How much money do you need to retire comfortably?

There are four parts to this infinitely complicated question:

- What is your final salary?

- How much are you saving?

- What rate of return do you earn on your assets?

- How much money do you want to spend in retirement?

In order to quantify this, I turned to the talented Mr. Maggiulli.

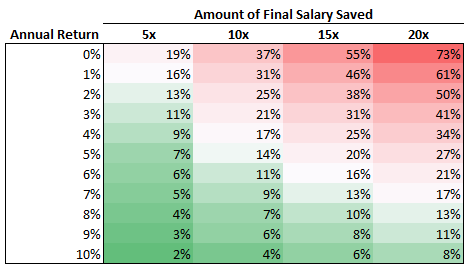

The first table shows the savings rate you would need in order to achieve a multiple of your final salary, with different rates of return. For example, if you wanted to retire with 20x your final salary, and you earned 7% a year, you would need to save 17% a month. If you wanted to retire with 20x your final salary, and earned nothing on your money, you would need to save an outrageous 73% a month of your pre-tax income.

You can see all the permutations in this table below.

And just because, for your viewing pleasure, here is the table in GIF form.

All of these numbers assume pre-tax savings, with a 2% annual increase in your salary, for forty years. Of course this is a conceptual exercise. Nobody knows what rate of return they will earn, and they certainly don’t get the same rate of return every month. Again, this is a thought exercise only. Okay, let’s move on.

