On today’s show we discuss:

- Why hindsight bias is so dangerous

- Laffer and Moore’s embarrassing op-ed

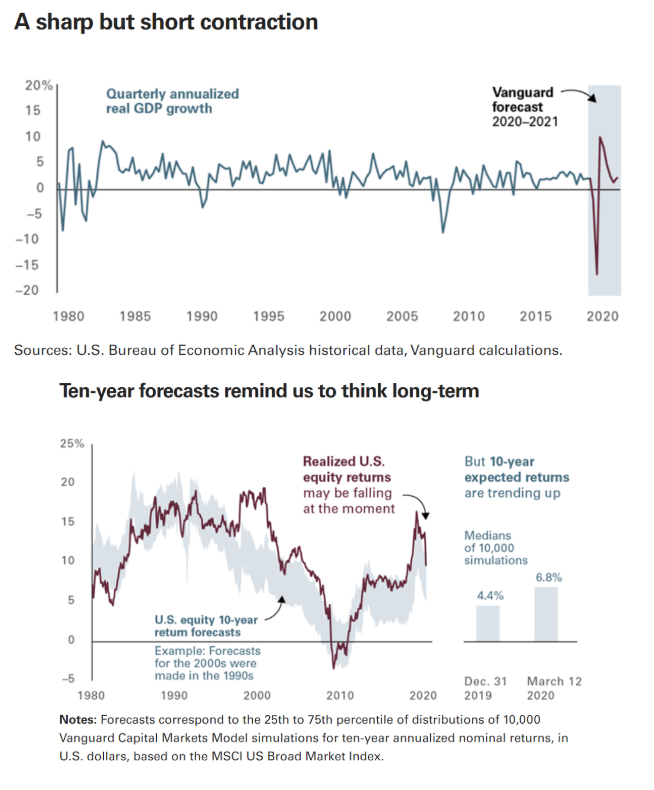

- Jobless rate might soar to 30%

- How Denmark is dealing with the crisis

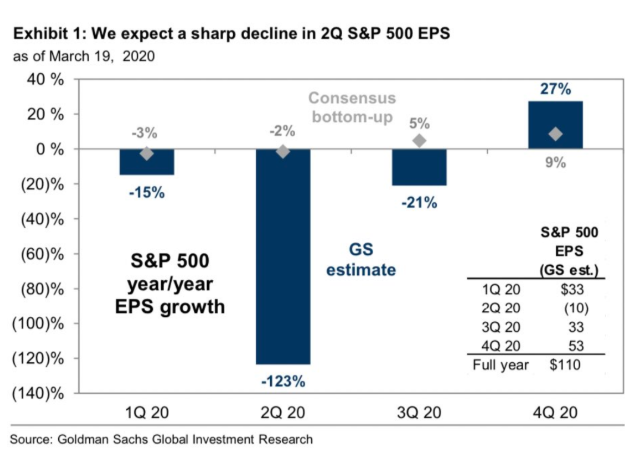

- Stock market valuations

- Damodaran on valuation

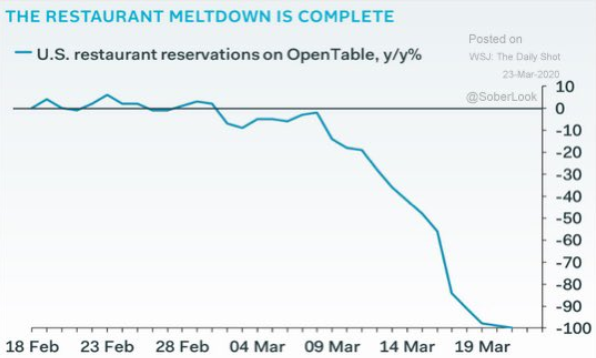

- Dining bonds

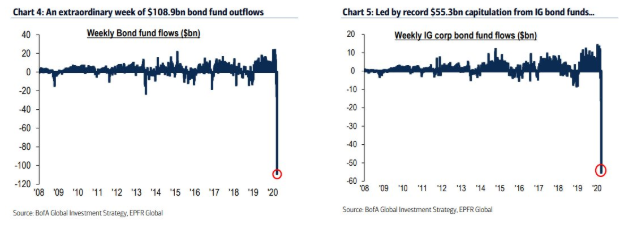

- Massive redemptions in bond funds

- The bond market and the ETF market

- The state of the consumer before the panic

Listen here:

Recommendations:

- Ted Seides and James Aitken on the guts of the financial system

- Coronavirus financial relief

- The Great Depression A Diary

- The Tiger King

- High Fidelity

- King of New York

- Cast Away rewatchable

Charts:

Tweets:

This quote man. pic.twitter.com/JKxsi7evBo

— Dani Burger (@daniburgz) March 20, 2020

https://twitter.com/Birdyword/status/1242400880072122368

The message from the flash PMIs in Europe and Japan: service industries are getting clobbered more than manufacturing. Once we get through this, it'll take much longer to turn service industries back on than manufacturing. A "V" for manufacturing maybe, but a "U" for services. pic.twitter.com/k7W7IMV8QV

— RenMac: Renaissance Macro Research (@RenMacLLC) March 24, 2020

Just an “insane stat of the day.”

In September 2008 – during the midst of the financial crisis – $LQD lost -10.5%.

Month-to-date, $LQD is down -20.3%.

— Corey Hoffstein 🏴☠️ (@choffstein) March 19, 2020

spread on investment grade bonds (363bps) is now higher than the spread on high-yield bonds just one month ago (junk's now above 1,000bps) pic.twitter.com/Eu91MSHdaZ

— James Crombie (@jtcrombie) March 23, 2020

Whoa Part II: Another fixed income mut fund $BDKAX is down 40% in two days. Its "NAV" was $10 for weeks until thur when outflows forced it to sell bonds, face reality. NAV curr $5.8. https://t.co/p44LEJQ8cp

— Eric Balchunas (@EricBalchunas) March 23, 2020