One of the reasons why so many mutual funds fail to beat their benchmark is because so many stocks fail to beat their benchmark. This idea has been pushed forward with papers like The Agony & The Ecstasy: The Risks and Rewards of a Concentrated Stock Position and Do Stocks Outperform Treasury Bills?

Vanguard recently came out with a piece that provides investors with additional data to bring to this conversation.

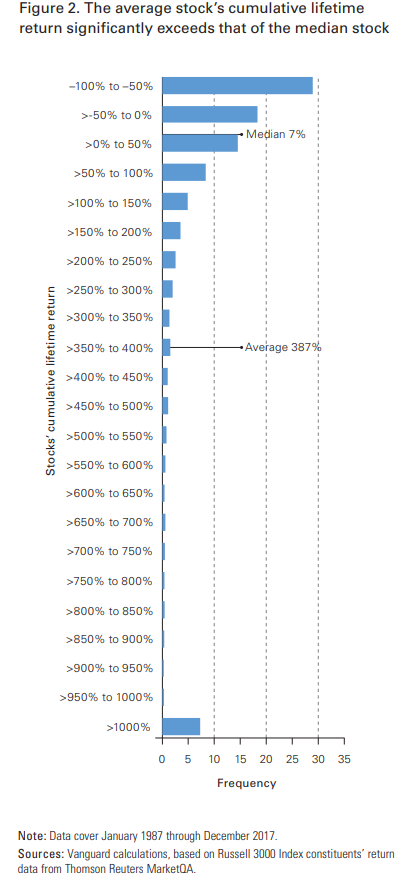

They calculated the returns of Russell 3000 stocks over the last 30 years and found that 47% of stocks were unprofitable investments and almost 30% lost more than half their value. They also found, and this is the big one, that 7% of stocks had cumulative returns over 1,000%.

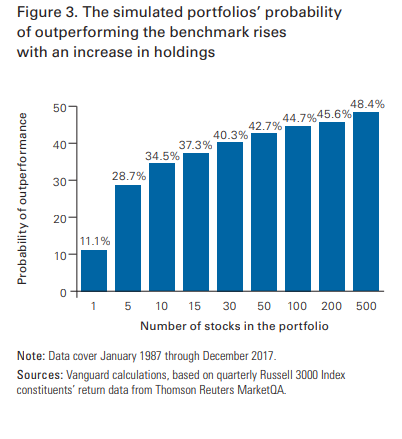

The implications for investors is obvious: If you’re picking stocks and you don’t own the 7%, it’s difficult to keep up with the index. In order to flesh this out, Vanguard quantified the effects of dart throwing to determine how many stocks are optimal in order to beat the benchmark, and the hurdles a concentrated position needs to overcome to get there.

The chart below shows the results from this study. The likelihood of performance from selecting just a few stocks randomly is not very attractive, to say the least.

There are a few of other charts worth checking out, but I want to make a quick point here that often gets lost when these studies are presented.

This is similar to showing what happens to the growth of $1 when you miss just the 25 best days. Nobody is going to only miss only the best days, they’re going to also avoid some of the worst days. Similarly, if you’re picking stocks, you’re not going to just miss the Apple’s of the world, you’re going to miss the General Electric’s as well. Now, this is not a great analogy because in the case of stocks, or more specifically index funds, the massive winners more than offset the losers. But here’s what I’m getting at. What if there was a strategy that focused on screening out stocks with unattractive business characteristics or those showing negative momentum?

What would the returns be if you owned the S&P 500 and screened out 50 expensive stocks whose growth was slowing and 50 “cheap stocks” trading below a moving average? I don’t know that this would necessarily improve the odds but this is just a reminder that it’s worth thinking about the other side of every coin. Hit the link below to read the whole thing.

How to increase the odds of owning the few stocks that drive returns