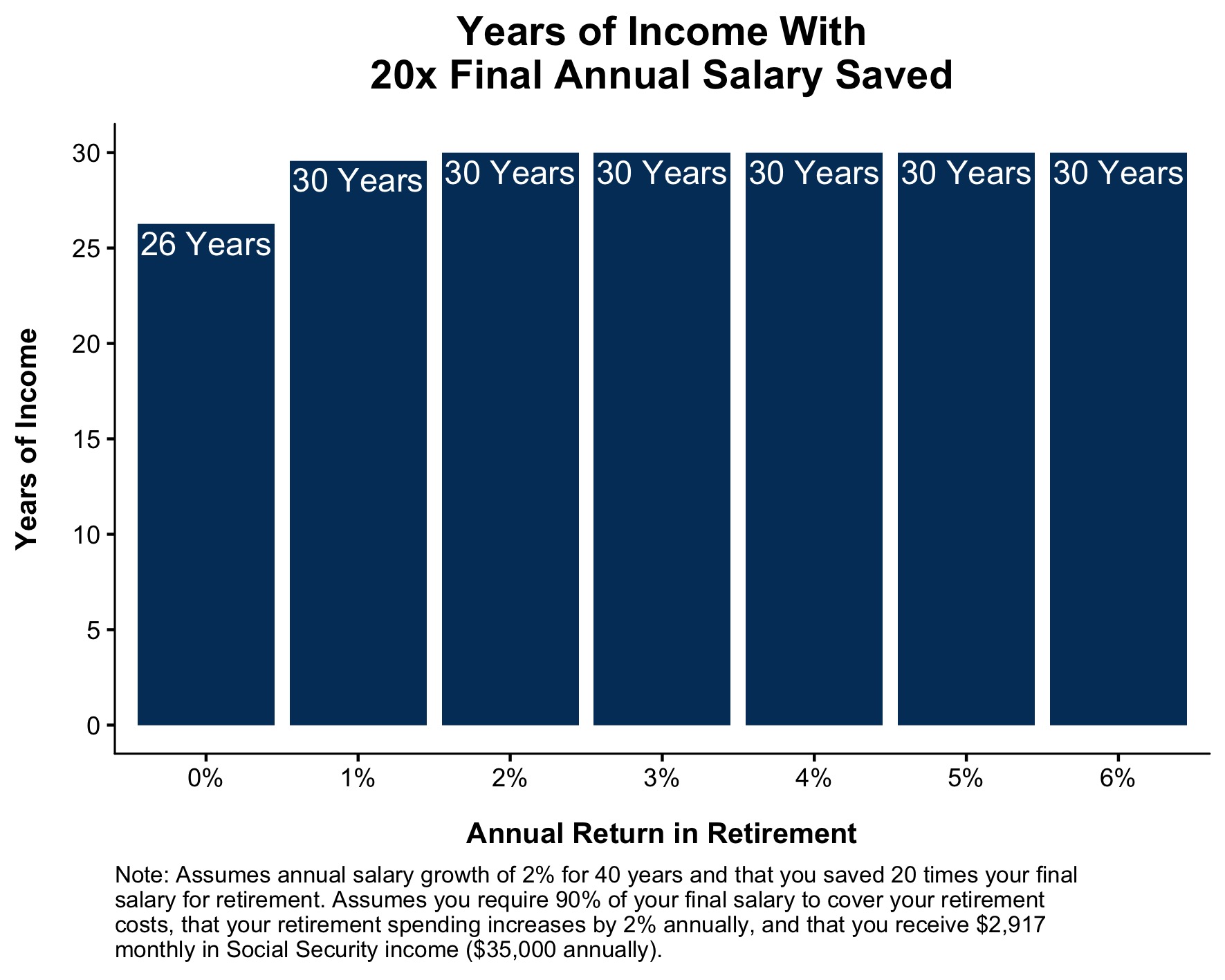

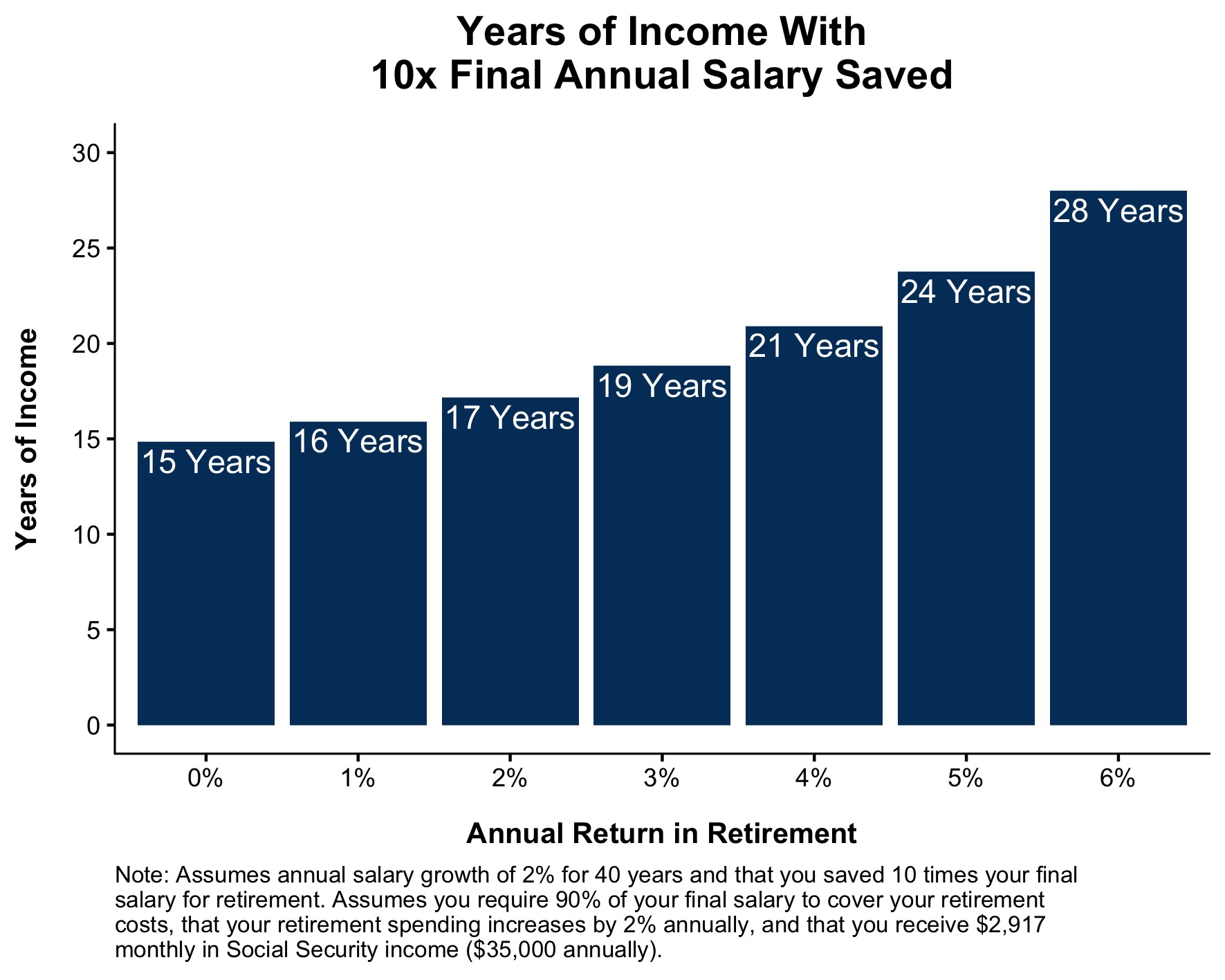

The next problem becomes, once you have a certain multiple of your final salary saved, how long can you live off of that pile of money, assuming you don’t want any drop-off in your standard of living.

Therefore, we assumed that you’re living off 90% of your final salary, with the assumption that you had been saving 10% per annum. We also assume that your spending increases with inflation at a rate of 2% a year. And finally, we assume that you receive 35k in social security a year, roughly in line with current benefits.

Assuming you save 20x your final salary, which as we’ve already show is very difficult, it’s likely that you can maintain your lifestyle until the day you die, regardless of how you’re invested.

Had you saved 10x your final annual salary and earn 3% a year in retirement, your money will last for 19 years.

And if you save 5x your final salary, you will almost certainly run out of money, assuming reasonable returns, and a level of spending that is consistent with the life that you’ve grown accustomed to. What’s scary about the chart below is that the median retirement account balance among retirees is $63,000. ?

One final point, none of these distributions take taxes into account, which obviously would represent a significant haircut. They also show social security in today’s dollars, so I guess that would help your money go a little further, but still, it’s safe to assume these numbers overstate how long you would be able to make your money last.

Retirement, as William Sharpe has said, is one of the nastiest, hardest problems in finance. There are a dozen or more inputs, and an infinite number of outputs. This is why financial planning is a process as opposed to an event. While the numbers above assumed linear outcomes, we know life is anything but.

The biggest takeaway for me was reinforcing what I already know to be true; saving and spending will have a larger impact on your retirement than your investing. Great investing results won’t make up for a shortfall in savings, but a high savings rate can more than offset lousy returns.