Do investors really need to hear from management every 90 days?

The 13-week cycle of reporting earnings and issuing guidance breeds short-term thinking and invites the wrong kinds of questions. Going from quarterly reporting to a biannual system could allow for a sharper focus on running the business rather than wasting time on the business of managing earnings and investor’s expectations.

I don’t read 10-Qs so perhaps I’m out of my depth here, but I think this would encourage better behavior from the people running the company and better behavior from shareholders. This got me thinking, what if trading was cut down to two days a year.

What if there existed a biannual purge in the stock market?

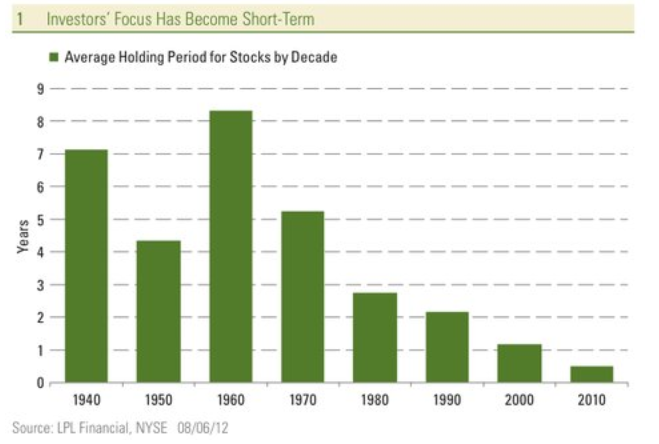

The idea that high turnover is correlated with lower returns is common knowledge at this point. However, as you can see in the chart below, the average holding period has dropped in each of the last five decades. Now, it’s important to point out that a lot of this decline has been driven by technological progress, which has been fantastic for investors. Commissions have come way down and have gone to zero in many cases. With the click of a button, you can own hundreds or thousands of stocks for free. Also, I’m guessing that computerized trading is drastically skewing these numbers. But be that as it may, the point remains that investors trade more than they should.

Technology has provided investors with instant access to their portfolios. If you wanted to know what your stocks were doing thirty years ago, you had to call your broker. Now we have real-time information and the more we look at our portfolio, the more we’re likely to see losses. And the more we’re likely to see losses, the more likely we are to trade.

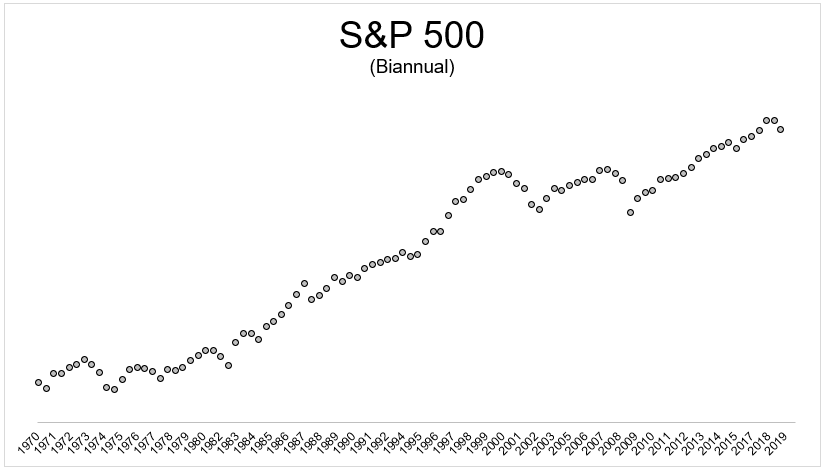

If you were to look at the S&P 500 every day since 1970, you would see red on 46% of all days. If you only looked twice a year (end of January/July in this case), you would see losses just 30% of the time.

Would biannual reporting encourage better behavior from management? I think so. Would biannual trading encourage better behavior from investors? On this I’m not so certain. One could argue that by checking your account a few times a month you grow less sensitive to the ups and downs of the market. If you were only allowed to trade twice a year, however, and you saw a 27% decline, maybe your worst instincts would kick into overdrive and you would sell everything.

Investors don’t have to worry about this scenario of biannual trading, but I do think investing is best when it’s out of sight out of mind. But knowing something and doing something are not one and the same. I also know that in order to lose weight, you must burn more calories than you consume, but I haven’t exercised in five years and I ate a chipwich last night.