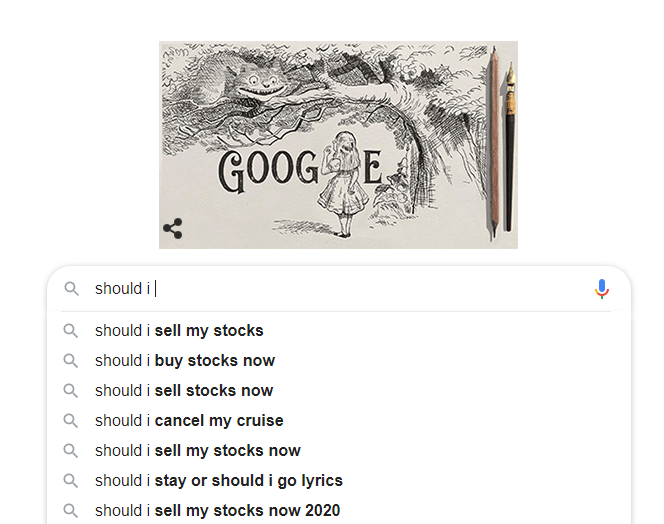

When you type in “should I” into the Google search bar, four of the top seven results are about selling stocks.

If you arrived at this website because you are Googling “should I sell my stocks,” relax, breathe, let me tell you how this all works.

Stocks generally go up over time. Why? Because stocks are not just numbers on a screen, they represent something very real. Stocks are fractional shares of ownership in a business. Businesses are the life blood of the economy, and the economy is an irrepressible engine of progress.

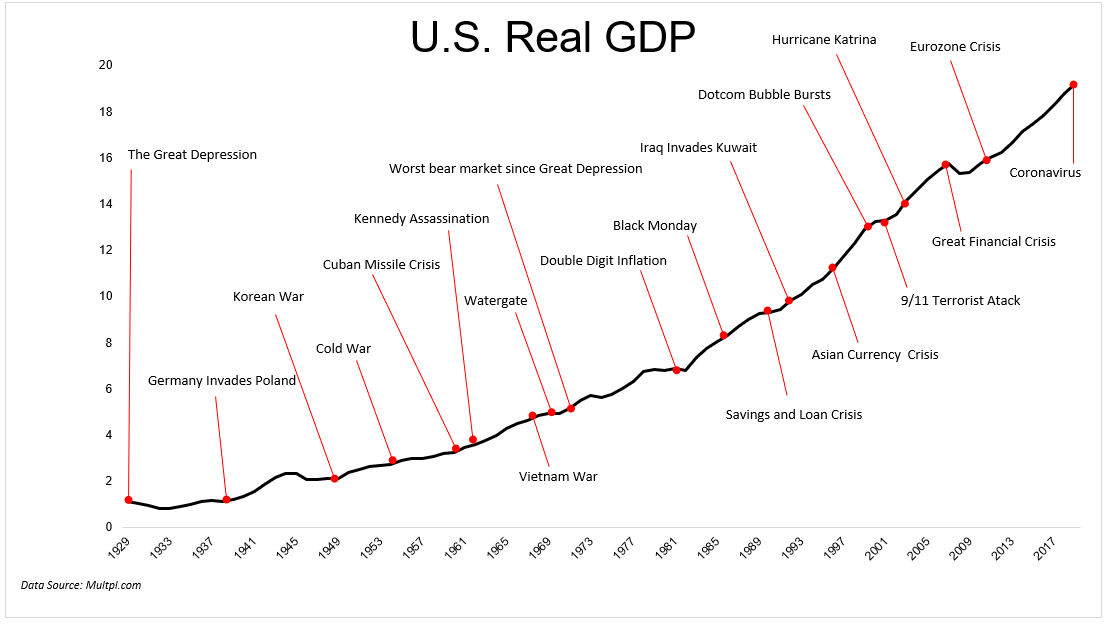

This country has seen it all: war and peace, inflation and deflation, natural disasters, and financial crises, just to name a few. The chart below shows the growth of real GDP over time. It is a testament to human’s ability to strive for and create a better tomorrow. Very few people have gotten rich by betting against progress.

The growth in economic activity flows through from businesses to their owners, or their stock holders more specifically. Over the course of modern history, U.S. stocks have had an annualized average return of 10.2%, doubling an investors money every seven or so years, on average. However, this does not mean that you should expect to see returns 10% every year, or even close to it.

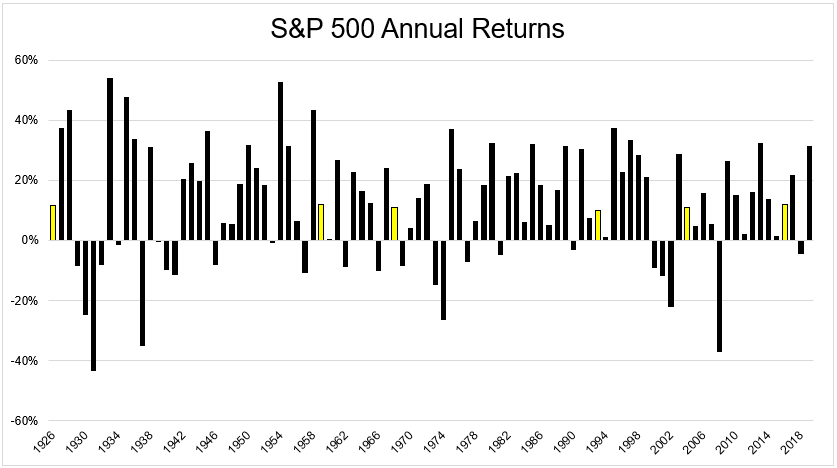

The economy is driven by business fundamentals, but the stock market is driven by investors who are driven by fear and greed. This fear and greed pushes annual returns way above and way below the average. In fact, only 6 times in the last 94 years did we have an annual return that was even close to the average.

