Barron’s ran their biannual Big Money Poll this weekend. As always, investors should take all surveys with a giant grain of salt, but I thought there were some interesting observations in this one.

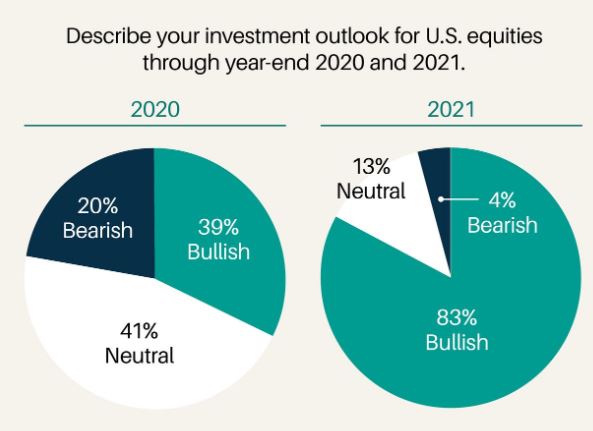

Investors were asked to describe their outlook for U.S. equities through the rest of this year and for 2021. Stocks fell hard in the first quarter and have recovered about 50% of those losses, so I’m not surprised to find “neutral” take the lion’s share of 2020’s pie. The results for 2021 are eye-opening; 83% are bullish, just 4% are bearish.

The way that one money manager described his outlook perfectly encapsulates the state of the American investor:

“In the grand scheme of things, I’m bullish. It’s a vote of confidence in America,” says Kevin Grimes, president and chief investment officer of Grimes & Co. in Westborough, Mass. “I have confidence in our scientists and our business leaders. I also have confidence in the American consumer. While some habits and patterns may be different in a postpandemic world, we believe that a lot of the demand has been pushed out, instead of eliminated.”

American’s in general are an optimistic bunch, and it takes more than a few bad weeks to change this. We can get to a dark place, but it will happen slowly, like turning around an aircraft carrier.

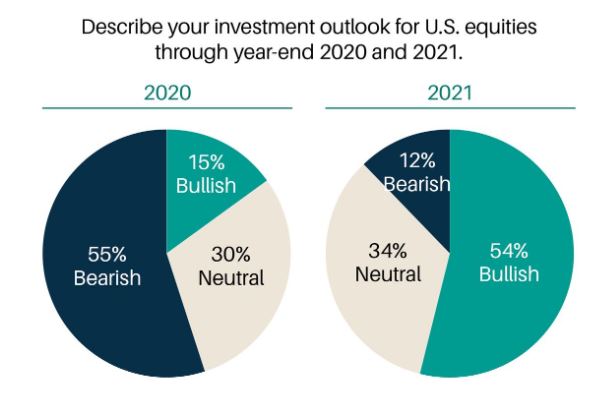

They asked the same question of the readers, and it turns out they have a much different opinion on the market, especially through the end of the year. Nearly three times as many readers than professionals said they are bearish for the duration of 2020. This makes sense to me for one very simple reason: 100% of the money managers still have a job. It’s hard to be bullish when you’ve been furloughed or laid off, and there’s no doubt that some of the respondents are currently without a paycheck.

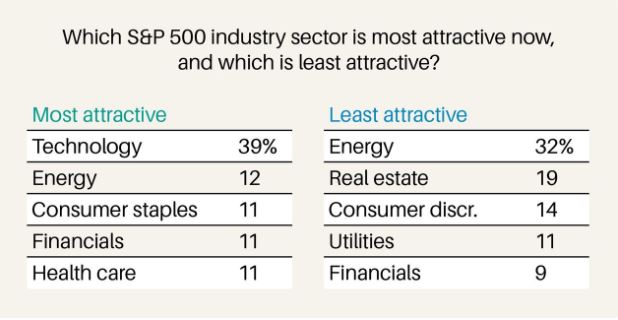

They asked which sector is most attractive right now and which is least attractive. Before looking at the results you can probably guess what they said. The most attractive is what’s working best (tech) and the least attractive is what’s getting hit the hardest (energy). We’re all momentum investors at heart.

Some people find comfort in surveys when they’re with the majority. Others get excited when they’re fading the crowd. You should be careful to never get too up or down based on the results because polls only reveal what people say, which is often very different from what they actually do.

Source: