I went through Zillow’s consumer housing trends report 2018 and pulled out some of the most interesting data points broken down by renters, buyers, sellers, and homeowners.

Renters

- Seventy-eight percent of renters who move from one rental to another experience a rent increase prior to their move

- Forty-seven percent of renters call the suburbs home while 40 percent live in an urban area and 13 percent live in a rural area

Buyers

- Millennials, those between the ages of 24 and 38, comprise 42 percent of the nation’s home buyers

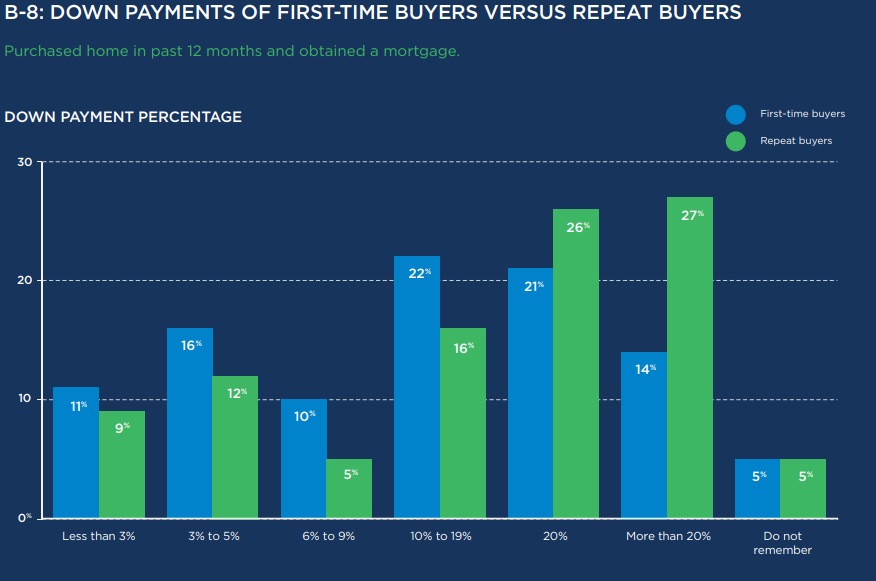

- Just over half (52 percent) of buyers put down less than 20 percent on their home.

Sellers

- At 31 percent, Millennials — those ages 24 to 38 — are the largest group of sellers.

- The vast majority (85 percent) of sellers work with agents

Homeowners

- Home equity remains the biggest financial asset for the typical American homeowner, who has 52 percent of their wealth tied up there.

- Nearly half (45 percent) of homeowners still live in the first home they purchased

Below are some of the most notable charts.

60% of first-time home buyers put down less than 20%.

67% of first-time buyers and 50% of repeat buyers had to make sacrifices. Assuming you have some sort of fixed budget, you’re not going to get everything you want.

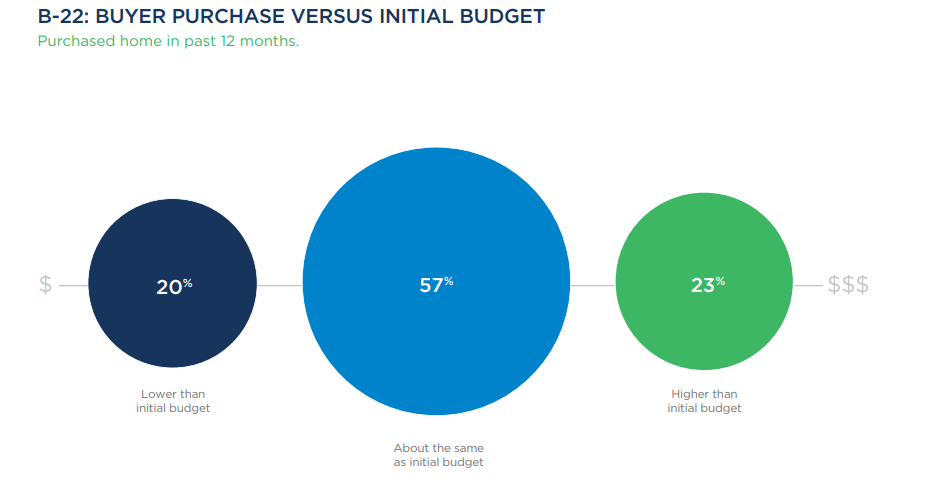

23% of buyers went over budget by an average of 12%.

This one surprised me. The largest group of home sellers are millennials, which made up 31% of all sales in 2018.

Some other nuggets

- The typical renter can expect to spend about 29 percent of their household income on rent

- 36% of Millennials and 26% of Gen Xers try to sell without the help of an agent.

- Six in 10 (59 percent) homeowners are still paying off their mortgage, and the typical mortgaged homeowner owes 62 percent of their home’s value

This was a huge report, hit the link below for more.