If you’re reading this you probably already heard that the yield curve has inverted, which you can see in the GIF below (H/t Nicky Numbers). You probably also heard that it has a perfect track record of preceding a recession.

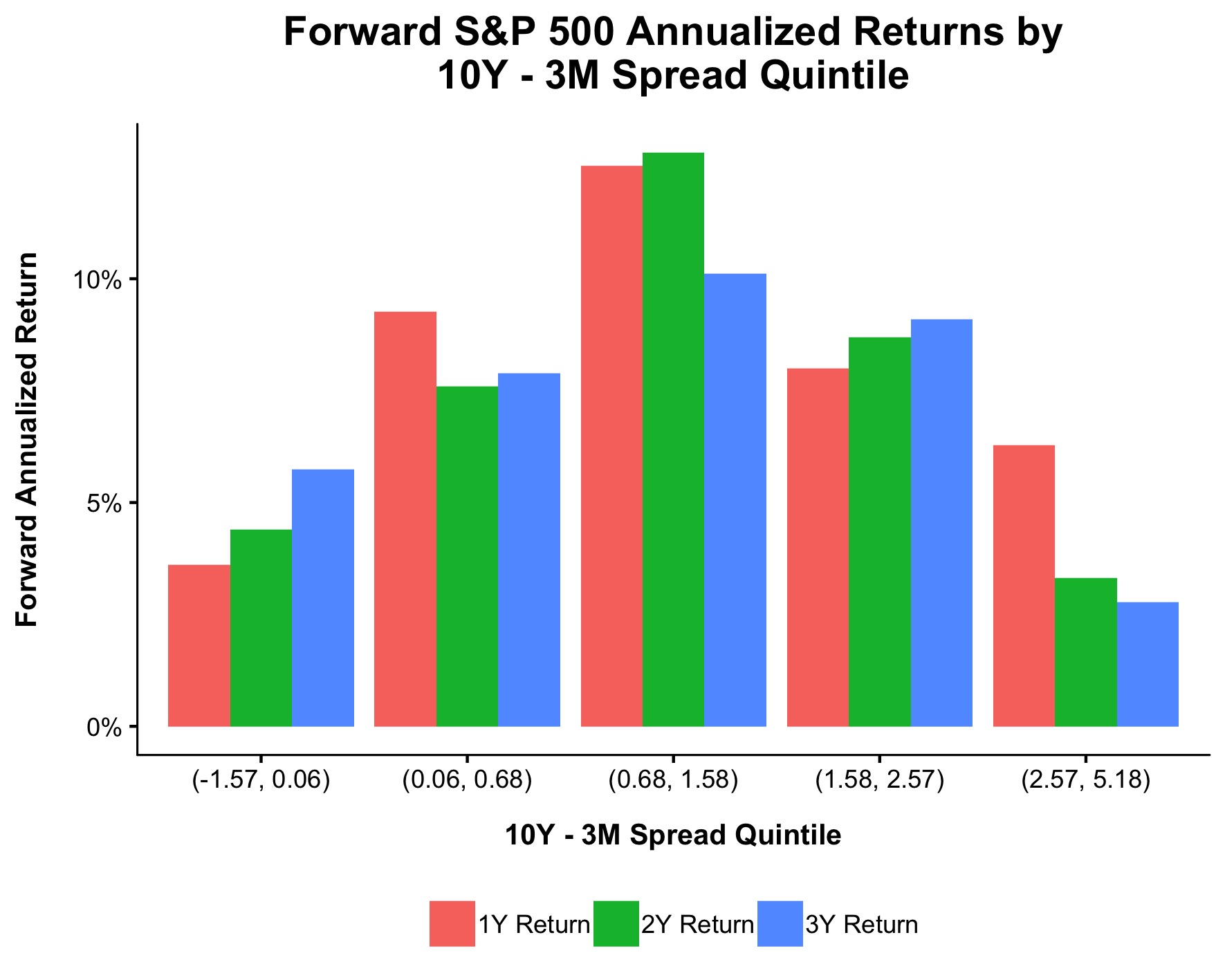

Empirically, this has not been good for stocks. 1, 2, and 3-year returns have been mediocre to lousy when the spread is in the first quintile, which is the situation we’re faced with today.

Despite the track record of this indicator, keep in mind that it is just one indicator. The inversion alone is not enough reason to be out of the market because there are no iron rules in a market of buyers and sellers. However, given that U.S. stocks aren’t particularly cheap, given that they’ve returned more than 15% a year for ten years, and given that the yield curve is where it is, it probably makes a lot of sense to lower your return expectations going forward.

Making all in or all out decisions with your retirement money, certainly a retirement that you’ll be funding for years or decades, is never the answer. Instead, listen to these wise words from my colleague Blair duQuesnay. “It would be riskier to try to predict market moves than to remain invested in a diversified portfolio matching your risk profile.”