On today’s Animal Spirits, we discuss:

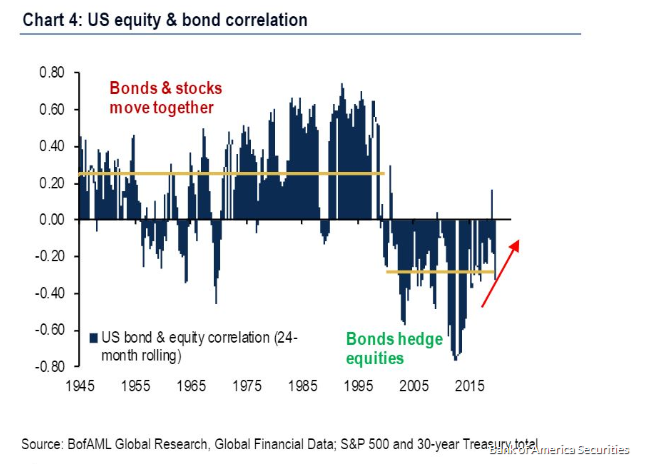

- The 60/40 is dead. Again

- But it has worked even when bond returns have sucked

- Why don’t rich people just stop working?

- Carl Icahn’s succession is like real life Succession

- Are influencers a winner take all game?

- Housing and recessions

- Wait, what about buyback data?

- The best predictor of stock returns

- The least happy age

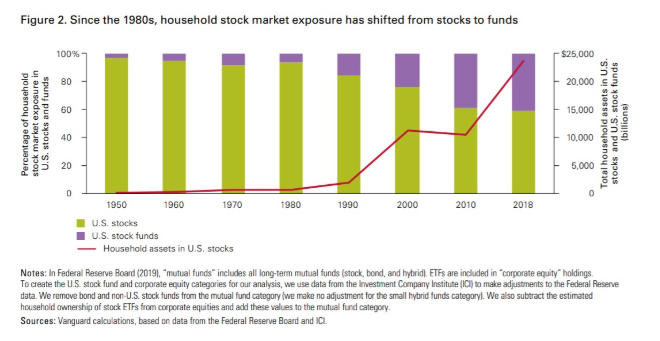

- How households invest

- Bob Iger’s big bet that Ben doesn’t think is a big bet

- Hanky panky in the futures market?

- Not exactly

- What is the fed doing now?

Listen here

Recommendations

- Netflixed

- I Heard You Paint Houses

- The Spy (Netflix)

- Netflix Versus Blockbuster

- Acquired

- Ten thousand shorts

Tweets

Really enjoyed the @bespokeinvest post yesterday about volume. Basically: stocks go up when volume is below average and down when volume is above average and the notion that rallies lacking volume aren't "real" is fake news. pic.twitter.com/3pFF5q3QOi

— Myles Udland (@MylesUdland) October 16, 2019

The S&P 500's dividend yield is above the 10 year Treasury yield right now

The 40 other months this happened from 1970-present, $SPX was up 95% of the time 1 year later

— SentimenTrader (@sentimentrader) October 16, 2019

Charts