On today’s show we discuss

- People aren’t doing much tinkering in their retirement accounts

- Airlines have declared bankruptcy 66 times since 2000

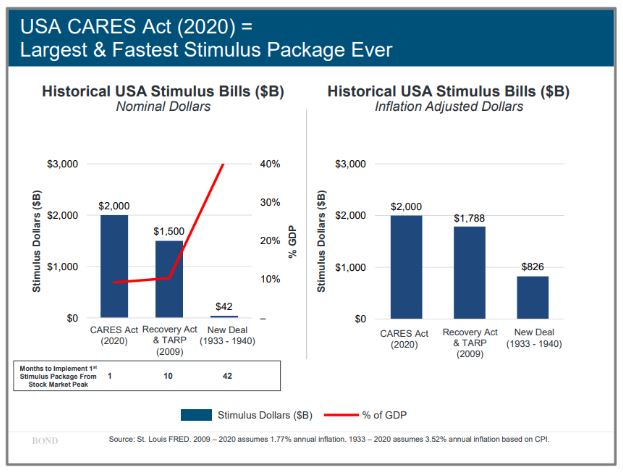

- Cullen Roche on the COVID-19 Aid package

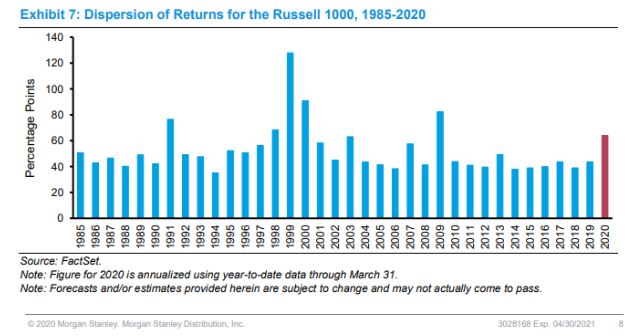

- Stock picker’s market

- Are Buffett and Munger slowing down?

- Will this recession destroy private equity?

- How the Coronavirus might reduce income inequality

- Quantifying the tradeoff between closing the economy versus leaving it open

- Garnishing relief money

- 8% of people pay 75% of overdraft fees

- Disney–workers versus investors

- Amazon slashes affiliates commisions

- Amazon Shareholder Letter

- Amazon pays a butt ton of payroll tax

- Mary Meeker charts

- If buybacks are bad, what about the alternative?

Listen here

Recommendations

Charts

Tweets

Unlike other indices, the biggest firms in the S&P 500 “are in sectors that have benefited, at least in relative terms, from measures taken to control the spread of the virus,” says @CapEconUS. Like I.T. and comm services

Ratio of top 50 S&P market caps to the rest of the index: pic.twitter.com/ff5HN3u7RO

— Carl Quintanilla (@carlquintanilla) April 17, 2020

— Jim Bianco (@biancoresearch) April 17, 2020