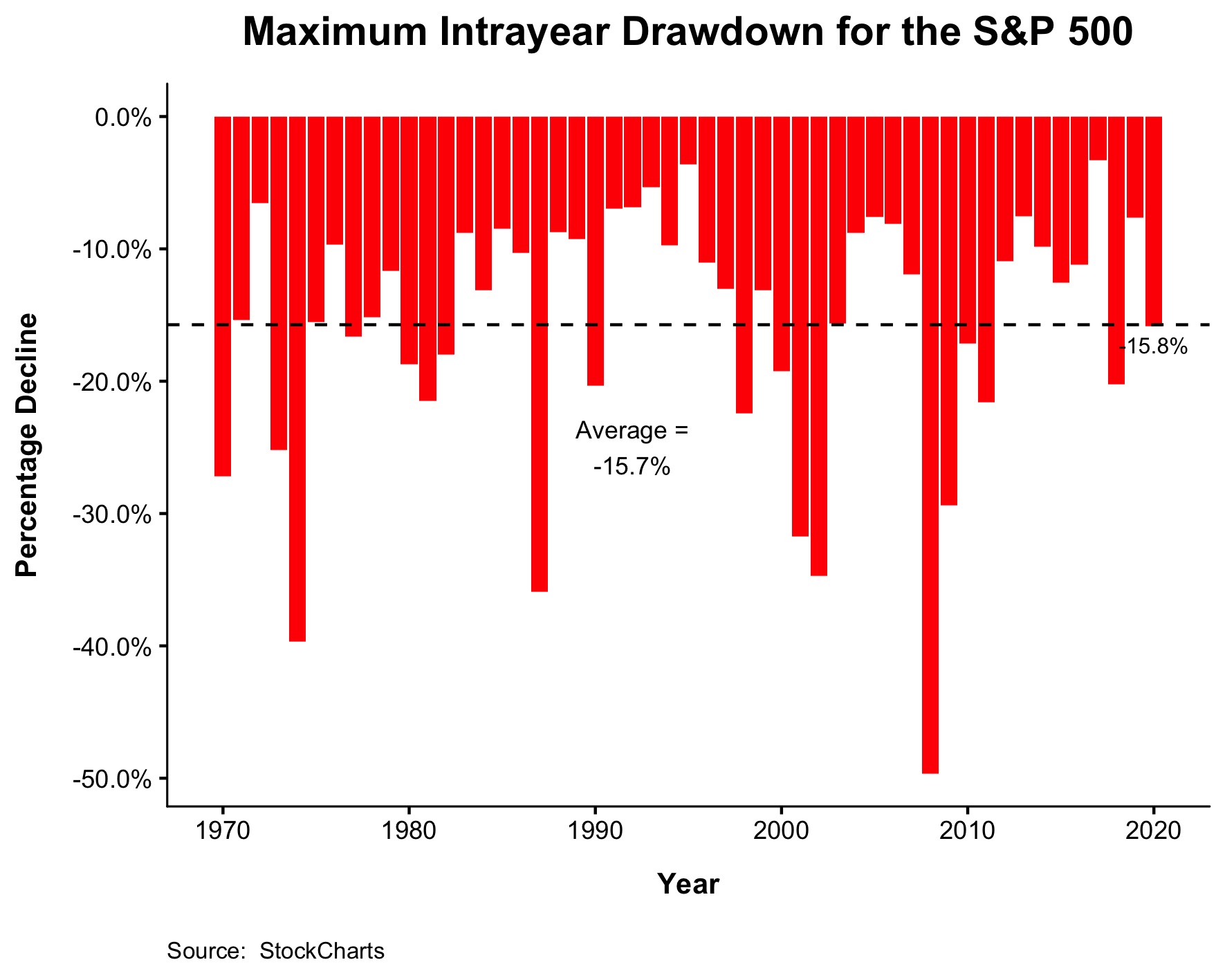

Stocks are the best way to build wealth over one’s lifetime, but there is a very real price to pay for these returns. That price is discomfort, anxiety, and a whole lot of pain.

The chart below is a good way to visualize the pain. It shows the maximum high point to the minimum low point for every calendar year going back to 1970. The average decline on a calendar basis is -15.7%. In some years investors experience only mild discomfort, in other years they experience maximum pain.

Unfortunately, we can never predict when these episodes will flare up or what will cause them or when they will end. This is why stocks are risky, and this is why people who can bear it usually get paid over the long run. I say usually because risk is not always rewarded, that’s what risk is.

When stocks are in free fall and it feels like there is no bottom in sight, it’s normal to experience different emotions. It’s how you behave in these times that determines whether or not you’ll be able to capitalize on the long run returns that stocks have to offer.

One of Warren Buffett’s most famous phrases is “be greedy when others are fearful.” What he means by this is that the expected returns from owning stocks goes up after they go down. This is not just anecdotal, the data backs it up. The average return on a 1-year basis for the S&P 500 is 8.8% going back to 1950. After a 15% decline, that number jumps to 10.4%. After a 20% decline, it goes up to 11.9% (this does not include dividends, mind you). Buffett built one of the biggest empires in the history of the United States by understanding this concept better than almost anyone else.

The Coronavirus is scary, no doubt, but if you feel like you see the train coming down the tracks, it’s probably the light at the end of the tunnel. And if you’re Googling “should I sell my stocks?” it’s usually too late.

If you’re new to investing and need our help, please check us out.