On today’s show we discuss:

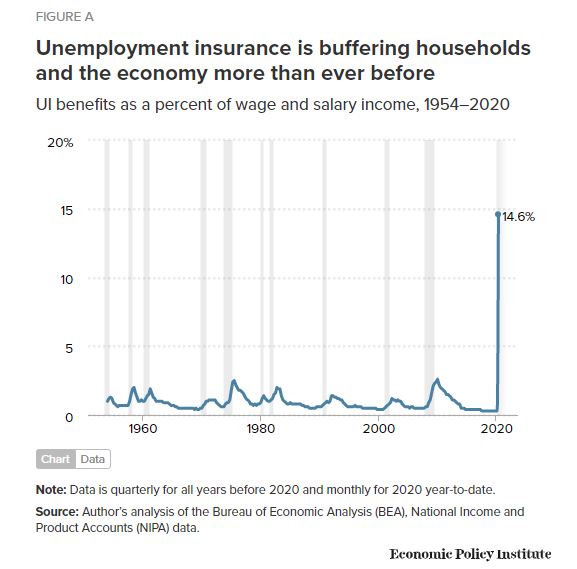

- How cutting off the $600 relief checks could cause another recession

- Restaurants are closing

- Ben’s take on double dip recessions

- The fed bans giant banks from buybacks and raising dividends

- New York office real estate is in trouble

- Berkshire Hathaway has fallen on tough times

- Now show Japan

- How COVID-19 is changing the future of travel

- The history of TIPS

Listen here:

Recommendations

- The Great Inflation and its Aftermath

- A Piece of the Action

- The Vast of Night

- The best content for financial advisors

- The Compound Show (Josh Brown)

Charts:

Tweets:

This is VERY close to what JPMorgan said yesterday: "Looking across categories of card spending, we find that the level of spending in restaurants three weeks ago was the strongest predictor of the rise in new virus cases over the subsequent three weeks." https://t.co/pOlOZ4S7QP

— Carl Quintanilla (@carlquintanilla) June 26, 2020

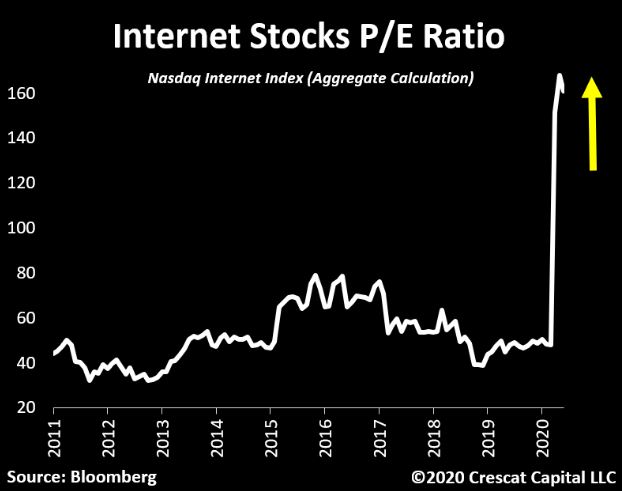

Wild EXPLOSION in speculation:

NASDAQ / S&P volume ratio has gone through the roof, and is now higher than at the peak of the dot-com bubble!

For those who are old enough to remember, most traders who got rich quick during the dot-com bubble also lost their shirts in the crash pic.twitter.com/JigxFj7tgh

— SentimenTrader (@sentimentrader) June 27, 2020

Online now accounts for almost 2/3 of advertising and two landlords, Google and Facebook, control 60% of worldwide digital-ad real estate.https://t.co/sFQPoLBGTH pic.twitter.com/ahidqWeGxt

— Adam Tooze (@adam_tooze) June 28, 2020