Below are the total annual returns for the S&P 500 over the past nine calendar years.

Nine consecutive years of calendar gains is terrific, but I don’t feel any comfort in writing this so I doubt you feel any comfort in reading it

I could show you a million stats about how accommodating the market has been over the last few years but right now context doesn’t help because we don’t care where stocks came from, we worry about where they might be going. The months and years fade away as we focus on yesterday while worrying about tomorrow.

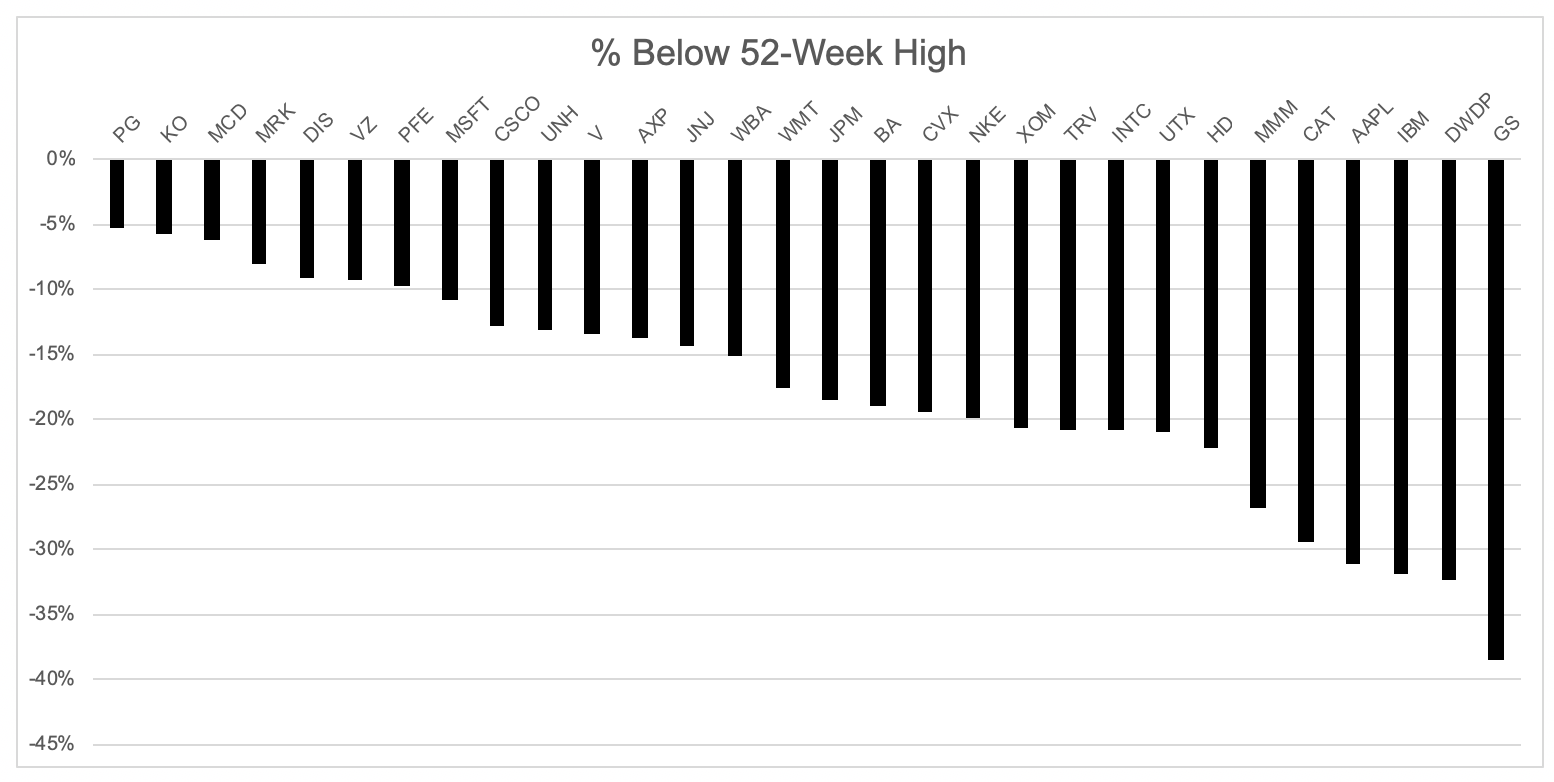

The average Dow stock is now 18% off its 52-week highs, with most of the damage occurring over just the last couple of weeks. If you weren’t following the stock market closely over the past few years, it probably has your attention now.

Only three short months ago the S&P 500 was up 10% on the year. But now, with just seven days left, it’s given back all of its gains and then some. The index is 14.5% below its recent highs, the deepest drawdown since October 2011, and is down 6.2% (-4.6% with dividends) on the year. The streak of consecutive annual gains might be coming to an end.

If you’re worried that stocks are going a lot lower, there’s still time to put a plan in place. I’m not suggesting anybody follow their intuition, but if you are starting to feel uncomfortable, then picture how you might feel if the Dow falls to 20,000 (~14% below current levels).

If you got out over your skis in terms of how aggressively you’re positioned, which is known to happen nine years into a bull market (wait how many years?), it’s better to adjust now while things are still relatively okay then panic if we do go much lower. If protecting yourself today by having a little more bonds and a little less stocks saves you from the worst investor version of yourself tomorrow, then I’m all for it.

Isn’t “stay the course” the right thing to say? Well sure, assuming you have an appropriate course then please stay on it, but for people that failed to chart one, it’s not too late.

What you can’t do are make all in/all out moves. These decisions are not symmetrical- it’s easy to sell, it’s hard to get back in. One big mistake and you will never earn market returns for the rest of your life.

If you’re investing for the future, you have to believe that things will get better, but if you’re a realist, you have to understand that things can still get a lot worse.