Today’s Animal Spirits is brought to you by YCharts

Mention Animal Spirits to receive 20% off when you initially sign up for the service

Listen here:

On today’s show we discuss:

- Joe Rogan going to Spotify

- Joining Bill Simmons

- People are using their stimulus checks to gamble

- Commercial rent plummeting

- Netflix turning off inactive accounts

- Call her daddy

- Amazon buying J.C. Penney?

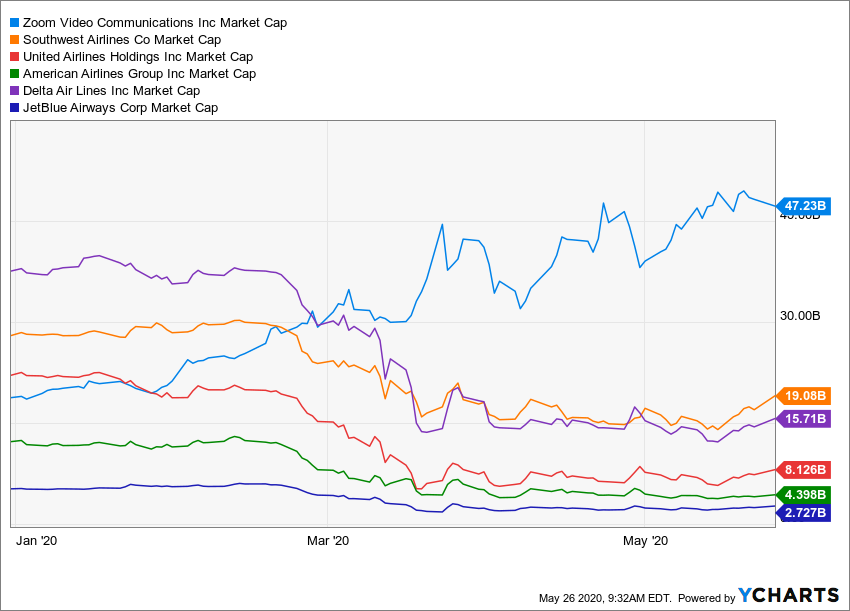

- The price-to-liquidity ratio

- There’s never a time when you can be sure that today’s market is going to be a replay of the familiar past (Peter Bernstein)

- Stocks are a better source of income than bonds

- Pier 1 is going out of business

- Peter Luger is delivering

- FaceBook employees can leave SF…If they want a paycut

- Coinbase going remote

Recommendations:

Charts:

Few things represent the market's zeitgeist more than the IPO market. IPO index making a new high today. pic.twitter.com/YCopmCSX0t

— RenMac: Renaissance Macro Research (@RenMacLLC) May 20, 2020

Tweets:

Our index that tracks dirt cheap core ETFs beloved by advisors is seeing 2nd straight month of outflows, which is totally unheard of. They did take in cash in March in face of selloff, so perhaps some models now rebalancing into bonds but not totally sure what to make of it tbh.. pic.twitter.com/EbLr7XlErJ

— Eric Balchunas (@EricBalchunas) May 20, 2020

Semi-shocker: JPMorgan closing their hedge fund ETFs. Bad sign for category if JPM bailing. My take: they fell into the dreaded ETF "dead zone," too complex/far away from beta for advisors and too public pool-ish for institutions who prefer (and will pay up for) exclusivity. RIP. pic.twitter.com/8WZIz8jUms

— Eric Balchunas (@EricBalchunas) May 16, 2020

eeeeeeeahhhh

via GMO pic.twitter.com/uxhg6pVePN

— Meb Faber (@MebFaber) May 14, 2020

Contact us at animalspiritspod@gmail.com with any feedback, recommendations, or questions.

Follow us on Facebook, Instagram, and YouTube.

Check out our t-shirts, stickers, coffee mugs, and other swag here.

Subscribe here: