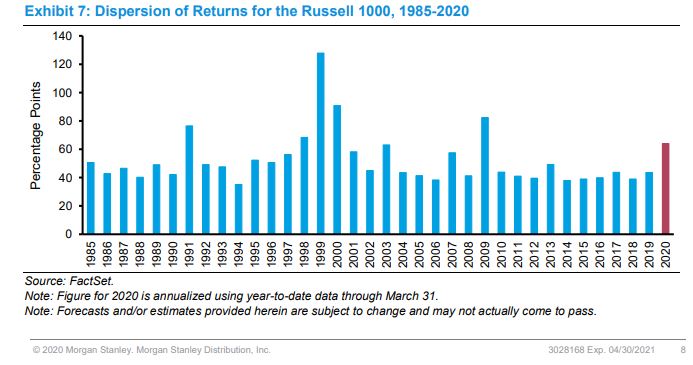

It’s hard to distinguish yourself from the crowd when everything is moving in unison. For stock pickers, 2020 is not one of those years.

Through the end of the first quarter, we have seen the biggest dispersion of returns for the stock market since 2009. In theory, this should provide an opportunity for those with skill, or with luck, to shine bright.

This comes from an excellent new research report by Michael Mauboussin and Dan Callahan called Dispersion and Alpha Conversion: How Dispersion Creates the Opportunity to Express Skill

In the paper they break down dispersion further into the difference between returns at the top and returns at the bottom. This year, more than any other year going back to 2000, has seen an explosion in the difference between the bad performers, think MetLife and Pulte Homes, and the very worst performers, think Delta and Carnival.

I don’t know that we can determine who has skill over such a short time frame, especially given the circumstances that caused the dispersion, but nevertheless it will be interesting to see how stock picker’s fare this year.

Source:

Dispersion and Alpha Conversion: How Dispersion Creates the Opportunity to Express Skill