Steven Pinker wrote, “In almost every year from 1992 through 2015, an era in which the rate of violent crime plummeted, a majority of Americans told pollsters that crime was rising. In late 2015, large majorities in eleven developed countries said that “the world is getting worse.”

But crime isn’t rising, and the world is objectively getting better. And while life is improving at the macro level, at the micro level, people aren’t feeling so great. So what gives?

We tend to expect the worst as a way to insulate ourselves from disappointment. Life is not about good or bad, it’s about better or worse, so if things don’t turn out as bad as we imagine, we’re pleasantly surprised.

If you were asked to think about how your life could improve, a few things might come to mind. But imagine how your life could get worse, and a barrage of negative possibilities fills your brain. The risk and reward of every day life is asymmetrical. This is why being a pessimist feels safe and being an optimist feels reckless.

One of the reasons why it seems like the world is getting worse is due to the cacophony of noise coming from the news. Here’s Pinker again:

Whether or not the world is really getting worse, the nature of news will interact with the nature of cognition to make us think that it is. News is about things that happen, nothing things that don’t happen. We never see a journalist saying to the camera, “I’m reporting live from a country where a war has not broken out”- or a city that has not been bombed, or a school that has not been shot up…Bad things can happen quickly, but good things aren’t built in a day, and as they unfold, they will be out of sync with the news cycle. The peace researcher John Galtung pointed out that if a newspaper came out once every fifty years, it would not report half a century gossip and political scandals. It would report momentous global changes such as the increase in life expectancy.

While the news certainly isn’t doing anyone any favors, there are legitimate reasons why people don’t feel like things are getting better. For too many, they aren’t.

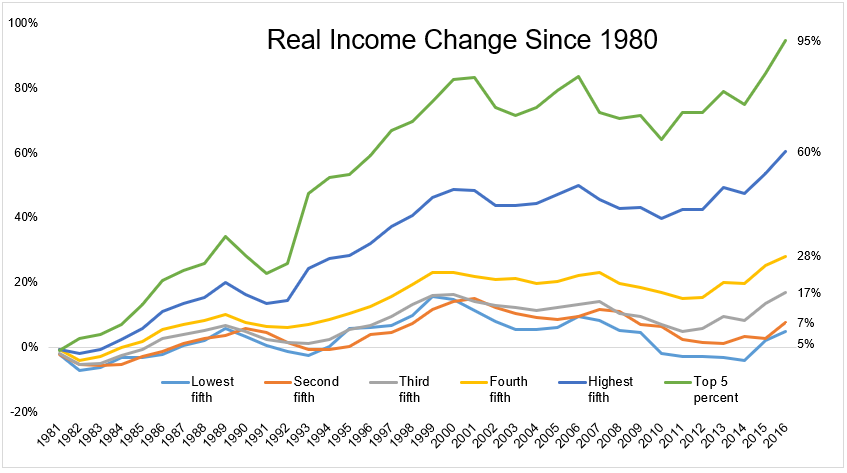

The chart below shows the change in real income since 1980. This chart is the root of all the negative things facing our society. People in the top 20% saw their income increase by 60%. People in the bottom 20% saw their income rise by just 5% over the same time. As Leonard Cohen said, “The poor stay poor, the rich get rich. That’s how it goes. Everybody knows.”

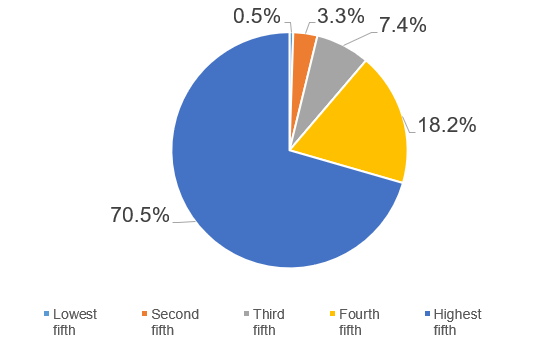

Real income increased 38% from 1980-2016, or just 0.87% per year, and 70% of that increase went to people in the top 20%. Things are better, especially around the world, but in our country, way too many people are getting left behind.

Extreme poverty is collapsing, but relative poverty is exploding, and everything in life is relative. If things don’t feel better than they were two hundred years ago, it’s because people compare themselves to their neighbors, not to their ancestors.

Source: