little less reactive.

Index funds are a great option for obvious reasons- they’re low cost, they’re rules based, they don’t require much due diligence, and they give you the best chance at capturing market returns. However, they are not a panacea, and unfortunately, some investors seem to have a fundamental misunderstanding of how they work.

Fidelity surveyed 3,483 customers who are mutual fund buyers, and found that one in five believed that stock index funds can protect them from market ups and downs. These people are in for a rude awakening.

42 years ago today, the investing world changed permanently. Indexes were not an overnight success, but they’re gaining more momentum every day and have some people worried that they’re distorting the market. I’m not one of those people. Active management still is and will forever be too lucrative for indexing to completely take over. And while indexing is a third of the market, according to Charley Ellis, they’re only responsible for 5% of the daily trading, “and trading is what sets prices.” We’re still riding active’s coattails, and I suspect we will for a long time to come.