On today’s show we discuss

- “Just a bear market rally”

- How tech could help us with the virus

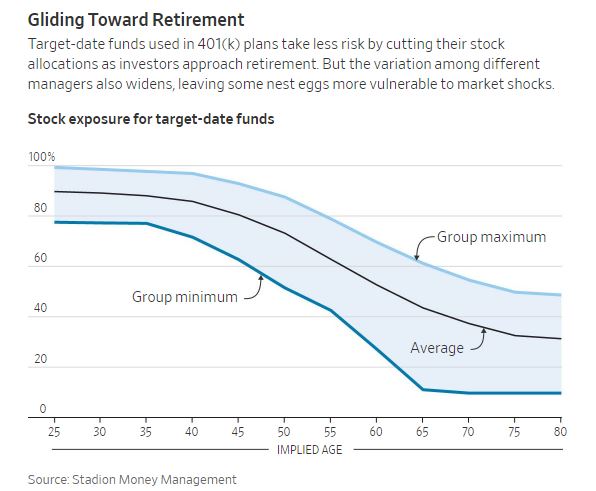

- Dispersion in target-date funds

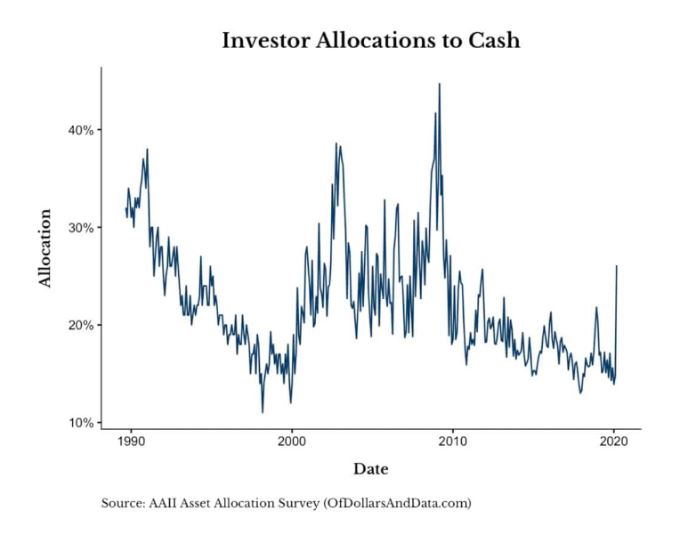

- The flight to safety

- Spitznagel killed it in March

- Millennials sold stocks

- Nearly one-third of renters missed their April payment

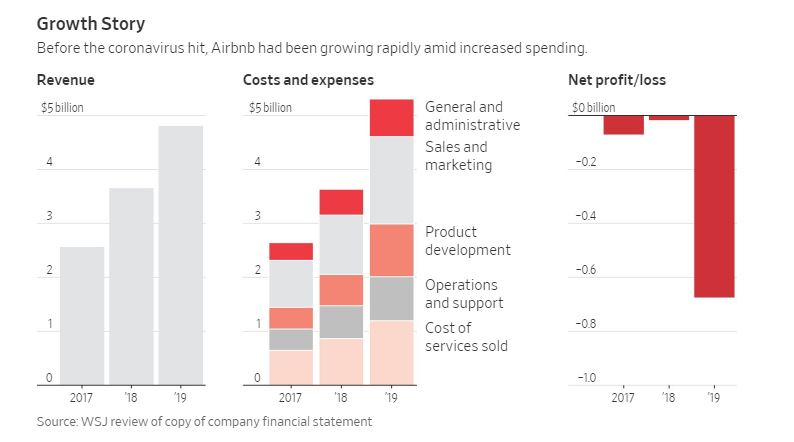

- What does AirBnb spend so much money on?

- Disney plus is crushing

- $17 billion in cruise bonds

- A corporate debt reckoning is coming

- William Bernstein is always worth reading

Listen here

Recommendations

Charts

Tweets

Some of the rally earlier this week may very well have been coronavirus optimism. BUT, it looks more likely it was technical, driven by short covering.

Nomura says that in recent days, CTAs reduced SPX shorts by 11%. And by 45% in the Russell 2000!

— Dani Burger (@daniburgz) April 8, 2020

The Fed can now buy $HYG too as part of the just announced additional $25b facility. In related news, $HYG went up 3.5% in about 10min flat in pre-market. $JNK not getting same love. h/t @mbarna6 pic.twitter.com/Nv9O7TTerB

— Eric Balchunas (@EricBalchunas) April 9, 2020

While we knew Vanguard would do well relative to peers during selloff (bc they always do) we were surprised they did so well relative to themselves w/ record $47b in Q1 ETF flows. (Blk #2 w/ $10b). Notable: it was ALL equity ETFs, their fixed income ETFs netted out to $0. pic.twitter.com/HojdCWwFyE

— Eric Balchunas (@EricBalchunas) April 7, 2020

I’ll take the other side of almost all of these

People are going way too far w/how they think behavior will change following this crisis https://t.co/wvanlRtLVu

— Ben Carlson (@awealthofcs) April 7, 2020

https://t.co/53PHrSLxVr pic.twitter.com/CpzbzlIrkN

— George Pearkes (@pearkes) April 9, 2020

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: